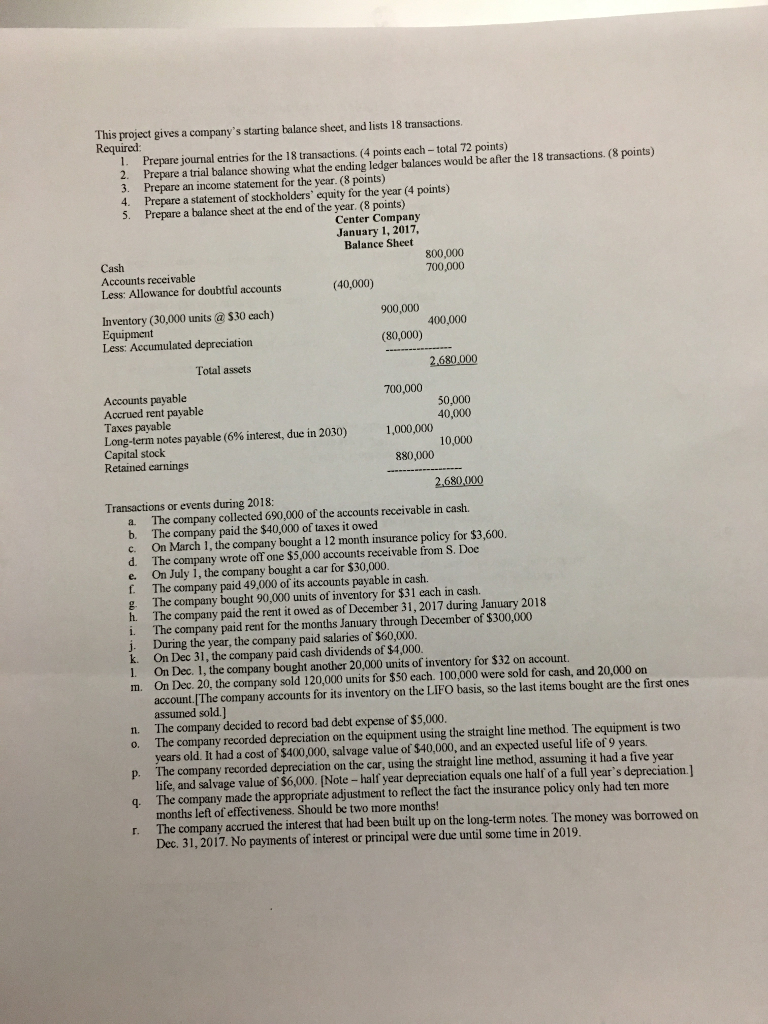

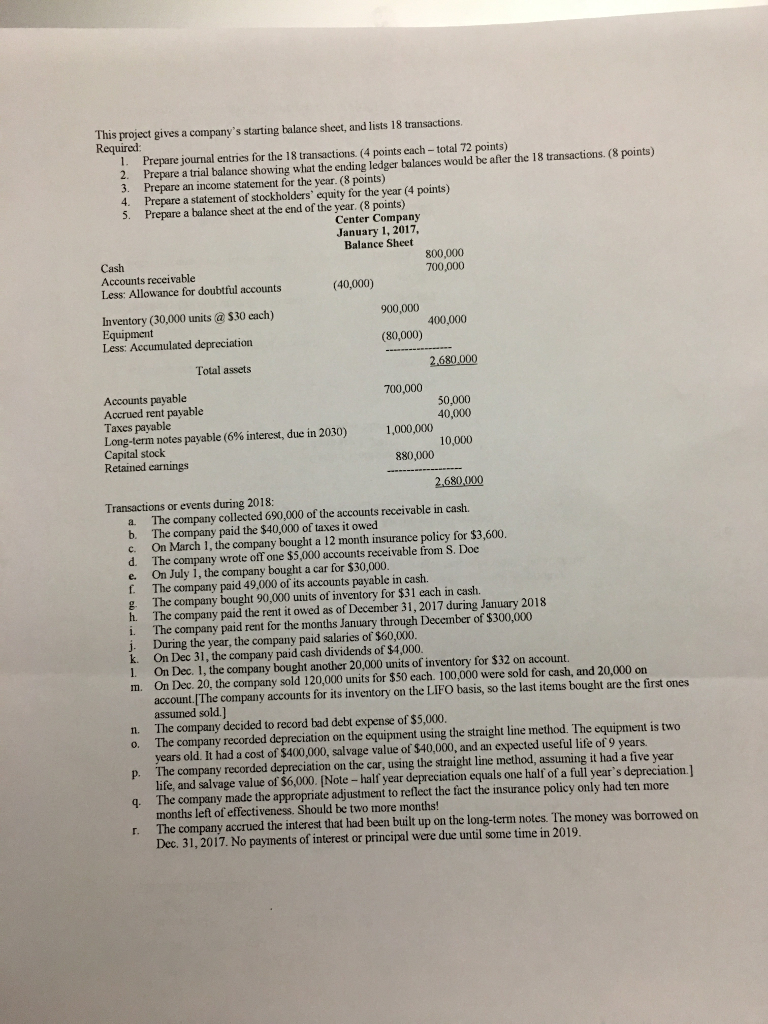

This project gives a company's starting balance sheet, and lists 18 transactions Prepare journal entries for the 18 transactions. Prepare a trial balance showing what the ending ledger balances would be after the 18 transactions. Prepare an income statement for the year. Prepare a statement of stockholders' equity for the year Prepare a balance sheet at the end of the year. Transactions or events during 2018: The company collected 690,000 of tire accounts receivable in cash. The company paid the $40,000 of taxes it owed On March 1, the company bought a 12 month insurance policy for $3, 600. the company wrote off one $5,000 accounts receivable from S. Doe On July 1, the company bought a car for $30,000. The company paid 49,000 of its accounts payable in cash. The company bought 90,000 units of inventory for $31 each in cash. The company paid the rent it owed as of December 31, 2017 during January 2018 The company paid rent for the months January through December of $300,000 During the year, the company paid salaries of $60,000. On Dec 31, the company paid cash dividends of $4,000. On Dec. 1, the company bought another 20,000 units of inventory for $32 on account. On Dec. 20, the company sold 120,000 units for $50 each. 100,000 were sold for cash, and 20,000 on account.[The company accounts for its inventory on the LIFO basis, so the last items bought are the first ones assumed sold] The company decided to record bad debt expense of $5,000. The company recorded depreciation on the equipment using the straight line method. The equipment is two years old. It had a cost of $400,000, salvage value of $40,000, and an expected useful life of 9 years. The company recorded depreciation on the car, using the straight line method, assuming it had a five year life., and salvage value of $6,000. The company made the appropriate adjustment to reflect the fact the insurance policy only had ton more months left of effectiveness. Should be two more months! The company accrued the interest that had been built up on the long-term notes. The money was borrowed on Dec. 31, 2017. No payments of interest or principal were due until some time in 2019