Answered step by step

Verified Expert Solution

Question

1 Approved Answer

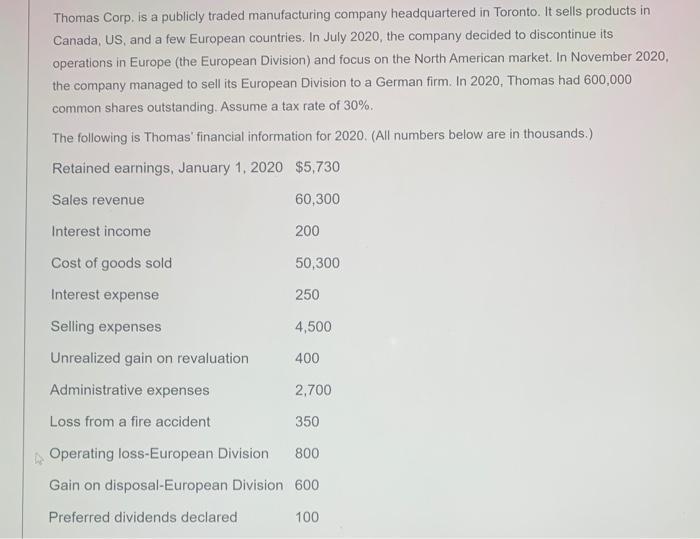

Thomas Corp. is a publicly traded manufacturing company headquartered in Toronto. It sells products in Canada, US, and a few European countries. In July

Thomas Corp. is a publicly traded manufacturing company headquartered in Toronto. It sells products in Canada, US, and a few European countries. In July 2020, the company decided to discontinue its operations in Europe (the European Division) and focus on the North American market. In November 2020, the company managed to sell its European Division to a German firm. In 2020, Thomas had 600,000 common shares outstanding. Assume a tax rate of 30%. The following is Thomas' financial information for 2020. (All numbers below are in thousands.) Retained earnings, January 1, 2020 $5,730 Sales revenue 60,300 Interest income 200 Cost of goods sold 50,300 Interest expense 250 Selling expenses 4,500 Unrealized gain on revaluation 400 Administrative expenses 2,700 Loss from a fire accident 350 A Operating loss-European Division 800 Gain on disposal-European Division 600 Preferred dividends declared 100 Instructions: Prepare a multiple-step statement of financial performance for the year ended December 31, 2020. Include EPS disclosure and show calculation of EPS

Step by Step Solution

★★★★★

3.54 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Answer Thomas Corp Multiple Step income Statement For the year Ended December 31 2020 Amount in Thou...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started