Answered step by step

Verified Expert Solution

Question

1 Approved Answer

thumbs up for help The Walt Disney Company Consolidated Balance Sheets USD ($) in millions Current assets: Cash and cash equivalents Receivables Inventories Other current

thumbs up for help

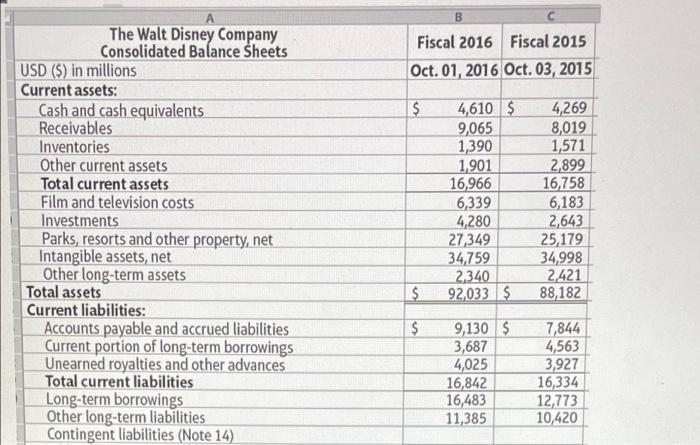

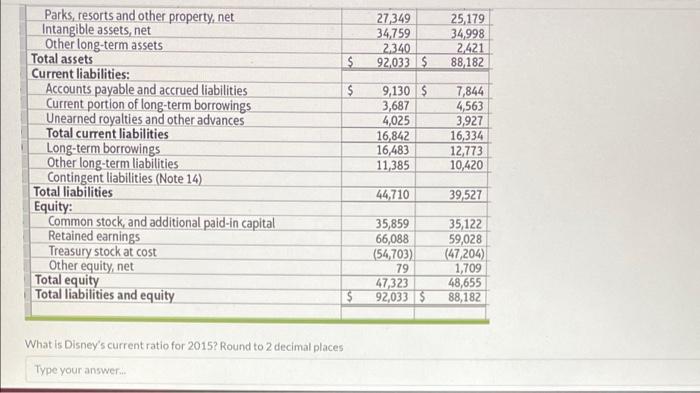

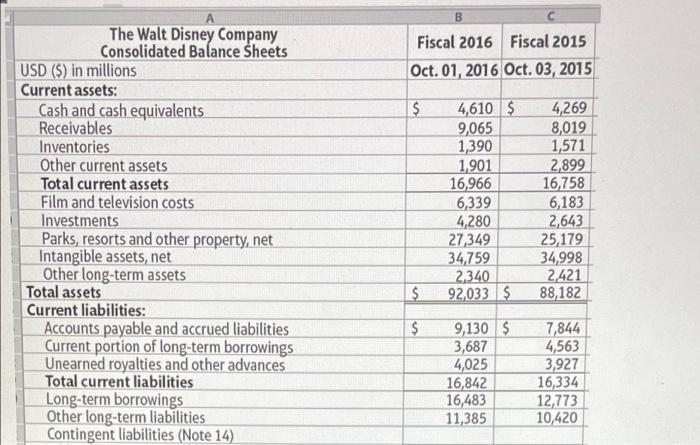

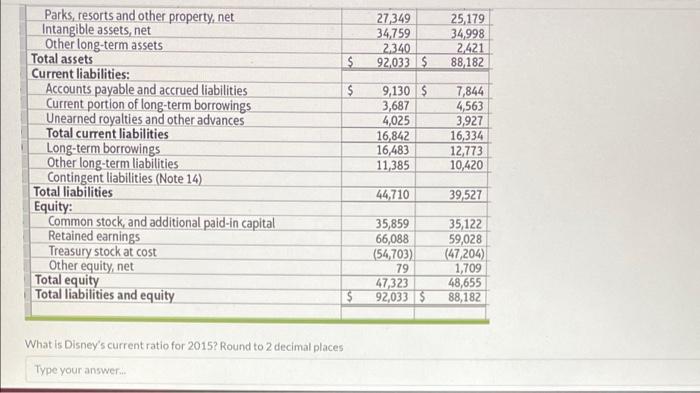

The Walt Disney Company Consolidated Balance Sheets USD ($) in millions Current assets: Cash and cash equivalents Receivables Inventories Other current assets Total current assets Film and television costs Investments Parks, resorts and other property, net Intangible assets, net Other long-term assets Total assets Current liabilities: Accounts payable and accrued liabilities Current portion of long-term borrowings Unearned royalties and other advances Total current liabilities Long-term borrowings Other long-term liabilities Contingent liabilities (Note 14) Fiscal 2016 Fiscal 2015 Oct. 01, 2016 Oct. 03, 2015 $ 4,610 $ 4,269 9,065 8,019 1,390 1,571 1,901 2,899 16,966 16,758 6,339 6,183 4,280 2,643 27,349 25,179 34,759 34,998 2,340 2,421 92,033 $ 88,182 7,844 9,130 $ 3,687 4,563 4,025 3,927 16,842 16,334 16,483 12,773 11,385 10,420 es $ S Parks, resorts and other property, net Intangible assets, net Other long-term assets Total assets Current liabilities: Accounts payable and accrued liabilities Current portion of long-term borrowings Unearned royalties and other advances Total current liabilities Long-term borrowings Other long-term liabilities Contingent liabilities (Note 14) Total liabilities Equity: Common stock, and additional paid-in capital Retained earnings Treasury stock at cost Other equity, net Total equity Total liabilities and equity $ What is Disney's current ratio for 2015? Round to 2 decimal places Type your answ answer... $ $ 27,349 34,759 2,340 92,033 $ 9,130 $ 3,687 4,025 16,842 16,483 11,385 44,710 35,859 66,088 (54,703) 79 47,323 92,033 $ 25,179 34,998 2,421 88,182 7,844 4,563 3,927 16,334 12,773 10,420 39,527 35,122 59,028 (47,204) 1,709 48,655 88,182

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started