Question

This problem will carry through several chapters, building in difficulty. It allows students to continuously practice skills and knowledge learned in previous chapters. In Chapter

This problem will carry through several chapters, building in difficulty. It allows students to continuously practice skills and knowledge learned in previous chapters.

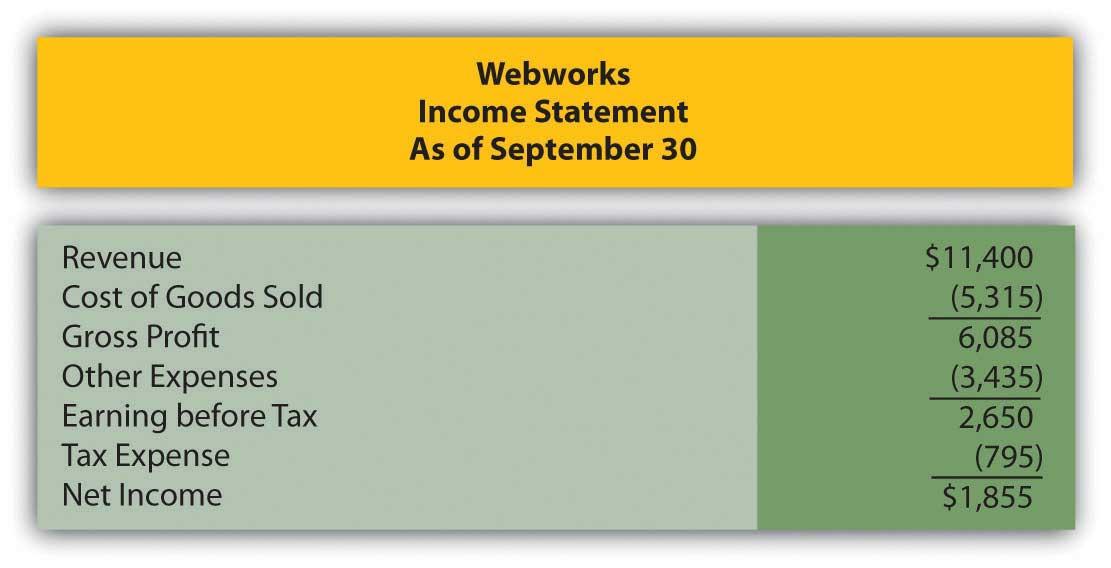

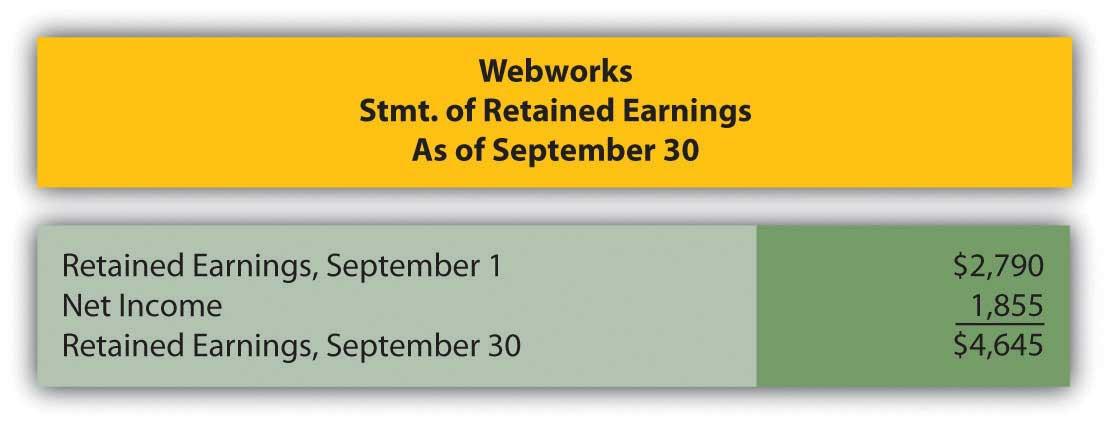

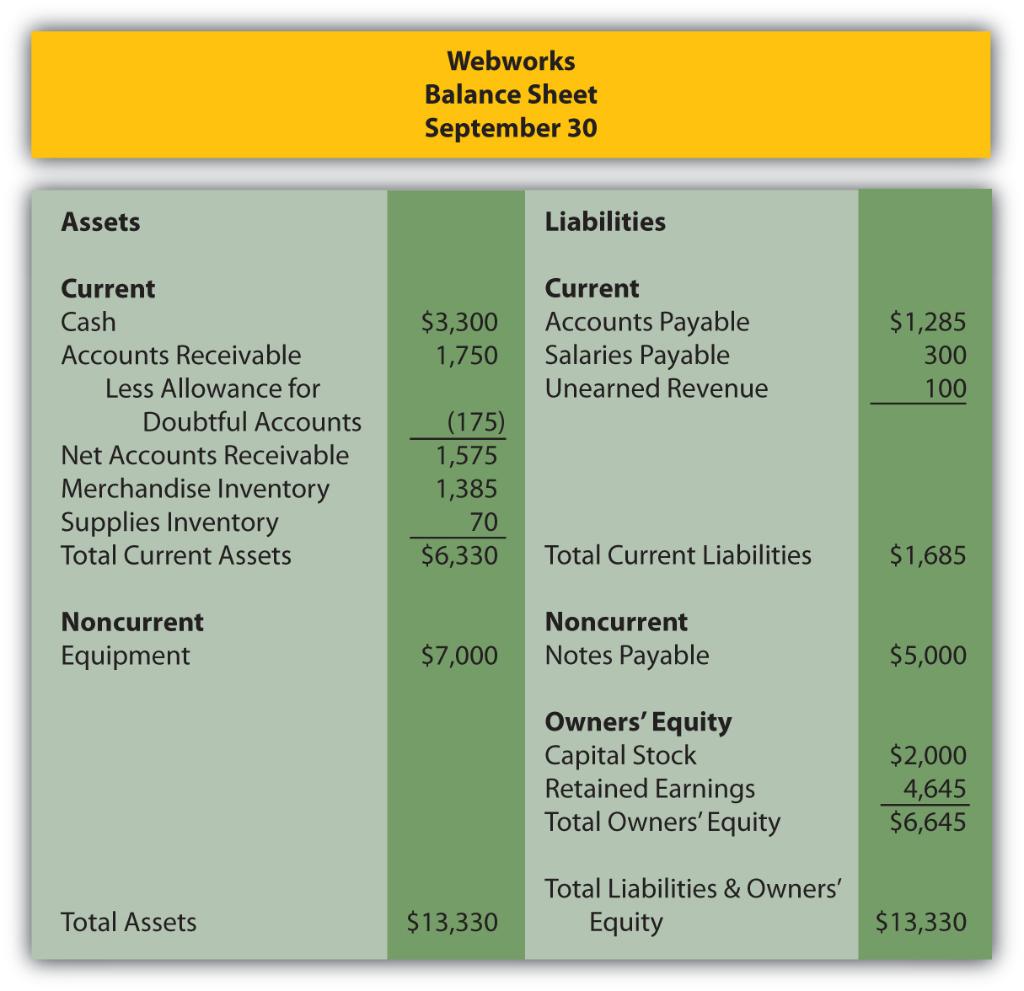

In Chapter 3 Why Does a Company Need a Cost Flow Assumption in Reporting Inventory?, you prepared Webworks statements for September. They are included here as a starting point for October.

Here are Webworks financial statements as of September 30.

Can i get the Trial Balance, Balance Sheet, Income Sheet, and Statement of Retained Earnings

The following events occur during October:

a. Webworks purchases supplies worth $100 on account.

b. Webworks paid $600 in rent for October, November, and December.

c. At the beginning of October, Webworks had nine keyboards costing $105 each and forty flash drives costing $11 each. Webworks uses periodic FIFO to cost its inventory.

d. On account, Webworks purchases fifty keyboards for $110 each and 100 flash drives for $12 each.

e. Webworks starts and completes seven more Web sites and bills clients for $3,900.

f. Webworks pays Nancy $700 for her work during the first three weeks of October.

g. Webworks sells 50 keyboards for $7,500 and 100 flash drives for $2,200 cash.

h. The Web site paid for in August and started in September was completed. The client had originally paid $100 in advance.

i. Webworks paid off the remainder of its note payable.

j. Webworks collects $4,000 in accounts receivable.

k. Webworks pays off its salaries payable from October.

l. Webworks pays off $6,000 of its accounts payable.

m. One Web site client is dissatisfied with the work done and refuses to pay his bill. Rather than incur the expense of taking the client to court, Webworks writes off the account in the amount of $200.

n. Webworks pays Leon a salary of $2,000.

o. Webworks purchased office furniture on account for $1,000, including transportation and setup.

p. Webworks pays taxes of $868 in cash.

