Answered step by step

Verified Expert Solution

Question

1 Approved Answer

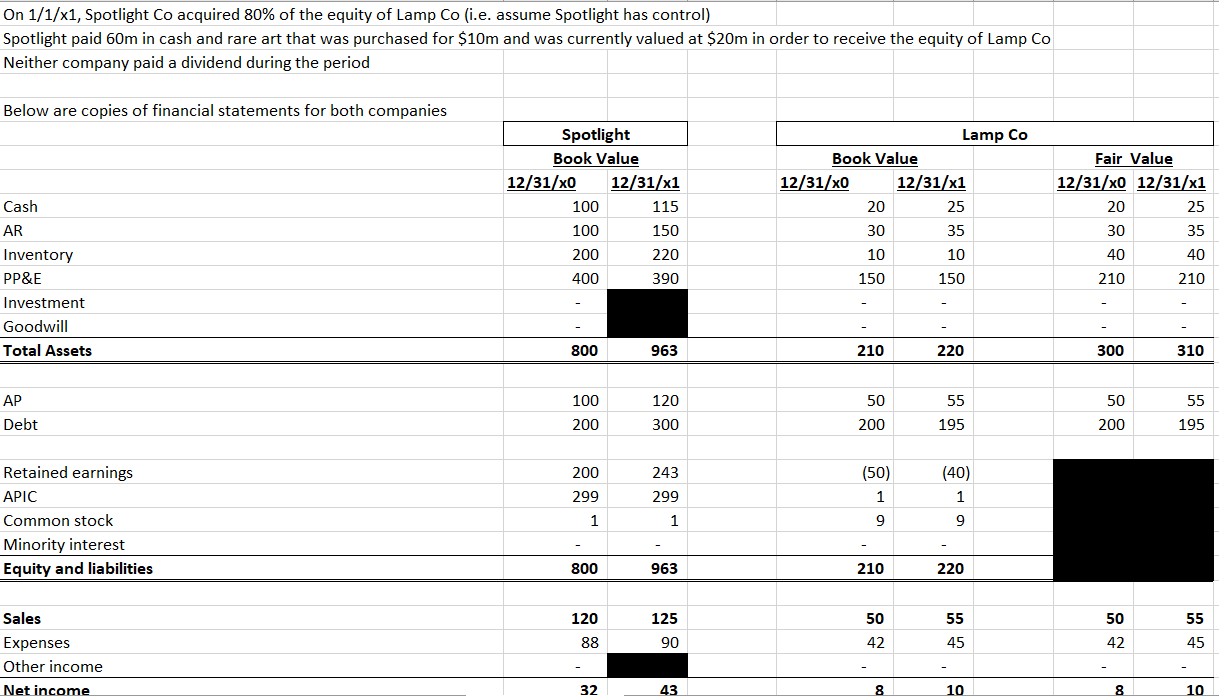

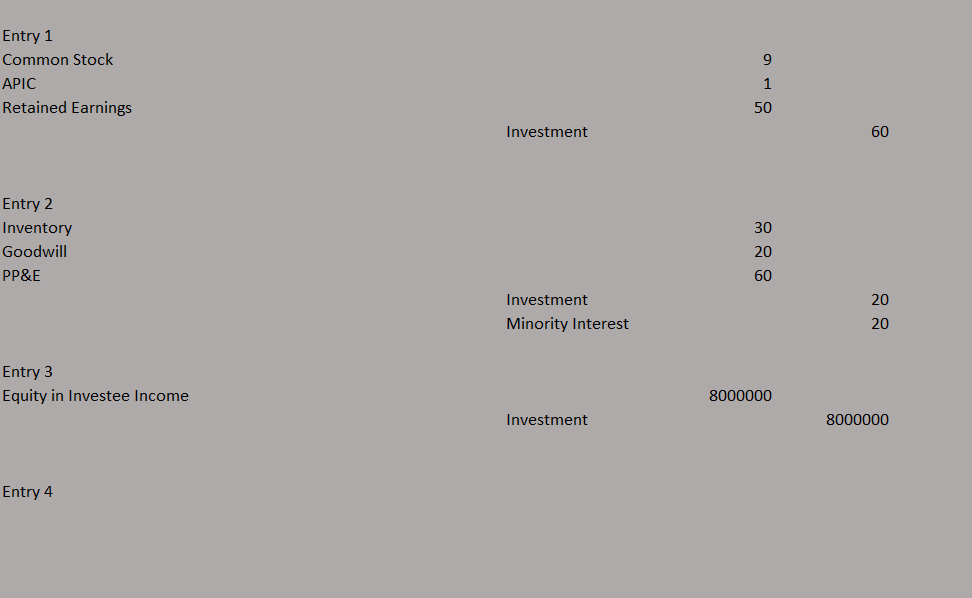

This is what I have so far: I don't understand how to balance out the closing entries. Please help The rare art was traded in

This is what I have so far:

I don't understand how to balance out the closing entries.

Please help

The rare art was traded in as part of a payment for the company.

On 1/1/x1, Spotlight Co acquired 80% of the equity of Lamp Co (i.e. assume Spotlight has control) Spotlight paid 60m in cash and rare art that was purchased for $10m and was currently valued at $20m in order to receive the equity of Lamp Co Neither company paid a dividend during the period Below are copies of financial statements for both companies Spotlight Book Value 12/31/x0 12/31/x1 100 115 100 150 200 220 400 390 Lamp Co Book Value 12/31/x0 12/31/x1 20 25 30 35 10 10 150 Fair Value 12/31/0 12/31/x1 25 20 30 Cash AR Inventory PP&E Investment Goodwill Total Assets 35 40 150 40 210 210 800 963 210 220 300 310 AP 50 55 50 55 100 200 120 300 Debt 200 195 200 195 Retained earnings APIC Common stock Minority interest Equity and liabilities 200 299 1 243 299 1 (50) 1 9 (40) 1 9 800 963 210 220 120 55 125 90 50 - 42 50 - 42 55 45 88 45 Sales Expenses Other income Net income - 32 43 8 10 Do 10 Entry 1 Common Stock APIC Retained Earnings Investment Entry 2 Inventory Goodwill PP&E Investment Minority Interest Entry 3 Equity in Investee Income 8000000 Investment 8000000 Entry 4 On 1/1/x1, Spotlight Co acquired 80% of the equity of Lamp Co (i.e. assume Spotlight has control) Spotlight paid 60m in cash and rare art that was purchased for $10m and was currently valued at $20m in order to receive the equity of Lamp Co Neither company paid a dividend during the period Below are copies of financial statements for both companies Spotlight Book Value 12/31/x0 12/31/x1 100 115 100 150 200 220 400 390 Lamp Co Book Value 12/31/x0 12/31/x1 20 25 30 35 10 10 150 Fair Value 12/31/0 12/31/x1 25 20 30 Cash AR Inventory PP&E Investment Goodwill Total Assets 35 40 150 40 210 210 800 963 210 220 300 310 AP 50 55 50 55 100 200 120 300 Debt 200 195 200 195 Retained earnings APIC Common stock Minority interest Equity and liabilities 200 299 1 243 299 1 (50) 1 9 (40) 1 9 800 963 210 220 120 55 125 90 50 - 42 50 - 42 55 45 88 45 Sales Expenses Other income Net income - 32 43 8 10 Do 10 Entry 1 Common Stock APIC Retained Earnings Investment Entry 2 Inventory Goodwill PP&E Investment Minority Interest Entry 3 Equity in Investee Income 8000000 Investment 8000000 Entry 4Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started