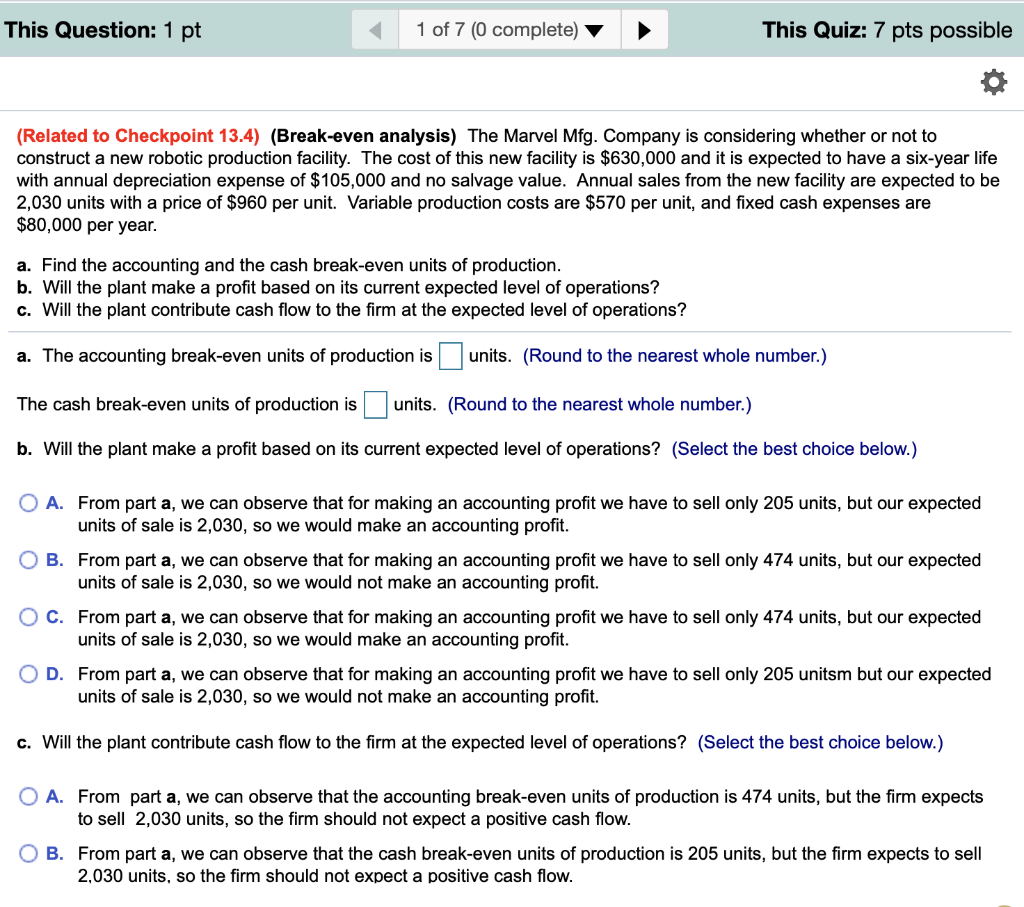

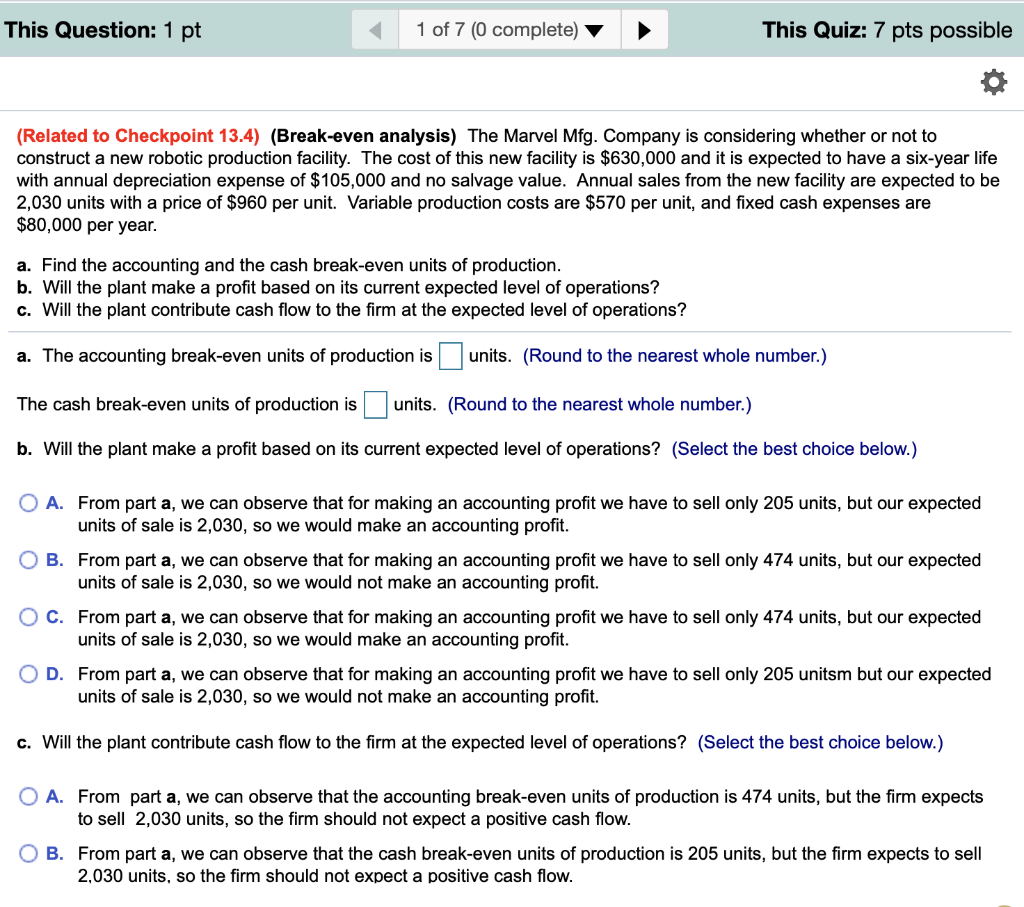

This Question: 1 pt 1 of 7 (0 complete) This Quiz: 7 pts possible (Related to Checkpoint 13.4) (Break-even analysis) The Marvel Mfg. Company is considering whether or not to construct a new robotic production facility. The cost of this new facility is $630,000 and it is expected to have a six-year life with annual depreciation expense of $105,000 and no salvage value. Annual sales from the new facility are expected to be 2,030 units with a price of $960 per unit. Variable production costs are $570 per unit, and fixed cash expenses are $80,000 per year. a. Find the accounting and the cash break-even units of production. b. Will the plant make a profit based on its current expected level of operations? c. Will the plant contribute cash flow to the firm at the expected level of operations? a. The accounting break-even units of production is units. (Round to the nearest whole number.) The cash break-even units of production is units. (Round to the nearest whole number.) b. Will the plant make a profit based on its current expected level of operations? (Select the best choice below.) O A. From part a, we can observe that for making an accounting profit we have to sell only 205 units, but our expected units of sale is 2,030, so we would make an accounting profit. O B. From part a, we can observe that for making an accounting profit we have to sell only 474 units, but our expected units of sale is 2,030, so we would not make an accounting profit. O C. From part a, we can observe that for making an accounting profit we have to sell only 474 units, but our expected units of sale is 2,030, so we would make an accounting profit. OD. From part a, we can observe that for making an accounting profit we have to sell only 205 unitsm but our expected units of sale is 2,030, so we would not make an accounting profit. c. Will the plant contribute cash flow to the firm at the expected level of operations? (Select the best choice below.) O A. From part a, we can observe that the accounting break-even units of production is 474 units, but the firm expects to sell 2,030 units, so the firm should not expect a positive cash flow. O B. From part a, we can observe that the cash break-even units of production is 205 units, but the firm expects to sell 2,030 units, so the