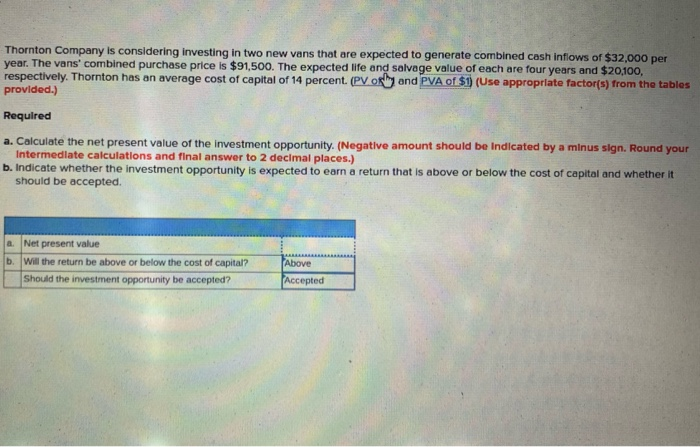

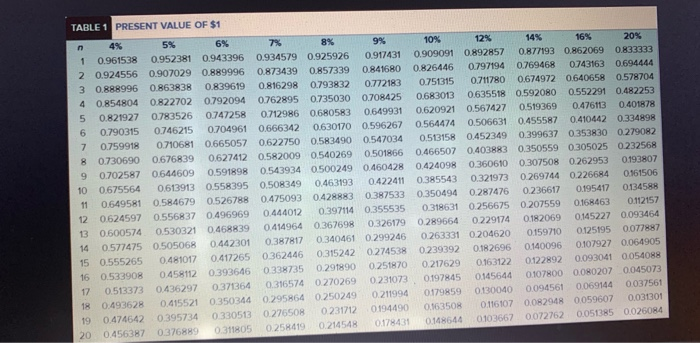

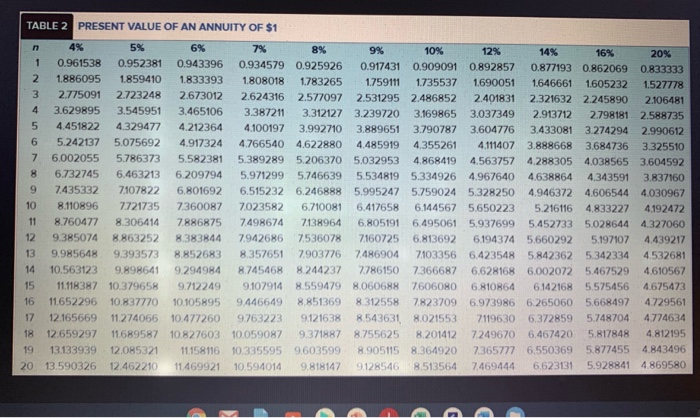

Thornton Company is considering investing in two new vans that are expected to generate combined cash inflows of $32,000 per year. The vans' combined purchase price is $91,500. The expected life and salvage value of each are four years and $20,100, respectively. Thornton has an average cost of capital of 14 percent. (PV ory and PVA of $1 (Use appropriate factor(s) from the tables provided.) Required a. Calculate the net present value of the investment opportunity. (Negative amount should be indicated by a minus sign. Round your Intermediate calculations and final answer to 2 decimal places.) b. Indicate whether the investment opportunity is expected to earn a return that is above or below the cost of capital and whether it should be accepted a. Net present value b. Will the return be above or below the cost of capital? Should the investment opportunity be accepted? Above Accepted TABLE 1 PRESENT VALUE OF $1 n 4% 5% 6% 7% 8% 9% 10% 12% 14% 16% 20% 1 0.961538 0.952381 0.943396 0.934579 0.925926 0.917431 0.909091 0.892857 0.877193 0.862069 0.833333 20.924556 0.907029 0.889996 0.873439 0.857339 0.841680 0.826446 0.797194 0.769468 0743163 0.694444 3 0.888996 0.863838 0.839619 0.816298 0.793832 0.772183 0.751315 0.711780 0.674972 0.640658 0.578704 4 0.854804 0.822702 0.792094 0.762895 0.735030 0.708425 0.683013 0.635518 0.592080 0.552291 0.482253 5 0.821927 0.783526 0.747258 0.712986 0.680583 0.649931 0.620921 0.567427 0.519369 0.476113 0.401878 6 0.790315 0.746215 0.704961 0.666342 0630170 0596267 0.564474 0.506631 0.455587 0.410442 0.334898 7 0.759918 0.710681 0.665057 0.622750 0.583490 0547034 0.513158 0.452349 0.399637 0.3538300279082 0.730690 0.676839 0.627412 0.582009 0.540269 0.501866 0.466507 0.403883 0.350559 0305025 0.232568 9 0.702587 0644609 0.591898 0.543934 0500249 0.460428 0.424098 0.360610 0.307508 0.262953 0193807 10 0.675564 0.613913 0.558395 0.508349 0.463193 0.422411 0.385543 0.321973 0269744 0.226684 0.161506 11 0.649581 0.584679 0.526788 0.475093 0.428883 0.387533 0.350494 0.287476 0.236617 0.195417 0.134588 12 0.624597 0.556837 0.496969 0.444012 0.397114 0.355535 0.318631 0.256675 0.207559 0.168463 0.112157 13 0.600574 0.530321 0.468839 0.414964 0.367698 0.326179 0.289664 0.229174 0.182069 0.145227 0.093464 14 0.577475 0.505068 0.442301 0.387817 0.340461 0.299246 0.263331 0.204620 0.159710 0125195 0.077887 15 0.555265 0.481017 0.417265 0.362446 0.315242 0274538 0239392 0.182696 0140096 0.107927 0.064905 16 0.533908 