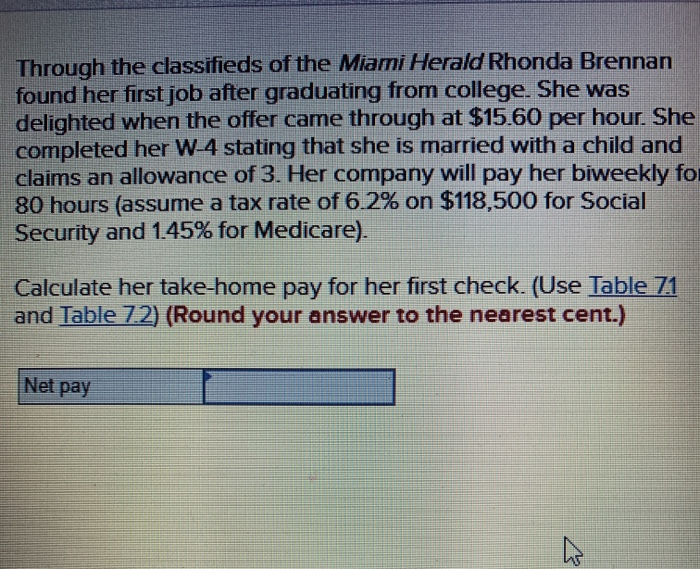

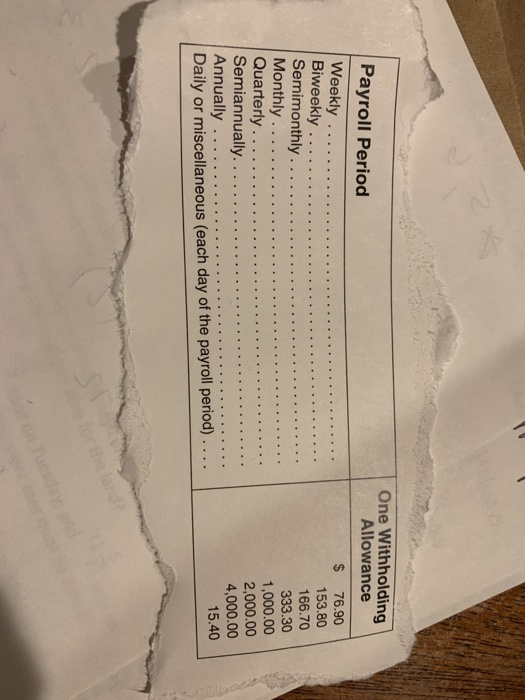

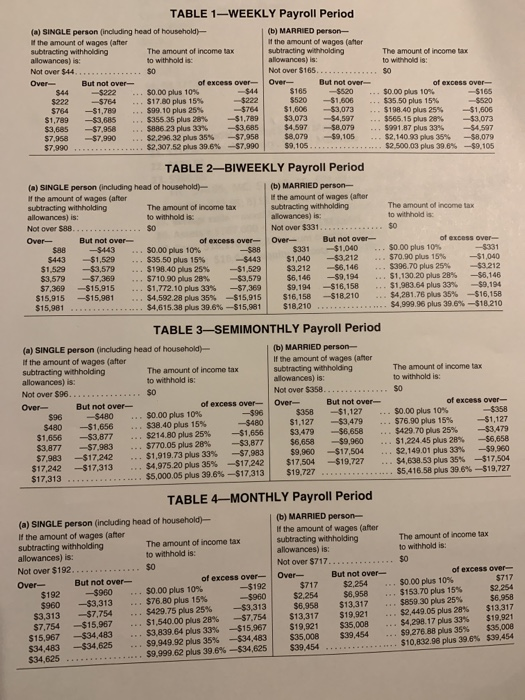

Through the classifieds of the Miami Herald Rhonda Brennan found her first job after graduating from college. She was delighted when the offer came through at $15.60 per hour. She completed her W-4 stating that she is married with a child and claims an allowance of 3. Her company will pay her biweekly for 80 hours (assume a tax rate of 6.2% on $118,500 for Social Security and 1.45% for Medicare). Calculate her take-home pay for her first check. (Use Table 71 and Table 7.2) (Round your answer to the nearest cent.) Net pay Payroll Period Weekly ... Biweekly .... Semimonthly ..... Monthly Quarterly ....... Semiannually....... Annually ...... One Withholding Allowance 76.90 153.80 166.70 333.30 1,000.00 2,000.00 4,000.00 15.40 Daily or miscellaneous (each day of the payroll period).... The amount of income tax to withholdis: TABLE 1-WEEKLY Payroll Period (a) SINGLE person (including head of household) (b) MARRIED person the amount of wages (after If the amount of wages (after subtracting with holding The amount of income tax subtracting withholding allowances) is: to withholdi allowances) is: Not over $44.... 50 Not over $165 Over But not over of excess over- But not over ... $0.00 plus 10% $165 -$520 $222 -5764 ... $17.00 plus 15% $520 $1.606 $764 -$1,789 .. $99.10 plus 25% $764 $1,606 - $3,073 $1,789 -$2.685 ... $355 35 plus 28% - $1,789 $3,685 -$7.958 .. $886 23 plus 33% -$2.68S $4.597 - $8.079 $7.958 $7.990 ..$2,295 32 plus 35% $7.95B $8,079 -$9,105 $7.990 $9.105 ********* * - $7.990 $2,307.52 plus 39.6% of ONCOSS Over ... $0.00 plus 10% ---$165 ... $35.50 plus 15% -$520 ... $198.40 plus 25% - $1,606 $565.15 plus 20% ---$3.073 ... 999187 plus 33% -$4.597 .. $2,140.90 plus 35% -$8,079 $2.500.03 plus 39.6% -$9,105 TABLE 2-BIWEEKLY Payroll Period (*) SINGLE person (including head of household) (b) MARRIED person the amount of wages Cher the amount of wages (her subtracting withholding The amount of income tax subtracting withholding The amount of income tax allowances) allowances) is Not Over $88. Not over $331.. 50 Over But not over of excess over Over But not over of excess over --$-443 $0.00 plus 10% $331 $1.040 . 000 plus 10% -$331 -$1.529 ... $35.50 plus 15% $443 $1,040 -$3.212 ... 