Answered step by step

Verified Expert Solution

Question

1 Approved Answer

this questions are cost accounting questions. the first one talks about budget and the second talks about relevant costing SECTION A (40 marks) Answer both

this questions are cost accounting questions.

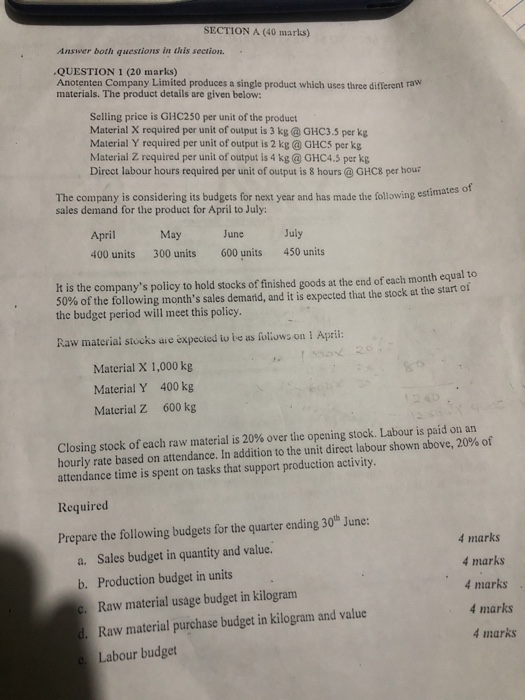

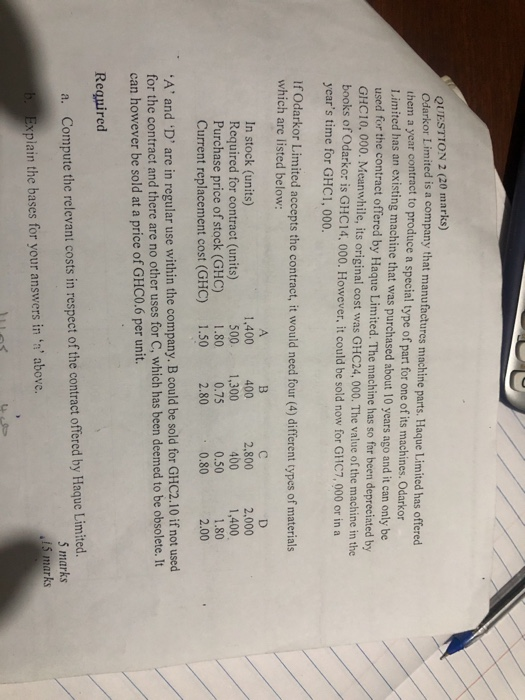

SECTION A (40 marks) Answer both questions in this section. QUESTION 1 (20 marks) Anotenten Company Limited produces a single product which uses three different raw materials. The product details are given below: Selling price is GHC250 per unit of the product Material X required per unit of output is 3 kg @ GHC3.5 per kg Material Y required per unit of output is 2 kg @ GHC5 per kg Material Z required per unit of output is 4 kg @ GHC4.5 per kg Direct labour hours required per unit of output is 8 hours @ GHC8 per hour The company is considering its budgets for next year and has made the following estimates of sales demand for the product for April to July: April May June July 400 units 300 units 600 units 450 units It is the company's policy to hold stocks of finished goods at the end of each month equal to 50% of the following month's sales demarid, and it is expected that the stock at the start of the budget period will meet this policy. Raw material stocks are expected to be as follows on 1 Aprii: Material X 1,000 kg Material Y 400 kg Material z 600 kg Closing stock of each raw material is 20% over the opening stock. Labour is paid on an hourly rate based on attendance. In addition to the unit direct labour shown above, 20% of attendance time is spent on tasks that support production activity. Required 4 marks 4 marks 4 marks Prepare the following budgets for the quarter ending 30 June: a. Sales budget in quantity and value. b. Production budget in units c. Raw material usage budget in kilogram d. Raw material purchase budget in kilogram and value e Labour budget 4 marks 4 marks QUESTION 2 (20 marks) Odarkor Limited is a company that manufactures machine parts. Haque Limited has offered them a year contract to produce a special type of part for one of its machines. Odarkor Limited has an existing machine that was purchased about 10 years ago and it can only be used for the contract offered by Haque Limited. The machine has so far been depreciated by GHC10.000. Meanwhile, its original cost was GHC24,000. The value of the machine in the books of Odarkor is GHC14.000. However, it could be sold now for GHC7,000 or in a year's time for GHCI,000. If Odarkor Limited accepts the contract, it would need four (4) different types of materials which are listed below: A B D In stock (units) 1,400 400 2.800 2,000 Required for contract (units) 500 1,300 400 1,400 Purchase price of stock (GHC) 1.80 0.75 0.50 1.80 Current replacement cost (GHC) 1.50 2.80 0.80 2.00 'A' and 'D' are in regular use within the company. B could be sold for GHC2.10 if not used for the contract and there are no other uses for C, which has been deemed to be obsolete. It can however be sold at a price of GHC0.6 per unit. Required a. Compute the relevant costs in respect of the contract offered by Haque Limited. 