Answered step by step

Verified Expert Solution

Question

1 Approved Answer

**THIS QUESTION HAS 5 PARTS TOTAL** 1. What is the yield to maturity on Ramblin Wreck, Inc. bonds? 2. What is the cost of equity?

**THIS QUESTION HAS 5 PARTS TOTAL**

**THIS QUESTION HAS 5 PARTS TOTAL**

1. What is the yield to maturity on Ramblin Wreck, Inc. bonds?

2. What is the cost of equity?

3. What is the weight in debt for the project?

4. What is the WACC for the project?

5. What is the NPV of the project? (express in millions, so 1000000 would be 1.00)

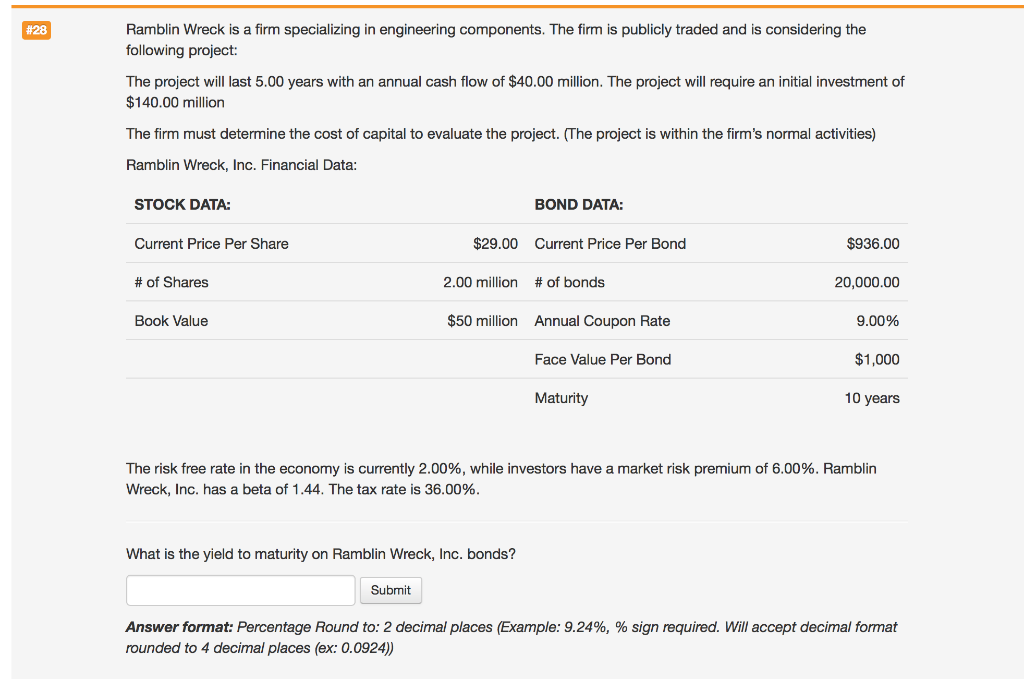

#28 Ramblin Wreck is a firm specializing in engineering components. The firm is publicly traded and is considering the following project: The project will last 5.00 years with an annual cash flow of $40.00 million. The project will require an initial investment of $140.00 million The firm must determine the cost of capital to evaluate the project. (The project is within the firm's normal activities) Ramblin Wreck, Inc. Financial Data: STOCK DATA: BOND DATA: Current Price Per Share $29.00 Current Price Per Bond $936.00 # of Shares 2.00 million # of bonds 20,000.00 Book Value $50 million Annual Coupon Rate 9.00% Face Value Per Bond $1,000 Maturity 10 years The risk free rate in the economy is currently 2.00%, while investors have a market risk premium of 6.00%. Ramblin Wreck, Inc. has a beta of 1.44. The tax rate is 36.00%. What is the yield to maturity on Ramblin Wreck, Inc. bonds? Submit Answer format: Percentage Round to: 2 decimal places (Example: 9.24%, % sign required. Will accept decimal format rounded to 4 decimal places (ex: 0.0924))

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started