Answered step by step

Verified Expert Solution

Question

1 Approved Answer

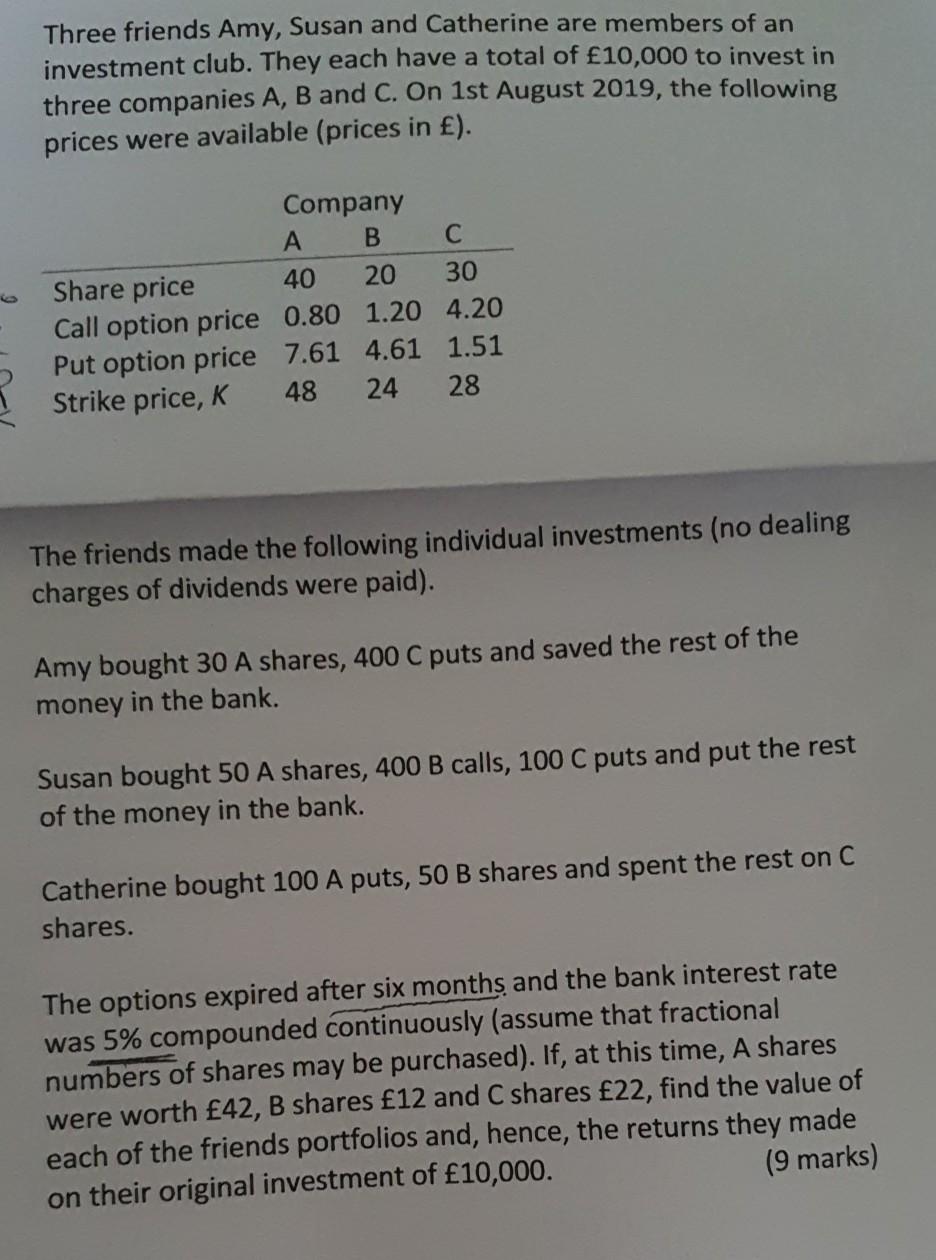

Three friends Amy, Susan and Catherine are members of an investment club. They each have a total of 10,000 to invest in three companies A,

Three friends Amy, Susan and Catherine are members of an investment club. They each have a total of 10,000 to invest in three companies A, B and C. On 1st August 2019, the following prices were available (prices in ). Company A B Share price 40 20 30 Call option price 0.80 1.20 4.20 Put option price 7.61 4.61 1.51 Strike price, K 48 24 28 The friends made the following individual investments (no dealing charges of dividends were paid). Amy bought 30 A shares, 400 C puts and saved the rest of the money in the bank. Susan bought 50 A shares, 400 B calls, 100 C puts and put the rest of the money in the bank. Catherine bought 100 A puts, 50 B shares and spent the rest on C shares. The options expired after six months and the bank interest rate was 5% compounded continuously (assume that fractional numbers of shares may be purchased). If, at this time, A shares were worth 42, B shares 12 and C shares 22, find the value of each of the friends portfolios and, hence, the returns they made on their original investment of 10,000. (9 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started