Answered step by step

Verified Expert Solution

Question

1 Approved Answer

thjere is no additional info [ please solve On Jan 1 , 2 XX 0 , Parent sells to its wholly owned investee equipment that

thjere is no additional info please solve On Jan XX Parent sells to its wholly owned investee equipment that had cost $ The selling price was $ and accumulated depreciation on that date was $ The subsidiary depreciates the equipment over its remaining life of years. The subsidiary sells the equipment on Jan XX for $

Required

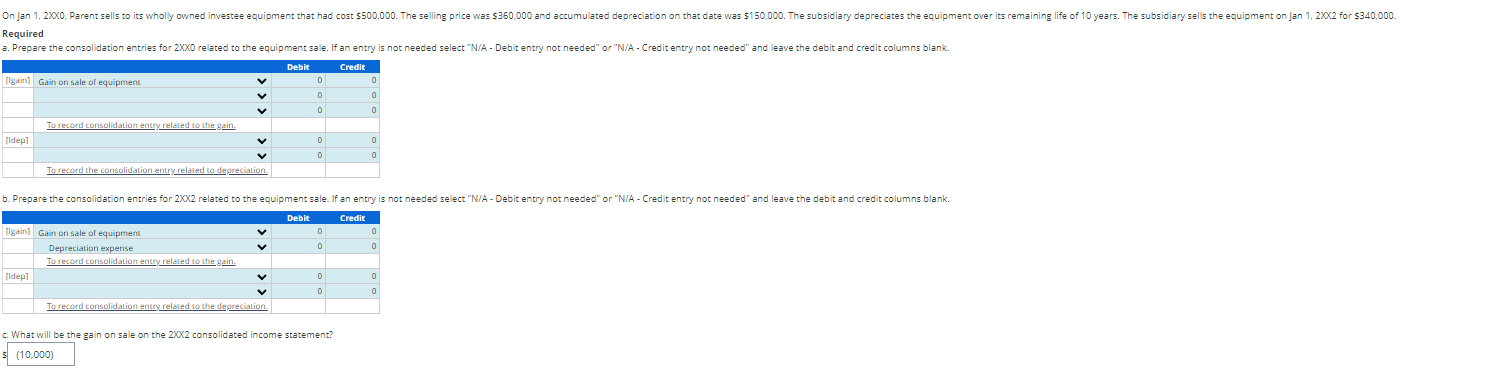

a Prepare the consolidation entries for XX related to the equipment sale. If an entry is not needed select NA Debit entry not needed" or NA Credit entry not needed" and leave the debit and credit columns blank.

b Prepare the consolidation entries for XX related to the equipment sale. If an entry is not needed select NA Debit entry not needed" or NA Credit entry not needed" and leave the debit and credit columns blank.

c What will be the gain on sale on the XX consolidated income statement?Required

a Prepare the consolidation entries for XXO related to the equipment sale. If an entry is not needed select NA Debit entry not needed" or NA Credit entry not needed" and leave the debit and credit columns blank.

b Prepare the consolidation entries for XX related to the equipment sale. If an entry is not needed select NA Debit entry not needed" or NA Credit entry not needed" and leave the debit and credit columns blank.

c What will be the gain on sale on the consolidated income statement?

Drop down options are, gain on sale of equipment, accumlated deprecation, equiment, equity investment, goodwill, na credit entry not needed, na debit entry not needed, patent, retained earnings

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started