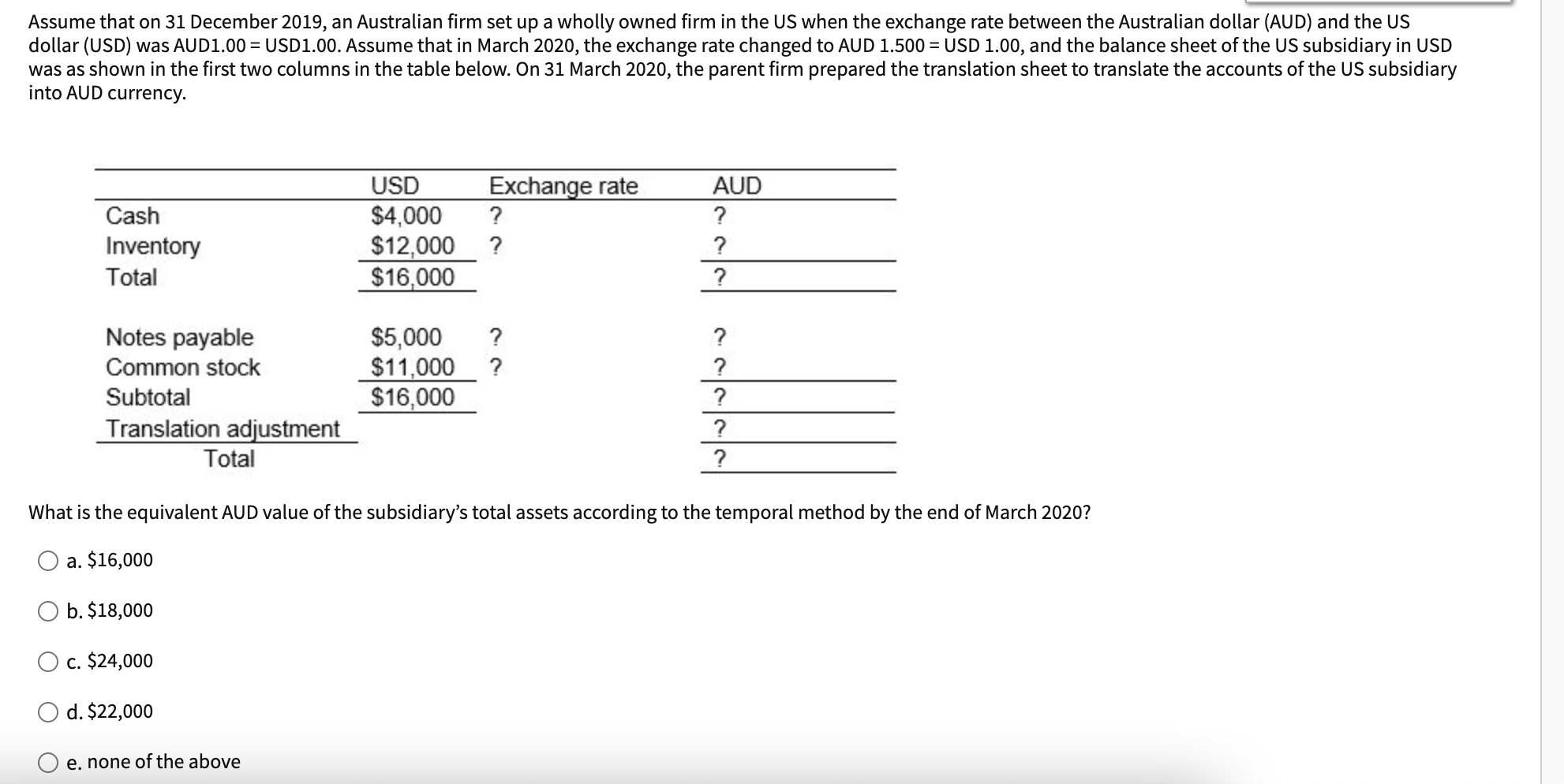

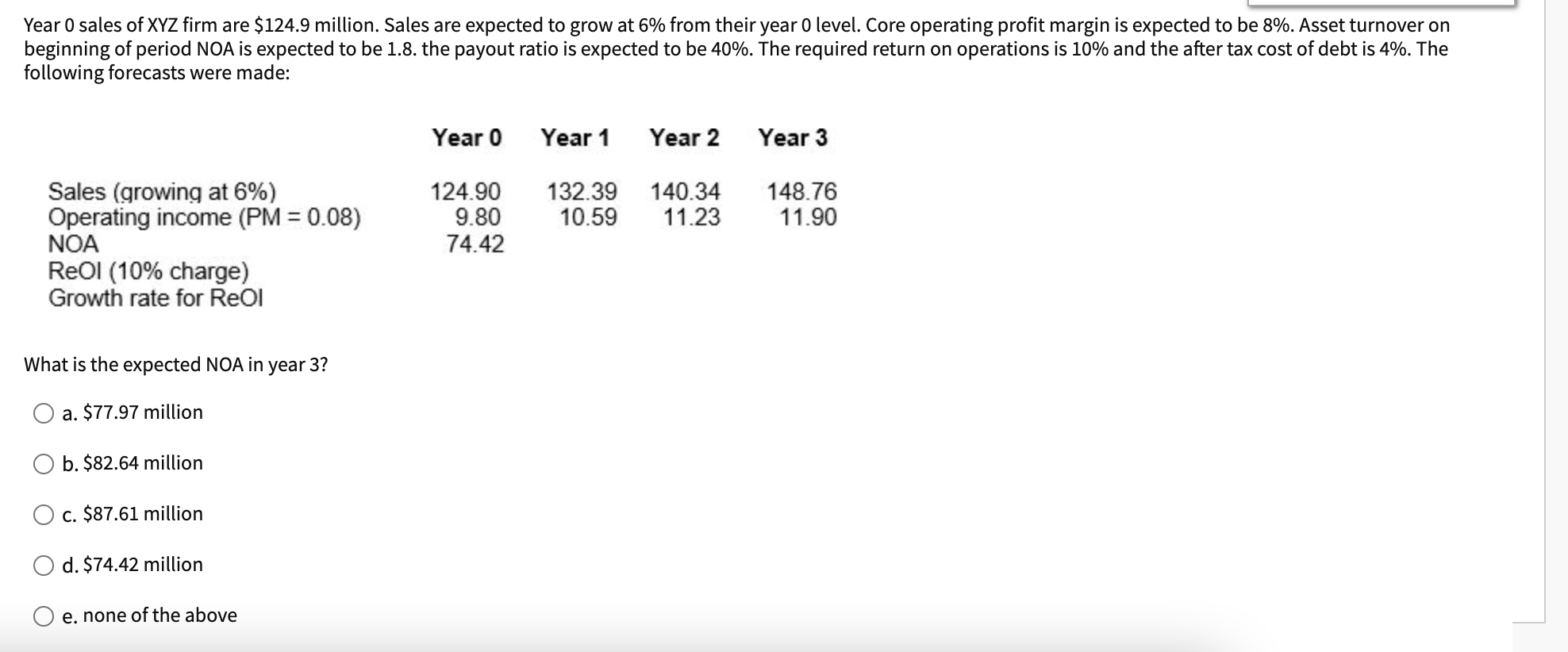

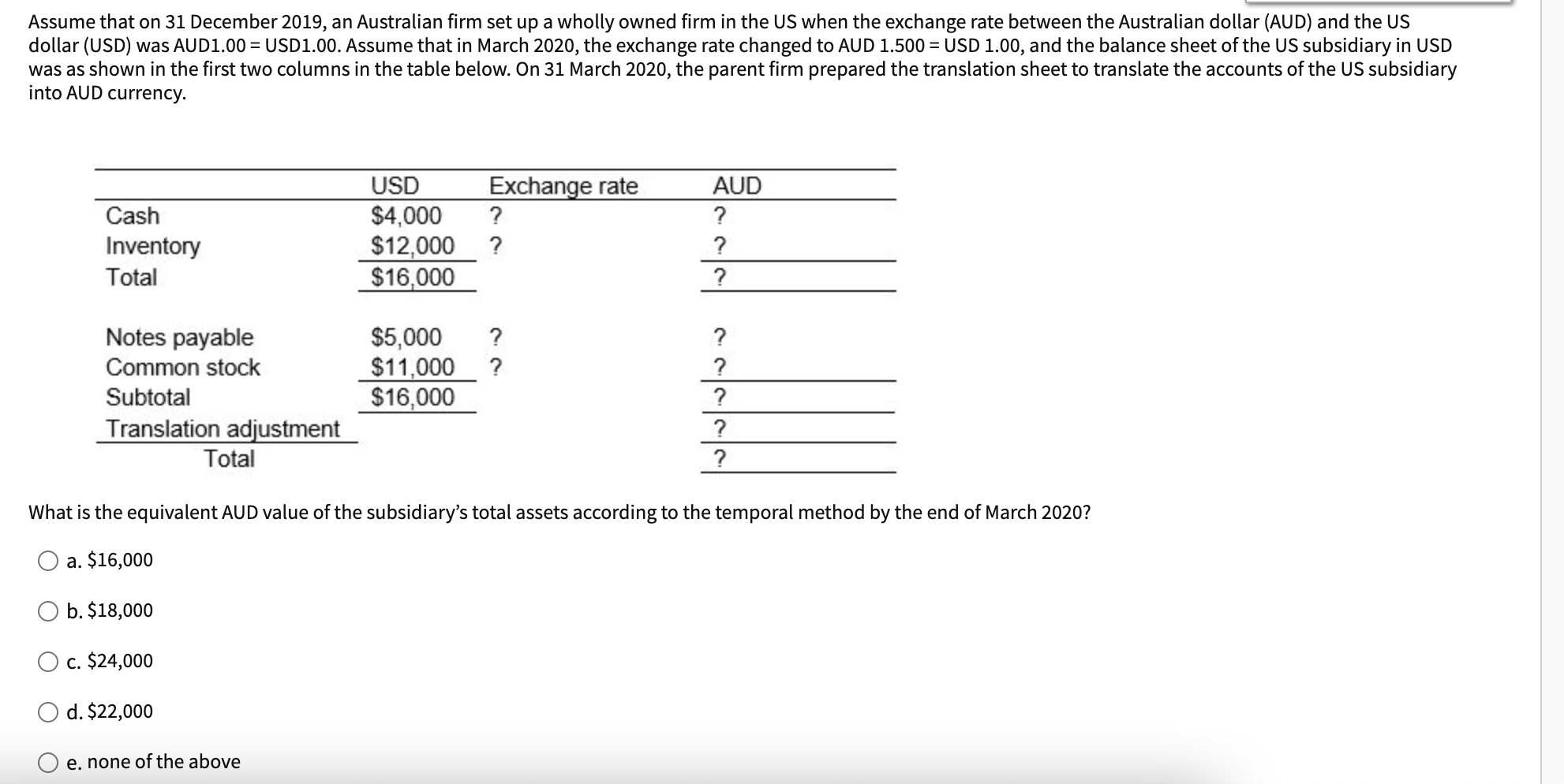

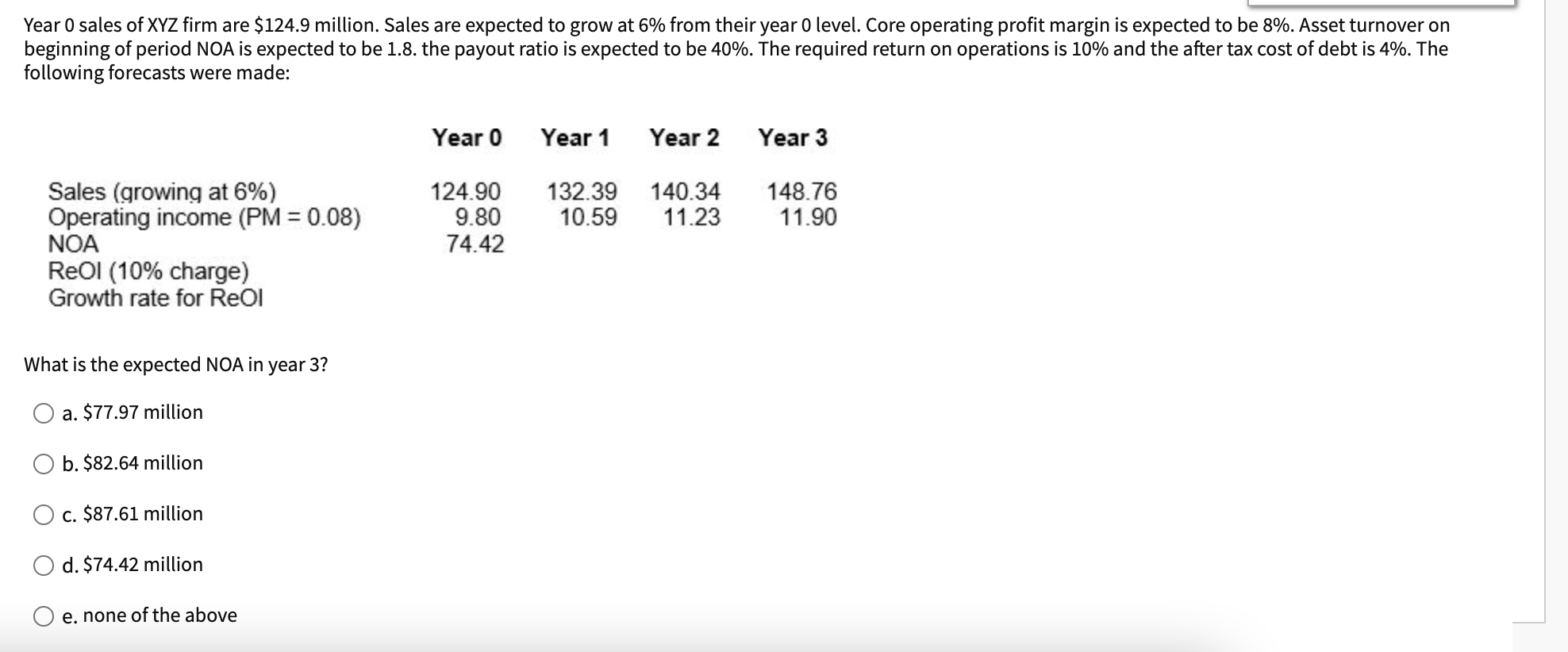

Assume that on 31 December 2019, an Australian firm set up a wholly owned firm in the US when the exchange rate between the Australian dollar (AUD) and the US dollar (USD) was AUD1.00 = USD1.00. Assume that in March 2020, the exchange rate changed to AUD 1.500 = USD 1.00, and the balance sheet of the US subsidiary in USD was as shown in the first two columns in the table below. On 31 March 2020, the parent firm prepared the translation sheet to translate the accounts of the US subsidiary into AUD currency. AUD ? Cash Inventory Total USD Exchange rate $4,000 ? $12,000 ? $16,000 ? ? ? $5,000 $11,000 $16,000 ? ? Notes payable Common stock Subtotal