Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This subject is Advance Corporate Finance. Please help me to solve this question Thanksss Proctor Berhad (PB') is a conglomerate Malaysian public-listed company. The company

This subject is Advance Corporate Finance.

Please help me to solve this question Thanksss

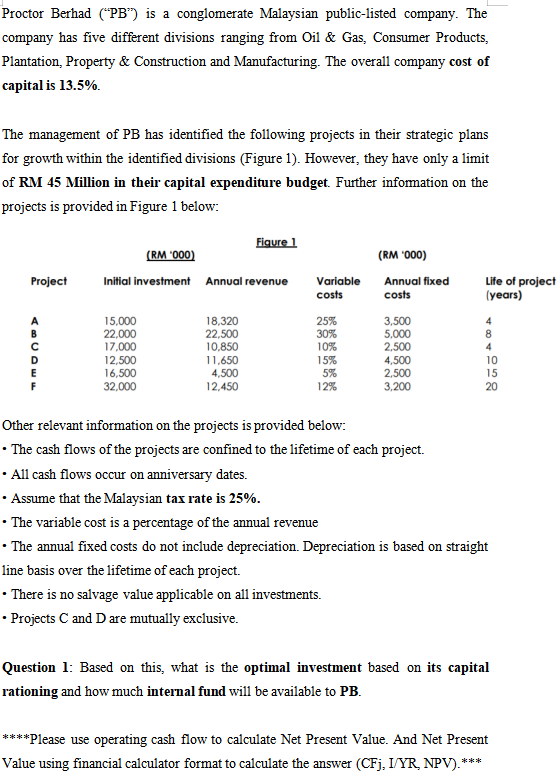

Proctor Berhad (PB') is a conglomerate Malaysian public-listed company. The company has five different divisions ranging from Oil & Gas, Consumer Products, Plantation, Property & Construction and Manufacturing. The overall company cost of capital is 13.5%. The management of PB has identified the following projects in their strategic plans for growth within the identified divisions (Figure 1). However, they have only a limit of RM 45 Million in their capital expenditure budget. Further infomation on the projects is provided in Figure 1 below: Figure 1 (RM '000) Initial investment Annual revenue Project Life of project (years) 15,000 22.000 17,000 12,500 16,500 32,000 B 18,320 22,500 10,850 11,650 4,500 12.450 (RM '000) Annual fixed costs 3,500 5.000 2,500 4,500 2,500 3,200 Variable costs 25% 30% 10% 15% 5% 12% 4 8 4 10 15 20 D Other relevant information on the projects is provided below: The cash flows of the projects are confined to the lifetime of each project. All cash flows occur on anniversary dates. Assume that the Malaysian tax rate is 25%. The variable cost is a percentage of the annual revenue The annual fixed costs do not include depreciation. Depreciation is based on straight line basis over the lifetime of each project. There is no salvage value applicable on all investments. Projects C and D are mutually exclusive. Question 1: Based on this, what is the optimal investment based on its capital rationing and how much internal fund will be available to PB. ****Please use operating cash flow to calculate Net Present Value. And Net Present Value using financial calculator format to calculate the answer (CFj, I/YR NPV).*** Proctor Berhad (PB') is a conglomerate Malaysian public-listed company. The company has five different divisions ranging from Oil & Gas, Consumer Products, Plantation, Property & Construction and Manufacturing. The overall company cost of capital is 13.5%. The management of PB has identified the following projects in their strategic plans for growth within the identified divisions (Figure 1). However, they have only a limit of RM 45 Million in their capital expenditure budget. Further infomation on the projects is provided in Figure 1 below: Figure 1 (RM '000) Initial investment Annual revenue Project Life of project (years) 15,000 22.000 17,000 12,500 16,500 32,000 B 18,320 22,500 10,850 11,650 4,500 12.450 (RM '000) Annual fixed costs 3,500 5.000 2,500 4,500 2,500 3,200 Variable costs 25% 30% 10% 15% 5% 12% 4 8 4 10 15 20 D Other relevant information on the projects is provided below: The cash flows of the projects are confined to the lifetime of each project. All cash flows occur on anniversary dates. Assume that the Malaysian tax rate is 25%. The variable cost is a percentage of the annual revenue The annual fixed costs do not include depreciation. Depreciation is based on straight line basis over the lifetime of each project. There is no salvage value applicable on all investments. Projects C and D are mutually exclusive. Question 1: Based on this, what is the optimal investment based on its capital rationing and how much internal fund will be available to PB. ****Please use operating cash flow to calculate Net Present Value. And Net Present Value using financial calculator format to calculate the answer (CFj, I/YR NPV).***Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started