Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This question is meant to help clarify the example of the profit maximizing monopolist from the lecture notes. In particular, you have a monopolist that

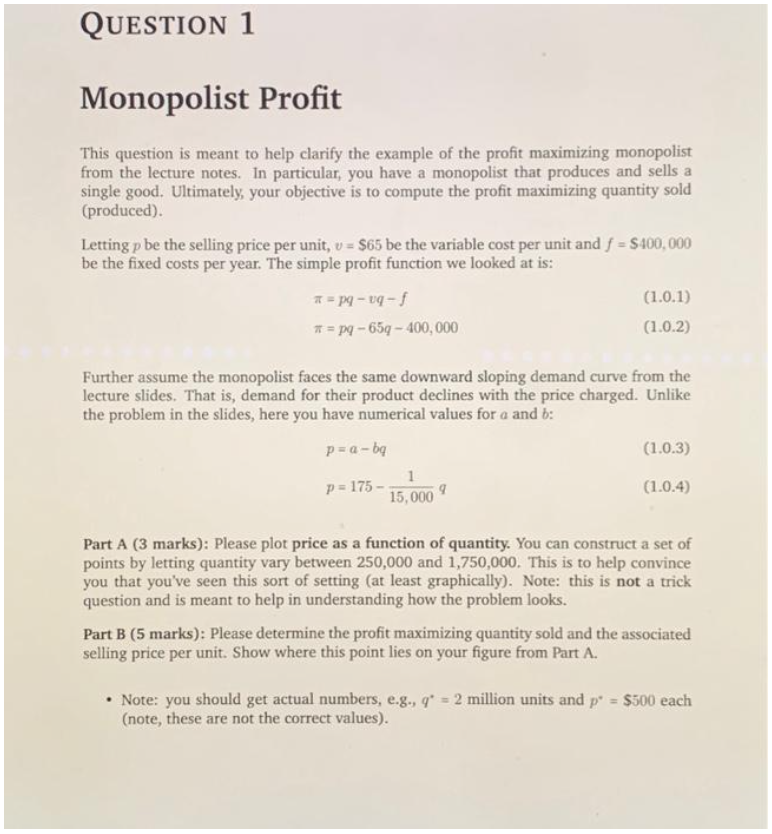

This question is meant to help clarify the example of the profit maximizing monopolist from the lecture notes. In particular, you have a monopolist that produces and sells a single good. Ultimately, your objective is to compute the profit maximizing quantity sold (produced). Letting p be the selling price per unit, v=$65 be the variable cost per unit and f=$400,000 be the fixed costs per year. The simple profit function we looked at is: =pqvqf=pq65q400,000 Further assume the monopolist faces the same downward sloping demand curve from the lecture slides. That is, demand for their product declines with the price charged. Unlike the problem in the slides, here you have numerical values for a and b : p=abqp=17515,0001q Part A (3 marks): Please plot price as a function of quantity. You can construct a set of points by letting quantity vary between 250,000 and 1,750,000. This is to help convince you that you've seen this sort of setting (at least graphically). Note: this is not a trick question and is meant to help in understanding how the problem looks. Part B ( 5 marks): Please determine the profit maximizing quantity sold and the associated selling price per unit. Show where this point lies on your figure from Part A. - Note: you should get actual numbers, e.g., q=2 million units and p=$500 each (note, these are not the correct values)

This question is meant to help clarify the example of the profit maximizing monopolist from the lecture notes. In particular, you have a monopolist that produces and sells a single good. Ultimately, your objective is to compute the profit maximizing quantity sold (produced). Letting p be the selling price per unit, v=$65 be the variable cost per unit and f=$400,000 be the fixed costs per year. The simple profit function we looked at is: =pqvqf=pq65q400,000 Further assume the monopolist faces the same downward sloping demand curve from the lecture slides. That is, demand for their product declines with the price charged. Unlike the problem in the slides, here you have numerical values for a and b : p=abqp=17515,0001q Part A (3 marks): Please plot price as a function of quantity. You can construct a set of points by letting quantity vary between 250,000 and 1,750,000. This is to help convince you that you've seen this sort of setting (at least graphically). Note: this is not a trick question and is meant to help in understanding how the problem looks. Part B ( 5 marks): Please determine the profit maximizing quantity sold and the associated selling price per unit. Show where this point lies on your figure from Part A. - Note: you should get actual numbers, e.g., q=2 million units and p=$500 each (note, these are not the correct values) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started