Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Three mines labeled as 1,2 , and 3 are producing rare-mineral ores with the annual marginal costs given by MC1(Q1)=Q1/5+1MC2(Q2)=Q2/2+1MC3(Q3)=Q3+1 where the marginal costs are

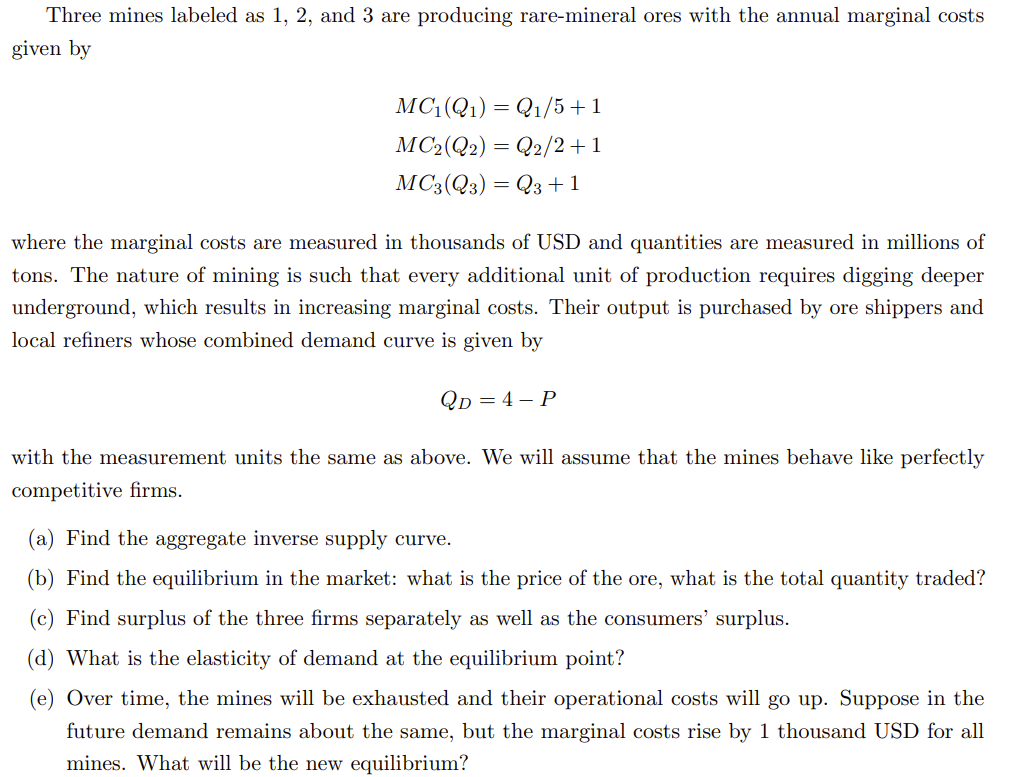

Three mines labeled as 1,2 , and 3 are producing rare-mineral ores with the annual marginal costs given by MC1(Q1)=Q1/5+1MC2(Q2)=Q2/2+1MC3(Q3)=Q3+1 where the marginal costs are measured in thousands of USD and quantities are measured in millions of tons. The nature of mining is such that every additional unit of production requires digging deeper underground, which results in increasing marginal costs. Their output is purchased by ore shippers and local refiners whose combined demand curve is given by QD=4P with the measurement units the same as above. We will assume that the mines behave like perfectly competitive firms. (a) Find the aggregate inverse supply curve. (b) Find the equilibrium in the market: what is the price of the ore, what is the total quantity traded? (c) Find surplus of the three firms separately as well as the consumers' surplus. (d) What is the elasticity of demand at the equilibrium point? (e) Over time, the mines will be exhausted and their operational costs will go up. Suppose in the future demand remains about the same, but the marginal costs rise by 1 thousand USD for all mines. What will be the new equilibrium

Three mines labeled as 1,2 , and 3 are producing rare-mineral ores with the annual marginal costs given by MC1(Q1)=Q1/5+1MC2(Q2)=Q2/2+1MC3(Q3)=Q3+1 where the marginal costs are measured in thousands of USD and quantities are measured in millions of tons. The nature of mining is such that every additional unit of production requires digging deeper underground, which results in increasing marginal costs. Their output is purchased by ore shippers and local refiners whose combined demand curve is given by QD=4P with the measurement units the same as above. We will assume that the mines behave like perfectly competitive firms. (a) Find the aggregate inverse supply curve. (b) Find the equilibrium in the market: what is the price of the ore, what is the total quantity traded? (c) Find surplus of the three firms separately as well as the consumers' surplus. (d) What is the elasticity of demand at the equilibrium point? (e) Over time, the mines will be exhausted and their operational costs will go up. Suppose in the future demand remains about the same, but the marginal costs rise by 1 thousand USD for all mines. What will be the new equilibrium Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started