Answered step by step

Verified Expert Solution

Question

1 Approved Answer

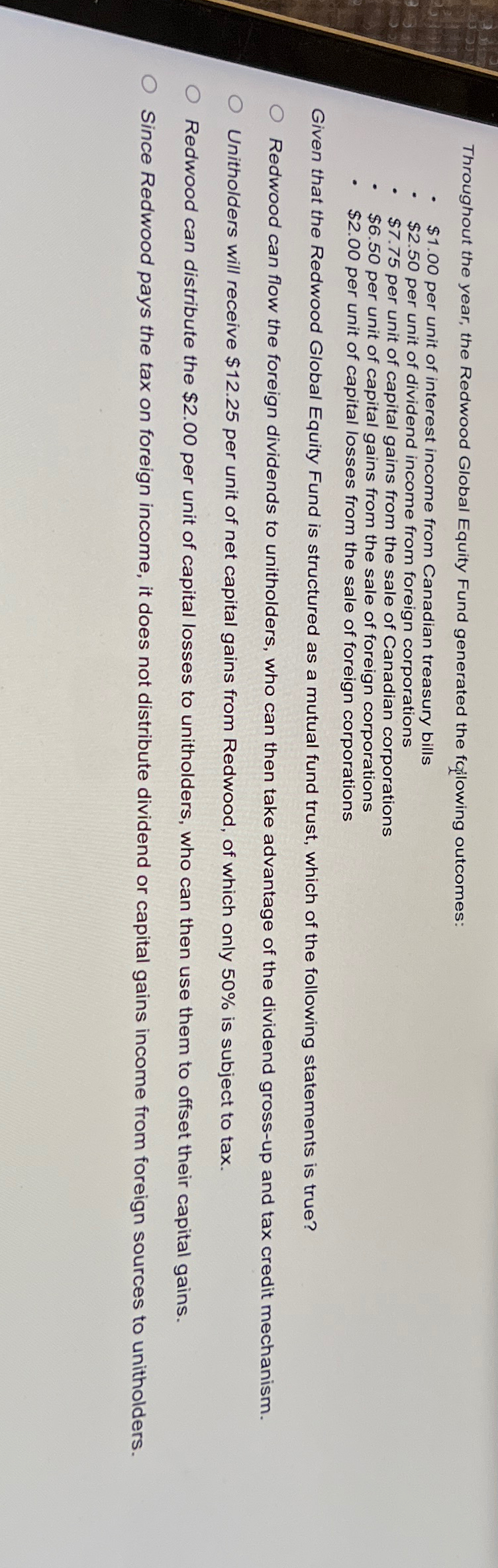

Throughout the year, the Redwood Global Equity Fund generated the forilowing outcomes: $ 1 . 0 0 per unit of interest income from Canadian treasury

Throughout the year, the Redwood Global Equity Fund generated the forilowing outcomes:

$ per unit of interest income from Canadian treasury bills

$ per unit of dividend income from foreign corporations

$ per unit of capital gains from the sale of Canadian corporations

$ per unit of capital gains from the sale of foreign corporations

$ per unit of capital losses from the sale of foreign corporations

Given that the Redwood Global Equity Fund is structured as a mutual fund trust, which of the following statements is true?

Redwood can flow the foreign dividends to unitholders, who can then take advantage of the dividend grossup and tax credit mechanism.

Unitholders will receive $ per unit of net capital gains from Redwood, of which only is subject to tax.

Redwood can distribute the $ per unit of capital losses to unitholders, who can then use them to offset their capital gains.

Since Redwood pays the tax on foreign income, it does not distribute dividend or capital gains income from foreign sources to unitholders.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started