Answered step by step

Verified Expert Solution

Question

1 Approved Answer

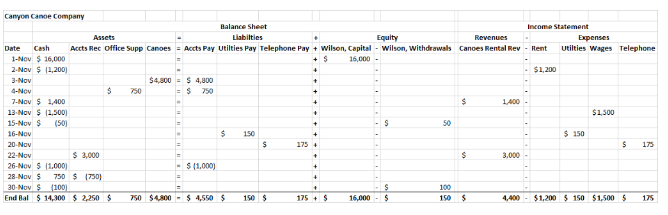

This problem continues the Canyon Canoe Company situation from Chapter F:2. You will need to use the unadjusted trial balance and posted T-accounts that you

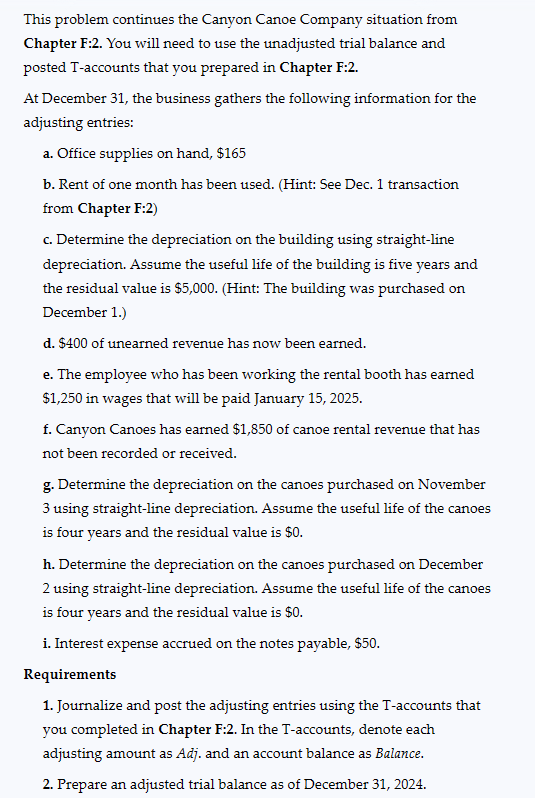

This problem continues the Canyon Canoe Company situation from Chapter F:2. You will need to use the unadjusted trial balance and posted T-accounts that you prepared in Chapter F:2. At December 31, the business gathers the following information for the adjusting entries: a. Office supplies on hand, $165 b. Rent of one month has been used. (Hint: See Dec. 1 transaction from Chapter F:2 ) c. Determine the depreciation on the building using straight-line depreciation. Assume the useful life of the building is five years and the residual value is $5,000. (Hint: The building was purchased on December 1.) d. $400 of unearned revenue has now been earned. e. The employee who has been working the rental booth has earned $1,250 in wages that will be paid January 15,2025. f. Canyon Canoes has earned $1,850 of canoe rental revenue that has not been recorded or received. g. Determine the depreciation on the canoes purchased on November 3 using straight-line depreciation. Assume the useful life of the canoes is four years and the residual value is $0. h. Determine the depreciation on the canoes purchased on December 2 using straight-line depreciation. Assume the useful life of the canoes is four years and the residual value is $0. i. Interest expense accrued on the notes payable, $50. Requirements 1. Journalize and post the adjusting entries using the T-accounts that you completed in Chapter F:2. In the T-accounts, denote each adjusting amount as Adj. and an account balance as Balance. 2. Prepare an adjusted trial balance as of December 31, 2024

This problem continues the Canyon Canoe Company situation from Chapter F:2. You will need to use the unadjusted trial balance and posted T-accounts that you prepared in Chapter F:2. At December 31, the business gathers the following information for the adjusting entries: a. Office supplies on hand, $165 b. Rent of one month has been used. (Hint: See Dec. 1 transaction from Chapter F:2 ) c. Determine the depreciation on the building using straight-line depreciation. Assume the useful life of the building is five years and the residual value is $5,000. (Hint: The building was purchased on December 1.) d. $400 of unearned revenue has now been earned. e. The employee who has been working the rental booth has earned $1,250 in wages that will be paid January 15,2025. f. Canyon Canoes has earned $1,850 of canoe rental revenue that has not been recorded or received. g. Determine the depreciation on the canoes purchased on November 3 using straight-line depreciation. Assume the useful life of the canoes is four years and the residual value is $0. h. Determine the depreciation on the canoes purchased on December 2 using straight-line depreciation. Assume the useful life of the canoes is four years and the residual value is $0. i. Interest expense accrued on the notes payable, $50. Requirements 1. Journalize and post the adjusting entries using the T-accounts that you completed in Chapter F:2. In the T-accounts, denote each adjusting amount as Adj. and an account balance as Balance. 2. Prepare an adjusted trial balance as of December 31, 2024 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started