Required:

A. Prepare journal entries for the above events.

B. Post the journal entries to T-accounts.

C. Prepare an unadjusted trial balance for Webworks for October.

D. Prepare adjusting entries for the following and post them to your T-accounts.

q. Webworks owes Nancy $100 for her work during the last week of October.

r. Leons parents let him know that Webworks owes $300 toward the electricity bill. Webworks will pay them in November.

s. Webworks determines that it has $50 worth of supplies remaining at the end of October.

t. Prepaid rent should be adjusted for Octobers portion.

u. Webworks is continuing to accrue bad debts at 10 percent of accounts receivable.

v. A CPA tells Leon that Webworks should be depreciating its equipment and furniture. The CPA recommends that Webworks use the straight-line method with a four-year life for the equipment and a five-year life for the furniture. Normally, when an error is made, such as not depreciating equipment, the company must go back and restate prior financial statements correctly. Since Webworks is only generating these monthly statements for internal information, the CPA recommends that Leon just catch up the prior months depreciation on the equipment this month. So when Webworks records Octobers equipment depreciation, it will also record the deprecation that should have been taken in July, August and September. The depreciation on the furniture should just be for one month. Round to the nearest whole number.

E. Prepare an adjusted trial balance.

F. Prepare financial statements for October.

The following events occur during November:

a. Webworks starts and completes eight more Web sites and bills clients for $4,600.

b. Webworks purchases supplies worth $80 on account.

c. At the beginning of November, Webworks had nine keyboards costing $110 each and forty flash drives costing $12 each. Webworks uses periodic FIFO to cost its inventory.

d. On account, Webworks purchases sixty keyboards for $111 each and ninety flash drives for $13 each.

e. Webworks pays Nancy $800 for her work during the first three weeks of October.

f. Webworks sells 60 keyboards for $9,000 and 120 flash drives for $2,400 cash.

g. A local realtor pays $400 in advance for a Web site. It will not be completed until December.

h. Leon read about a new program that could enhance the Web sites Webworks is developing for clients. He decides to purchase a license to be able to use the program for one year by paying $2,400 cash. This is called a license agreement and is an intangible asset.

i. Webworks collects $4,200 in accounts receivable.

j. Webworks pays off its salaries payable from November.

k. Webworks pays off $9,000 of its accounts payable.

l. Webworks pays Leon a salary of $2,000.

m. Webworks wrote off an uncollectible account in the amount of $100.

n. Webworks pays taxes of $1,135 in cash.

Required:

A. Prepare journal entries for the above events.

B. Post the journal entries to T-accounts.

C. Prepare an unadjusted trial balance for Webworks for November.

D. Prepare adjusting entries for the following and post them to your T-accounts.

o. Webworks owes Nancy $150 for her work during the last week of November.

p. Leons parents let him know that Webworks owes $290 toward the electricity bill. Webworks will pay them in December.

q. Webworks determines that it has $20 worth of supplies remaining at the end of November.

r. Prepaid rent should be adjusted for Novembers portion.

s. Webworks is continuing to accrue bad debts at 10 percent of accounts receivable.

t. Webworks continues to depreciate its equipment over four years and its furniture over five years, using the straight-line method.

u. The license agreement should be amortized over its one-year life.

v. Record cost of goods sold.

E. Prepare an adjusted trial balance.

F. Prepare financial statements for November.

Update: I just need the the journal entries (a-p) and the adjusted entries (q-v). Its all one question

Webworks Income Statement As of September 30 Revenue Cost of Goods Sold Gross Profit Other Expenses Earning before Tax Tax Expense Net Income $11,400 (5,315) 6,085 (3,435) 2,650 (795) $1,855 Webworks Stmt. of Retained Earnings As of September 30 Retained Earnings, September 1 Net Income Retained Earnings, September 30 $2,790 1,855 $4,645 Webworks Balance Sheet September 30 Assets Liabilities $3,300 1,750 Current Accounts Payable Salaries Payable Unearned Revenue $1,285 300 100 Current Cash Accounts Receivable Less Allowance for Doubtful Accounts Net Accounts Receivable Merchandise Inventory Supplies Inventory Total Current Assets (175) 1,575 1,385 70 $6,330 Total Current Liabilities $1,685 Noncurrent Equipment Noncurrent Notes Payable $7,000 $5,000 Owners' Equity Capital Stock Retained Earnings Total Owners' Equity $2,000 4,645 $6,645 Total Liabilities & Owners' Equity Total Assets $13,330 $13,330Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started