5 marks b. Explain the bases for your answers in 'n' above. . 15 marks SECTION A (40 marks) Answer both questions in this section. QUESTION 1 (20 marks) Anotenten Company Limited produces a single product which uses three different raw materials. The product details are given below: Selling price is GHC250 per unit of the product Material X required per unit of output is 3 kg @ GHC3.5 per kg Material Y required per unit of output is 2 kg @ GHC5 per kg Material Z required per unit of output is 4 kg @ GHC4.5 per kg Direct labour hours required per unit of output is 8 hours @ GHC8 per hour The company is considering its budgets for next year and has made the following estimates of sales demand for the product for April to July: April May June July 400 units 300 units 600 units 450 units It is the company's policy to hold stocks of finished goods at the end of each month equal to 50% of the following month's sales demarid, and it is expected that the stock at the start of the budget period will meet this policy. Raw material stocks are expected to be as follows on 1 Aprii: Material X 1,000 kg Material Y 400 kg Material z 600 kg Closing stock of each raw material is 20% over the opening stock. Labour is paid on an hourly rate based on attendance. In addition to the unit direct labour shown above, 20% of attendance time is spent on tasks that support production activity. Required 4 marks 4 marks 4 marks Prepare the following budgets for the quarter ending 30 June: a. Sales budget in quantity and value. b. Production budget in units c. Raw material usage budget in kilogram d. Raw material purchase budget in kilogram and value e Labour budget 4 marks 4 marks QUESTION 2 (20 marks) Odarkor Limited is a company that manufactures machine parts. Haque Limited has offered them a year contract to produce a special type of part for one of its machines. Odarkor Limited has an existing machine that was purchased about 10 years ago and it can only be used for the contract offered by Haque Limited. The machine has so far been depreciated by GHC10.000. Meanwhile, its original cost was GHC24,000. The value of the machine in the books of Odarkor is GHC14.000. However, it could be sold now for GHC7,000 or in a year's time for GHCI,000. If Odarkor Limited accepts the contract, it would need four (4) different types of materials which are listed below: A B D In stock (units) 1,400 400 2.800 2,000 Required for contract (units) 500 1,300 400 1,400 Purchase price of stock (GHC) 1.80 0.75 0.50 1.80 Current replacement cost (GHC) 1.50 2.80 0.80 2.00 'A' and 'D' are in regular use within the company. B could be sold for GHC2.10 if not used for the contract and there are no other uses for C, which has been deemed to be obsolete. It can however be sold at a price of GHC0.6 per unit. Required a. Compute the relevant costs in respect of the contract offered by Haque Limited. 5 marks b. Explain the bases for your answers in 'n' above. . 15 marks the first one talks about budget and the second talks about relevant costing

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started