Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This Question: 1 pt Next Question 2 of 11 (1 complete) Which of the following is true with regard to the punishment for tax evasion?

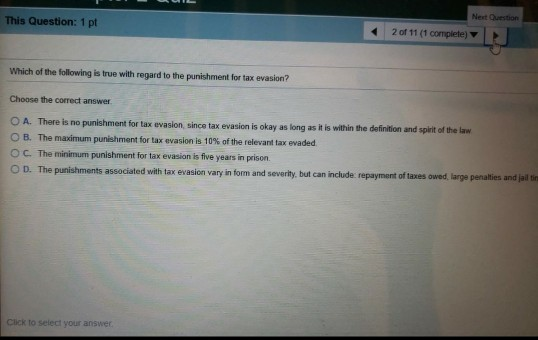

This Question: 1 pt Next Question 2 of 11 (1 complete) Which of the following is true with regard to the punishment for tax evasion? Choose the correct answer O A. There is no punishment for tax evasion, since tax evasion is okay as long as it is within the definition and spirit of the law OB. The maximum punishment for tax evasion is 10% of the relevant tax evaded. OC. The minimum punishment for tax evasion is five years in prison OD. The punishments associated with tax evasion vary in form and severity, but can include: repayment of taxes owed, large penalties and jail ti Click to select your

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started