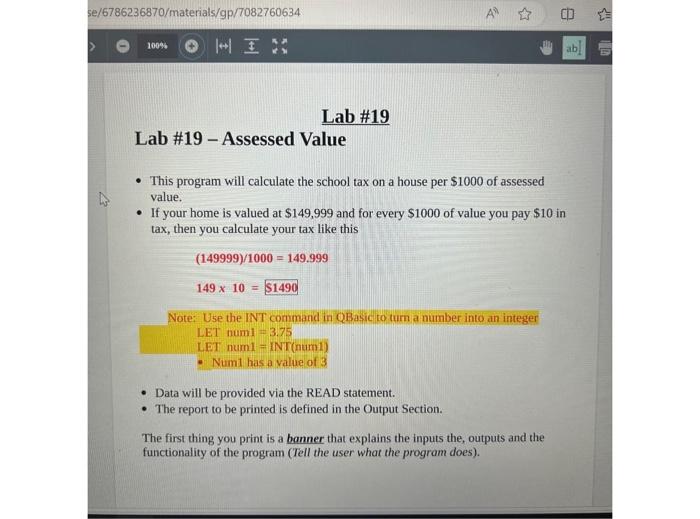

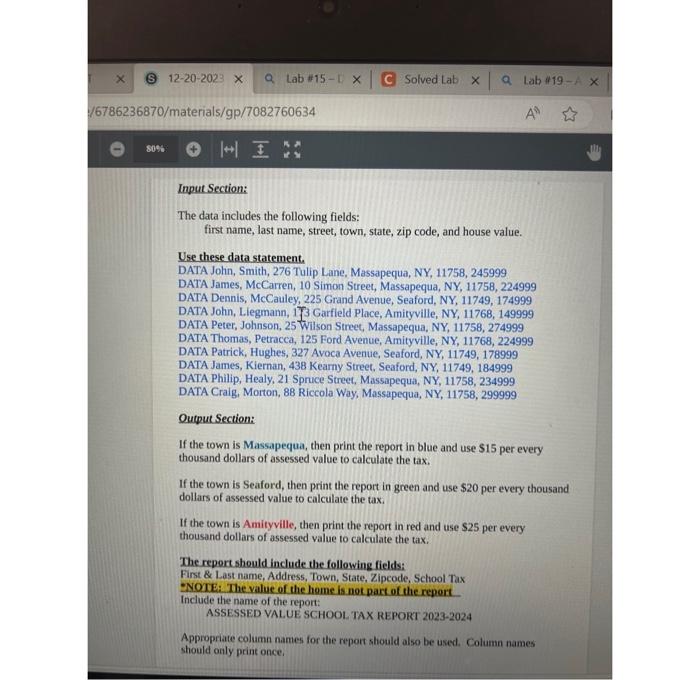

- This program will calculate the school tax on a house per $1000 of assessed value. - If your home is valued at $149,999 and for every $1000 of value you pay $10 in tax, then you calculate your tax like this (149999)/1000=149.99914910=$1490 Note: Use the INT command in QBasic to turn a number into an integer LET numl =3.75 LET numl =INT( numi ) - Numi has a value of 3 - Data will be provided via the READ statement. - The report to be printed is defined in the Output Section. The first thing you print is a banner that explains the inputs the, outputs and the functionality of the program (Tell the user what the program does). The data includes the following fields: first name, last name, street, town, state, zip code, and house value. Use these data statement. DATA John, Smith, 276 Tulip Lane, Massapequa, NY, 11758, 245999 DATA James, McCarren, 10 Simon Street, Massapequa, NY, 11758, 224999 DATA Dennis, McCauley, 225 Grand Avenue, Seaford, NY, 11749, 174999 DATA John, Liegmann, 173 Garfleld Place, Amityville, NY, 11768, 149999 DATA Peter, Johnson, 25 Wilson Street, Massapequa, NY, 11758, 274999 DATA Thomas, Petracca, 125 Ford Avenue, Amityville, NX, 11768, 224999 DATA Patrick, Hughes, 327 Avoca Avenue, Seaford, NY, 11749, 178999 DATA James, Kiernan, 438 Kearny Street, Seaford, NY, 11749, 184999 DATA Philip, Healy, 21 Sprice Street, Massapequa, NY, 11758, 234999 DATA Craig, Morton, 88 Rccola Way, Massapequa, NY, 11758, 299999 Output Section: If the town is Massapequa, then print the report in blue and use $15 per every thousand dollars of assessed value to calculate the tax. If the town is Seaford, then print the report in green and use $20 per every thousand dollars of assessed value to calculate the tax. If the town is Amityville, then print the report in red and use \$25 per every thousand dollars of assessed value to calculate the tax. The report should include the following fields: First \& Last name, Address, Town, State, Zipcode, School Tax TNOTE: The value of the home is not part of the report Include the name of the report: ASSESSED VALUE SCHOOL TAX REPORT 2023-2024 Appropriate column names for the report should also be used. Column names should only print once