Question

This question builds off the last questions (the one I am asking to be solved in the screen shot here is the previous questions and

This question builds off the last questions (the one I am asking to be solved in the screen shot here is the previous questions and answers:

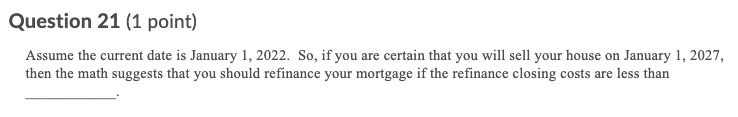

Assume the current date is January 1, 2022. You took out a 30-year, 4.5%, $200,000 mortgage on January 1, 2017, so 60 regular payments of $1,013.38 have already been made. The remaining loan balance is now $182,316.58. As of January 1, 2027, after another 60 payments have been made, the balance on the original mortgage: 160,184.98.

Assume the current date is January 1, 2022. If the remaining balance on the original mortgage is refinanced using a 25-year, 4% mortgage, then the new monthly payments are: 962.35

Assume the current date is January 1, 2022. If the remaining balance on the original mortgage is refinanced using a 25-year, 4% mortgage, then the balance on the new mortgage on January 1, 2027, after 60 payments have been made, is: 158,806.45

Assume the current date is January 1, 2022. Using a 4% annual discount rate (4%/12 per month), the difference in the present value of the next 60 monthly payments between the original mortgage and the new mortgage is 2770.93

Assume the current date is January 1, 2022. Using a 4%/12 = 1/3% per month discount rate, the difference in the present value of the January 1, 2027 principal amounts remaining between the original mortgage and the new mortgage is 1129.02

Next Question in the serise (the one that needs to be answered)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started