Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This question is related to forex and international finance. Thanks, and definite thumbs up! I only need answer for question #8 for this post. I

This question is related to forex and international finance. Thanks, and definite thumbs up!

I only need answer for question #8 for this post. I have posted 6 and 7 separately already. I have included 6 and 7 in this post to provide and information/context you may need for #8.

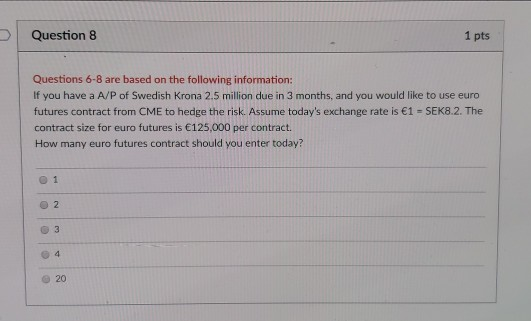

This is question I need, please:

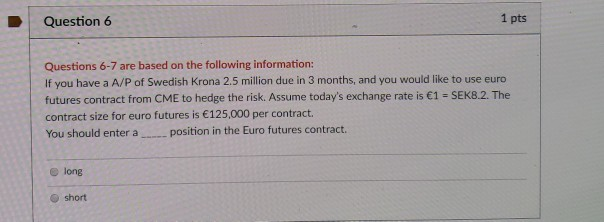

Here are other parts of the series. 6

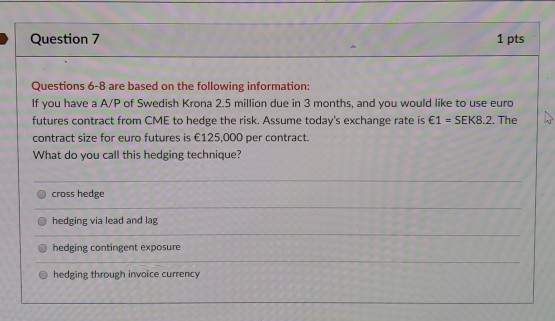

7

Question 8 1 pts Questions 6-8 are based on the following information: If you have a A/P of Swedish Krona 2.5 million due in 3 months, and you would like to use euro futures contract from CME to hedge the risk. Assume today's exchange rate is 1 -SEK8.2. The contract size for euro futures is 125,000 per contract. How many euro futures contract should you enter today? 0 3 e 20 Question 6 1 pts Questions 6-7 are based on the following information If you have a A/P of Swedish Krona 2.5 million due in 3 months, and you would like to use euro futures contract from CME to hedge the risk. Assume today's exchange rate is 1 SEK8.2. The contract size for euro futures is 125,000 per contract. You should enter aposition in the Euro futures contract. e long short Question 7 1 pts Questions 6-8 are based on the following information If you have a A/P of Swedish Krona 2.5 million due in 3 months, and you would like to use euro futures contract from CME to hedge the risk. Assume today's exchange rate is 1 -SEK8.2. The contract size for euro futures is 125,000 per contract. What do you call this hedging technique? O cross hedge O hedging via lead and lag O hedging contingent exposure e hedging through invoice currency

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started