Answered step by step

Verified Expert Solution

Question

1 Approved Answer

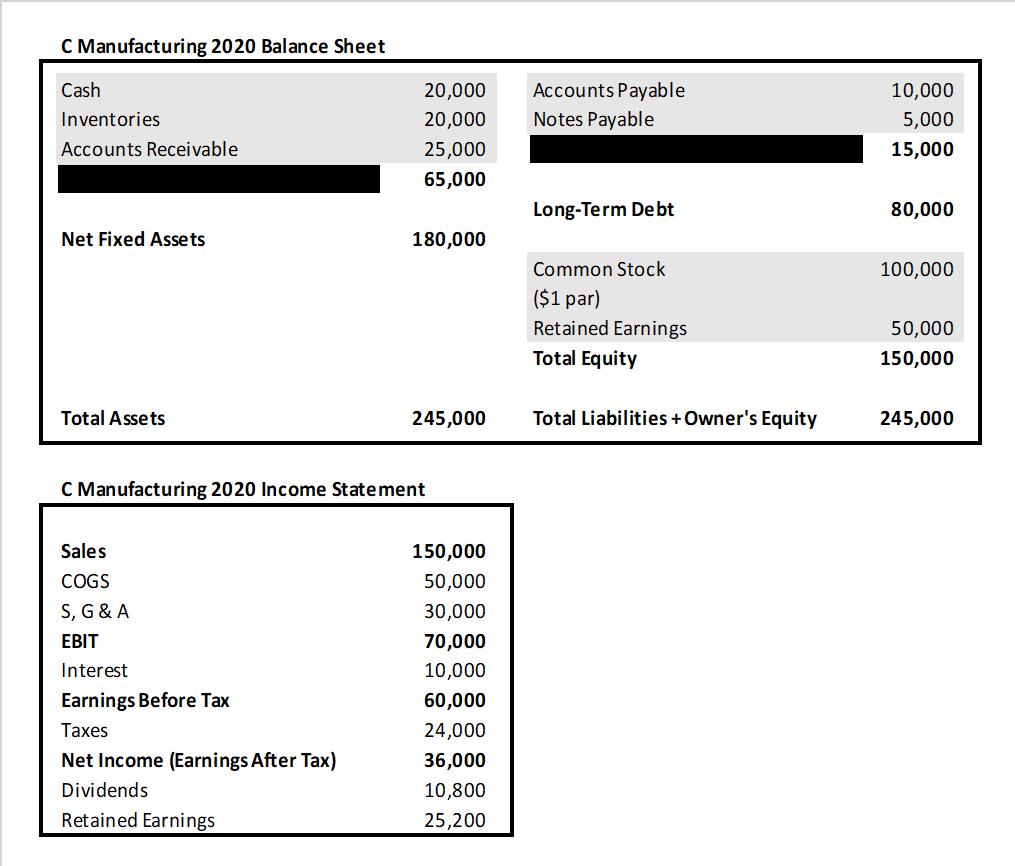

This question relates to the below C Manufacturing 2020 Income Statement and Balance Sheet: Assuming C Manufacturing' management wanted to increase sales by the Internal

This question relates to the below C Manufacturing 2020 Income Statement and Balance Sheet:

Assuming C Manufacturing' management wanted to increase sales by the Internal Growth Rate over the next year, how much would they be increasing sales by in 2021?

C Manufacturing 2020 Balance Sheet Cash Inventories Accounts Receivable Net Fixed Assets Total Assets Sales COGS S, G & A EBIT Interest Earnings Before Tax Taxes Net Income (Earnings After Tax) 20,000 20,000 25,000 65,000 C Manufacturing 2020 Income Statement Dividends Retained Earnings 180,000 245,000 150,000 50,000 30,000 70,000 10,000 60,000 24,000 36,000 10,800 25,200 Accounts Payable Notes Payable Long-Term Debt Common Stock ($1 par) Retained Earnings Total Equity Total Liabilities + Owner's Equity 10,000 5,000 15,000 80,000 100,000 50,000 150,000 245,000

Step by Step Solution

★★★★★

3.61 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER To calculate the internal growth rate we need to use th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started