Question

This year, individual X and individual Y formed XY Partnership. X contributed $57,000 cash, and Y contributed business assets with a $57,000 FMV. Y?s adjusted

This year, individual X and individual Y formed XY Partnership. X contributed $57,000 cash, and Y contributed business assets with a $57,000 FMV. Y?s adjusted basis in these assets was only $11,400.The partnership agreement provides that income and loss will be divided equally between the two partners. Partnership operations for the year generated a $66,000 loss.

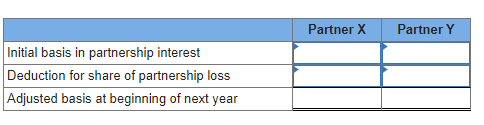

Required: How much loss may each partner deduct currently, and what basis will each partner have in her interest at the beginning of next year? Assume the excess business loss limitation does not apply to either X or Y. (Losses and deductions should be entered as negative numbers.

Partner X Partner Y Initial basis in partnership interest Deduction for share of partnership loss Adjusted basis at beginning of next year

Step by Step Solution

3.40 Rating (181 Votes )

There are 3 Steps involved in it

Step: 1

Initial basis in partnership intere...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started