570 90 plus 15% -$104 $1,529 -$3.579 ... $198.40 plus 25% -51.529 $3.212 $6,146 3306.70 plus 25% -$3.212 $3.579 $7,369 $710.90 plus 28% -$3,579 $6.146 $9.194 .. $1,130.20 plus 20% - $6.146 $7,369 -$15.915 .. $1.772.10 plus 33% -$7,369 $9,194 - $16,158 51.963. 64 plus 33% $9.194 $15.915 -$15,981 .. $4,592.28 plus 35% -$15,915 $16.158 518 210 .. $4,281.75 plus 35% $16,158 $15,981 ................. $4,615.30 plus 39.6%-$15.981 $18.210 .......$4.999.96 plus 39.6%-$18 210 TABLE 3-SEMIMONTHLY Payroll Period (a) SINGLE person (including head of household) (b) MARRIED person- If the amount of wages (after If the amount of wages (after subtracting withholding The amount of income tax subtracting withholding The amount of income tax allowances) is: to withhold is: allowances) is: to withhold is: Not over $96................ Not over $358 Over But not over of excess over Over But not over of excess over- $96 - $480 .. $0.00 plus 10% -596 $358 - $1,127 .. $0.00 plus 10% $358 $480 - $1,656 $38.40 plus 15% $480 $1,127 - $3,479 $76 90 plus 15% $1,127 $1.656 $3.877 $214 80 plus 25% $1.656 $3.479 - $6.658 $429 70 plus 25% -$3.479 $3.877 - $7.983 $770.05 plus 28% -$3.877 $6.658 -$9.950 .$1,224.45 plus 28% -56,658 $7983 $17242 .. $1,919.73 plus 33% -$7,983 $9.960 -$17.504 $2.149 01 plus 33 $9.960 $17.242 -$17,313 .. $4.975 20 plus 35% -$17.242 $17504 $19.727 53 plus 35% -$17.504 $17,313 .. ......... $5.000.05 plus 39.6%-$17,313 $19.727 .......... 55.416 58 plus 39.6% -$19.727 TABLE 4 MONTHLY Payroll Period (a) SINGLE person (including head of household) (b) MARRIED person- If the amount of wages (after the amount of wages (aher subtracting withholding The amount of income tax Subtracting withholding The amount of income tax allowances) is: to withhold is: allowances) is: to withholdis: Not over $192............... $0 Not over $717.... Over But not over of excess over Over But not over of excess over- $192 -$900 $0.00 plus 10% $192 $717 $2.254 $0.00 plus 10% $717 $960 - $3,313 $76 80 plus 15% -$960 $2.254 $8,958 ... $153.70 plus 15% $2,254 $3,313 - $7,754 .. $429.75 plus 25% -$3,313 $6.958 $13.317 $850 30 plus 25% $6.958 $7.754 $15,067 $1,540.00 plus 28% -7,754 $13,317 $19.921 ... $2,449.05 plus 28% $13,317 $15.967 - $34,483 $3,839.64 plus 33% -$15.967 $19,921 $35,008 ... $4,298.17 plus 33% $19,921 -$34,625 $34,483 ... $9.949.92 plus 35% -$34,483 ... $9.276 88 plus 35% $39,454 $35,008 $34,625 ..... ...... $9.999.62 plus 39.6%-$34,625 $39.454 $39,454 ... ********** $10,832.98 plus 39.6%