Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This two week case will use the following two year financial statements including the balance sheets and profit and loss statements for South Bridge

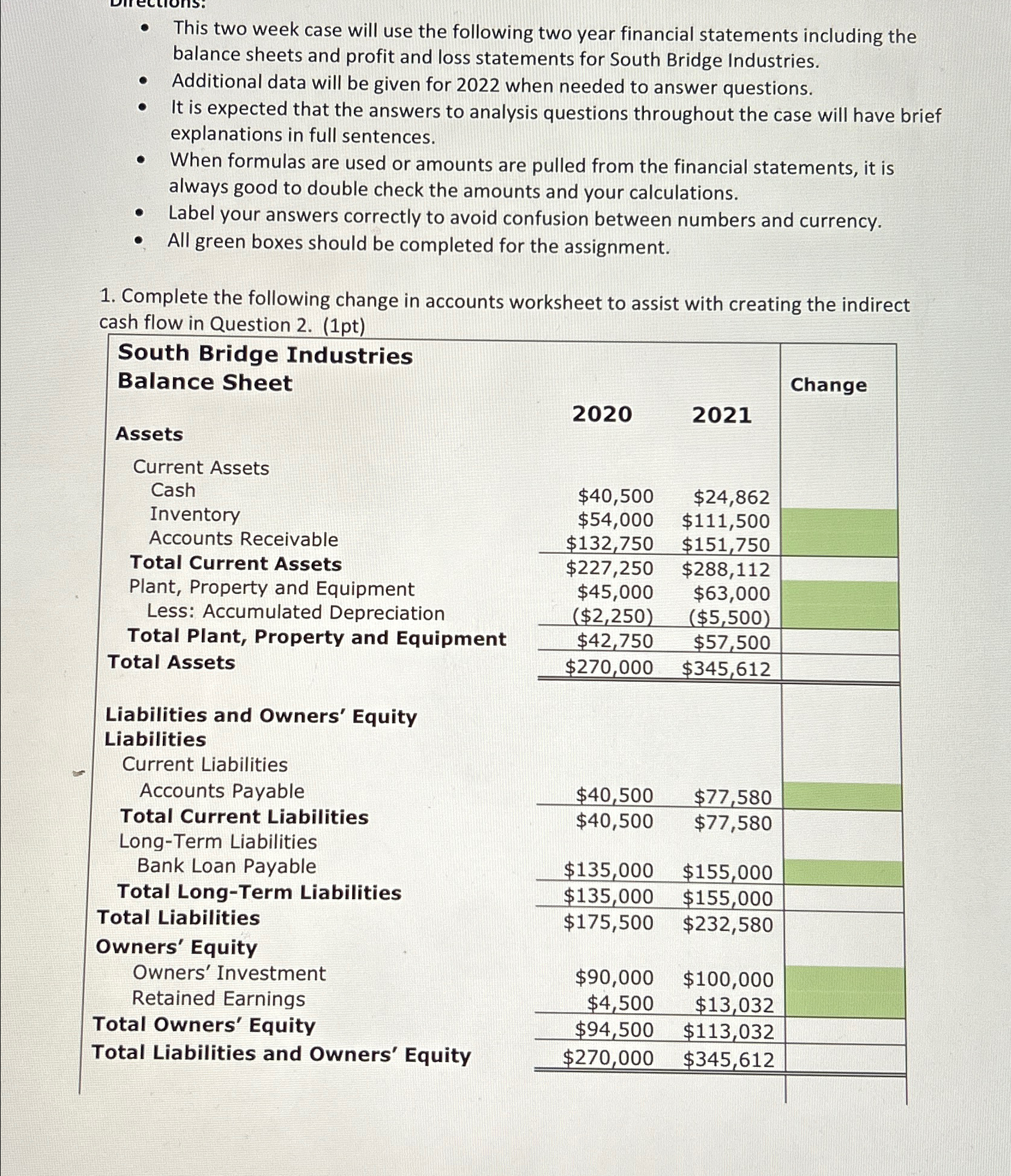

This two week case will use the following two year financial statements including the balance sheets and profit and loss statements for South Bridge Industries. Additional data will be given for 2022 when needed to answer questions. It is expected that the answers to analysis questions throughout the case will have brief explanations in full sentences. When formulas are used or amounts are pulled from the financial statements, it is always good to double check the amounts and your calculations. Label your answers correctly to avoid confusion between numbers and currency. All green boxes should be completed for the assignment. 1. Complete the following change in accounts worksheet to assist with creating the indirect cash flow in Question 2. (1pt) South Bridge Industries Balance Sheet Assets Current Assets Cash Inventory Accounts Receivable Change 2020 2021 $40,500 $24,862 $54,000 $111,500 $132,750 $151,750 Total Current Assets $227,250 $288,112 Plant, Property and Equipment $45,000 $63,000 Less: Accumulated Depreciation ($2,250) ($5,500) Total Plant, Property and Equipment $42,750 $57,500 Total Assets $270,000 $345,612 Total Current Liabilities Liabilities and Owners' Equity Liabilities Current Liabilities Accounts Payable Long-Term Liabilities $40,500 $77,580 $40,500 $77,580 Bank Loan Payable $135,000 $155,000 Total Long-Term Liabilities $135,000 $155,000 Total Liabilities $175,500 $232,580 Owners' Equity Owners' Investment $90,000 $100,000 Retained Earnings Total Owners' Equity Total Liabilities and Owners' Equity $94,500 $113,032 $270,000 $345,612 $4,500 $13,032

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started