Translation adjustment Total ? ? ? ? What is the equivalent AUD value of the subsidiary's total assets according to the temporal method by the end of March 2020? a. $16,000 b. $18,000 O c. $24,000 d. $22,000 e, none of the above Year 0 sales of XYZ firm are $124.9 million. Sales are expected to grow at 6% from their year O level. Core operating profit margin is expected to be 8%. Asset turnover on beginning of period NOA is expected to be 1.8. the payout ratio is expected to be 40%. The required return on operations is 10% and the after tax cost of debt is 4%. The following forecasts were made: Year o Year 1 Year 2 Year 3 124.90 9.80 74.42 132.39 10.59 140.34 11.23 Sales (growing at 6%) Operating income (PM = 0.08) NOA Reol (10% charge) Growth rate for Reol 148.76 11.90 What is the expected NOA in year 3? a. $77.97 million b. $82.64 million c. $87.61 million d. $74.42 million e. none of the above Assume that on 31 December 2019, an Australian firm set up a wholly owned firm in the US when the exchange rate between the Australian dollar (AUD) and the US dollar (USD) was AUD1.00 = USD1.00. Assume that in March 2020, the exchange rate changed to AUD 1.500 = USD 1.00, and the balance sheet of the US subsidiary in USD was as shown in the first two columns in the table below. On 31 March 2020, the parent firm prepared the translation sheet to translate the accounts of the US subsidiary into AUD currency. AUD ? Cash Inventory Total USD Exchange rate $4,000 ? $12,000 ? $16,000 ? ? ? $5,000 $11,000 $16,000 ? ? Notes payable Common stock Subtotal Translation adjustment Total ? ? ? ? What is the equivalent AUD value of the subsidiary's total assets according to the temporal method by the end of March 2020? a. $16,000 b. $18,000 O c. $24,000 d. $22,000 e, none of the above Year 0 sales of XYZ firm are $124.9 million. Sales are expected to grow at 6% from their year O level. Core operating profit margin is expected to be 8%. Asset turnover on beginning of period NOA is expected to be 1.8. the payout ratio is expected to be 40%. The required return on operations is 10% and the after tax cost of debt is 4%. The following forecasts were made: Year o Year 1 Year 2 Year 3 124.90 9.80 74.42 132.39 10.59 140.34 11.23 Sales (growing at 6%) Operating income (PM = 0.08) NOA Reol (10% charge) Growth rate for Reol 148.76 11.90 What is the expected NOA in year 3? a. $77.97 million b. $82.64 million c. $87.61 million d. $74.42 million e. none of the above