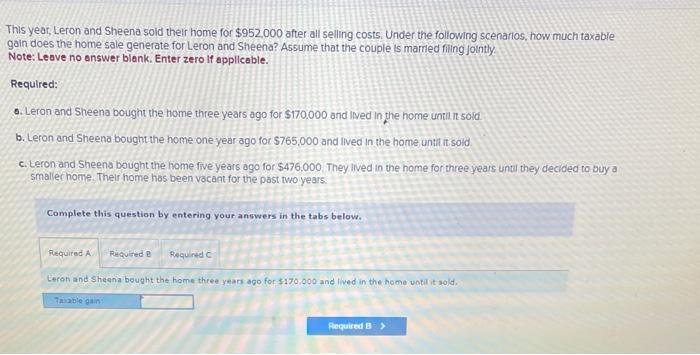

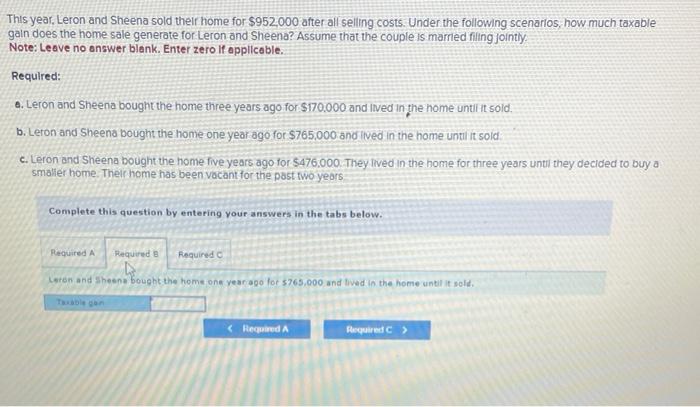

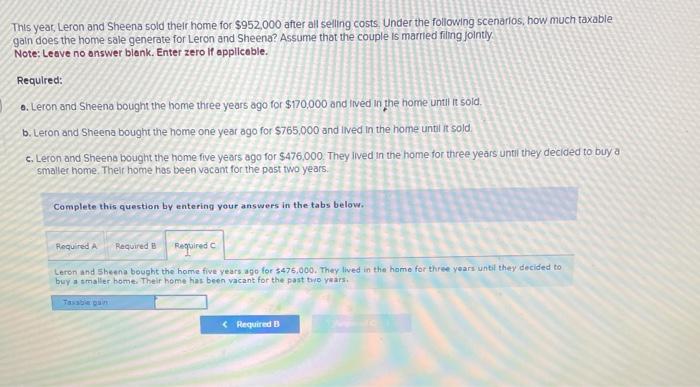

This year, Leron and Sheena sold their home for $952,000 after all selling costs. Under the following scenarios, how much taxable gain does the home sale generate for Leron and Sheena? Assume that the couple is mamed filing jointly: Note: Leave no onswer blank. Enter zero lf applicable. Required: 0. Leron and Sheena bought the home three years ago for $170.000 and lived in the home until it soid. b. Leron and Sheena bought the home one year ago for $765,000 and lived in the home until it sold. c. Leron and Sheena bought the home five years ago for $476.000. They ilved in the home for three years until they decided to buy a smaller home. Their home has been vacant for the past two years. Complete this question by entering your answers in the tabs below. Leran and Sheena bought the home three years ago for $170,000 and fived in the home votil it sold. This year, Leron and Sheena sold their home for $952,000 after all selling costs. Under the following scenarlos, how much taxable gain does the home sale generate for Leron and Sheena? Assume that the couple is marred filing jointly: Note: Leave no onswer blank. Enter zero if applicable. Required: Q. Leron and Sheena bought the home three years ago for $170.000 and ived in the home untilit sold. b. Leron and Sheena bought the home one year ago for $765,000 and lived in the home until it sold: c. Leron and Sheena bought the home five years ago for $476.000. They lived in the home for three years until they decided to buy a smaller home. Their home has been vacant for the past fwo years Complete this question by entering your answers in the tabs below. Leren and Sheene bought the home one year ago for 5765,000 and tived in the home until it sold. This yeas, Leron and Sheena sold their home for $952,000 after all selling costs. Under the following scenarlos, how much taxable gain does the home sale generate for Leron and Sheena? Assume that the couple is married filing jointly. Note: Leave no answer blenk. Enter zero if applicable. Required: 0. Leron and Sheena bought the home three years ago for $170,000 and ived in the home unth it sold. b. Leron and Sheena bought the home one year ago for $765,000 and itved in the home until it sold c. Leron and Sheena bought the home five years ago for $476,000. They ilved in the home for three years until they decided to buy a smaller home. Their home has been vacant for the past two years. Complete this question by entering your answers in the tabs below. Leron and 5 heen bought the home five years ago for $475,000. They lived in the hame for three years until they decided to buy a tmaller home. Their home has been yacant for the past two yaars