0458112 0.393646 0338735 0.291890 0.251870 0.217629 0.163122 0122892 0.0930410054088 17 0.513373 0.436297 0.371364 0.316574 0270269 0.231073 0.1978.45 0.145644 0107800 0.080207 0.045073 0.211994 18 0.493628 0.069144 0179859 0.094561 0037561 0.130040 0.415521 0.350344 0.295864 0.250249 19 0.474642 0.395734 0.031301 0.231712 0194490 0330513 0.276508 0.163508 0.116107 0.082948 0.059607 20 0.456387 0.376889 0.311805 0.178431 0.258619 0.214548 0.051385 0,026084 0.148644 0103667 01072762 TABLE 2 PRESENT VALUE OF AN ANNUITY OF $1 n 7% 1 4% 5% 6% 8% 9% 10% 12% 14% 16% 20% 0.961538 0.952381 0.943396 0.934579 0.925926 0.917431 0.909091 0.892857 0.877193 0.862069 0.833333 2 1.886095 1.859410 1.833393 1.808018 1.783265 1.759111 1.735537 1.690051 1.646661 1.605232 1.527778 3 2.775091 2.723248 2.673012 2.624316 2.577097 2.531295 2.486852 2.401831 2.321632 2.245890 2.106481 4 3.629895 3.545951 3.465106 3.387211 3.312127 3.239720 3.169865 3.037349 2.913712 2.798181 2.588735 5 4.451822 4.329477 4.212364 4.100197 3.992710 3.889651 3.790787 3.604776 3.433081 3.274294 2.990612 6 5.242137 5.075692 4.917324 4.766540 4.622880 4.485919 4.355261 4.111407 3.888668 3.684736 3.325510 7 6.002055 5.786373 5.582381 5.389289 5.206370 5.032953 4.868419 4.563757 4.288305 4.038565 3.604592 8 6.732745 6.463213 6.209794 5.971299 5.746639 5.534819 5.334926 4.967640 4.638864 4.343591 3.837160 9 7.435332 7.107822 6.801692 6.515232 6.246888 5.995247 5.759024 5.328250 4.946372 4.606544 4.030967 10 8.110896 7721735 7360087 7023582 6.710081 6.417658 6.144567 5.650223 5.216116 4.833227 4.192472 11 8.760477 8.306414 7.886875 7498674 7138964 6.805191 6.495061 5.937699 5.452733 5.028644 4.327060 12 9.385074 8.863252 8.383844 7.942686 7.536078 7160725 6.813692 6194374 5.660292 5.197107 4.439217 13 9.985648 9.393573 8.852683 8.357651 7903776 7.486904 7103356 6.423548 5.842362 5.342334 4.532681 14 10.563123 9.898641 9.294984 8.745468 8.244237 7786150 7366687 6.628168 6.002072 5.467529 4.610567 15 11.118387 10.379658 9.712249 9.107914 8.559479 8060688 7606080 6.810864 6142168 5.575456 4.675473 16 11.652296 10.837770 10.105895 9.446649 8.851369 8.312558 7.823709 6.973986 6.265060 5.668497 4.729561 17 12.165669 11.274066 10.477260 9.763223 9.121638 8.543631 8.021553 2119630 6,372859 5.748704 4.774634 18 12.659297 11.689587 10.827603 10.059087 9.371887 8.755625 8.201412 7249670 6.467420 5.817848 4.812195 19 13.133939 12.085321 11.158116 10.335595 9.603599 8.905115 8.364920 7.365777 6,550369 5.877455 4.843496 20 13.590326 12.462210 11.469921 10,594014 9.818147 9128546 8.513564 7.469444 6.623131 5.928841 4.869580