Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This project requires you to use python for all the calculations. 2. (10 points) During the class we derived the payoff for Call and Put

This project requires you to use python for all the calculations.

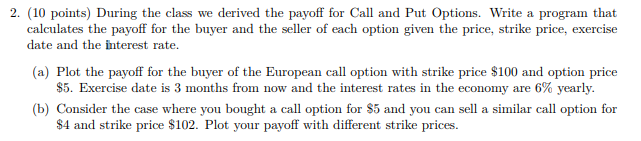

2. (10 points) During the class we derived the payoff for Call and Put Options. Write a program that calculates the payoff for the buyer and the seller of each option given the price, strike price, exercise date and the interest rate. (a) Plot the payoff for the buyer of the European call option with strike price $100 and option price $5. Exercise date is 3 months from now and the interest rates in the economy are 6% yearly. b) Consider the case where you bought a call option for $5 and you can sell a similar call option for S4 and strike price $102. Plot your payoff with different strike prices 2. (10 points) During the class we derived the payoff for Call and Put Options. Write a program that calculates the payoff for the buyer and the seller of each option given the price, strike price, exercise date and the interest rate. (a) Plot the payoff for the buyer of the European call option with strike price $100 and option price $5. Exercise date is 3 months from now and the interest rates in the economy are 6% yearly. b) Consider the case where you bought a call option for $5 and you can sell a similar call option for S4 and strike price $102. Plot your payoff with different strike pricesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started