firm should not expect a positive cash flow. This Question: 1 pt 1 of 7 (0 complete) This Quiz: 7 pts possible (Related to Checkpoint 13.4) (Break-even analysis) The Marvel Mfg. Company is considering whether or not to construct a new robotic production facility. The cost of this new facility is $630,000 and it is expected to have a six-year life with annual depreciation expense of $105,000 and no salvage value. Annual sales from the new facility are expected to be 2,030 units with a price of $960 per unit. Variable production costs are $570 per unit, and fixed cash expenses are $80,000 per year. a. Find the accounting and the cash break-even units of production. b. Will the plant make a profit based on its current expected level of operations? c. Will the plant contribute cash flow to the firm at the expected level of operations? a. The accounting break-even units of production is units. (Round to the nearest whole number.) The cash break-even units of production is units. (Round to the nearest whole number.) b. Will the plant make a profit based on its current expected level of operations? (Select the best choice below.) O A. From part a, we can observe that for making an accounting profit we have to sell only 205 units, but our expected units of sale is 2,030, so we would make an accounting profit. O B. From part a, we can observe that for making an accounting profit we have to sell only 474 units, but our expected units of sale is 2,030, so we would not make an accounting profit. O C. From part a, we can observe that for making an accounting profit we have to sell only 474 units, but our expected units of sale is 2,030, so we would make an accounting profit. OD. From part a, we can observe that for making an accounting profit we have to sell only 205 unitsm but our expected units of sale is 2,030, so we would not make an accounting profit. c. Will the plant contribute cash flow to the firm at the expected level of operations? (Select the best choice below.) O A. From part a, we can observe that the accounting break-even units of production is 474 units, but the firm expects to sell 2,030 units, so the firm should not expect a positive cash flow. O B. From part a, we can observe that the cash break-even units of production is 205 units, but the firm expects to sell 2,030 units, so the firm should not expect a positive cash flow