Answered step by step

Verified Expert Solution

Question

1 Approved Answer

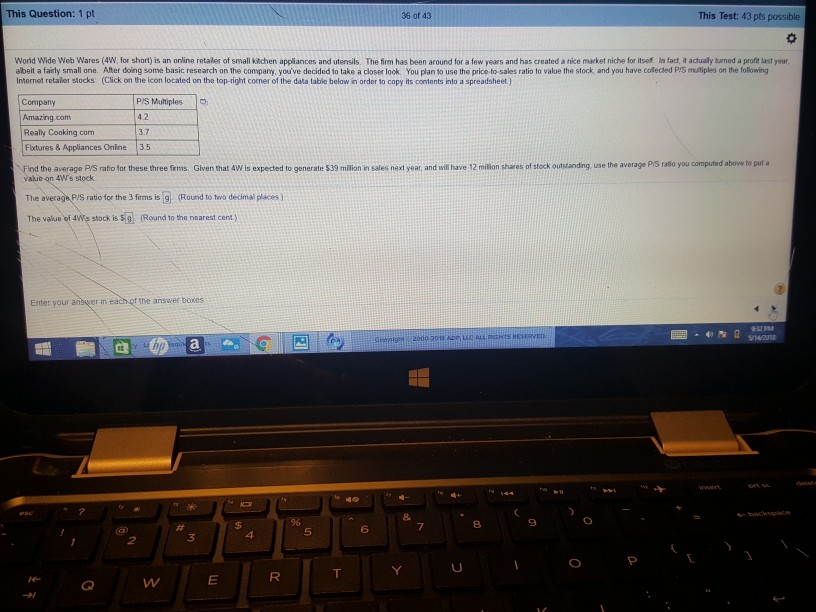

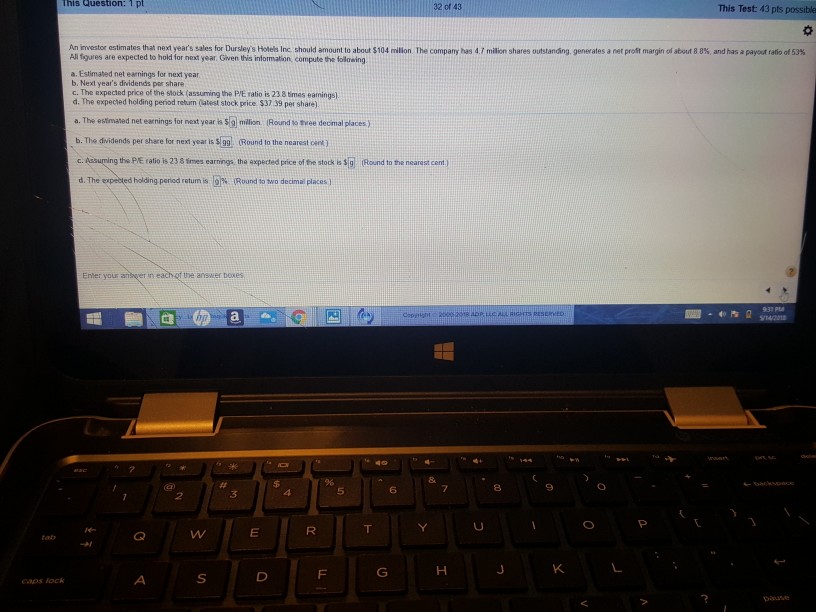

This Question: 1 pt 360143 This Test: 43 pts possible World Wide Web Wares (4W, for short) is an online retaler of small kitchen appliances

This Question: 1 pt 360143 This Test: 43 pts possible World Wide Web Wares (4W, for short) is an online retaler of small kitchen appliances and utensils. The 6irm has been around for a few years and has created a tice market niche for itsef in fact, it actually turned a profit last year albeit a fairly small one. Ater doing some basic research on the company, you've decided to take a closer look. You plan to use the price-to sales ratio to value the stock, and you have colected P/S multiples on the following Internet retailer stocks (Click on the icon located on the top-right comer of the dala table below in arder to copy its contents into a spreadsheet) Amazing com Really Cooking com Fuxtures & Appliances Online 3.5 PIS Multiples 42 3.7 find the average /S ratio for these three fims. Given that 4W is expected to generate $39 mllion in sales next year, and wil ave 12 milion shares af stock outstandng use the average PS raso you computed above to ur a 4Ws stock The averaga P/S ratio for the 3 firms is 9. Round to two decimal places ) The value of 4s stock is sRound to the nearest cent) the answer boxes Enter your anbger in 8 5 6 3

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started