Tidy Hair Ltd, manufactures two products that help create sensational hair styles at affordable prices. The two products are: the Curler 'Kirl' and the

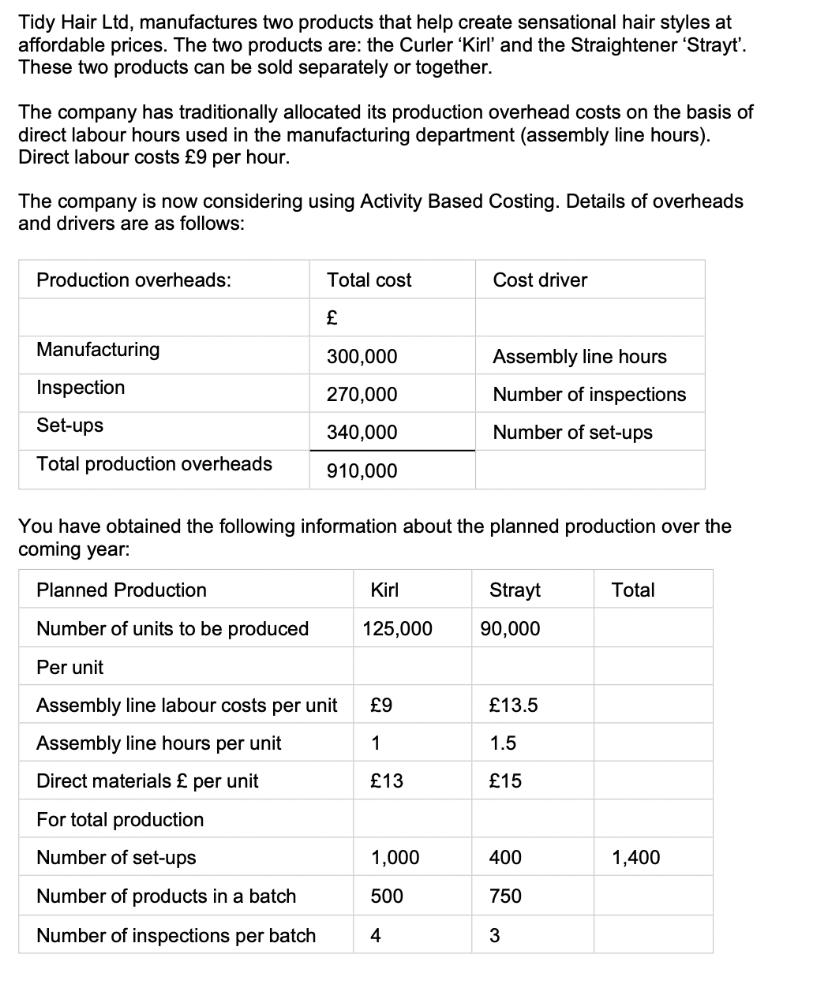

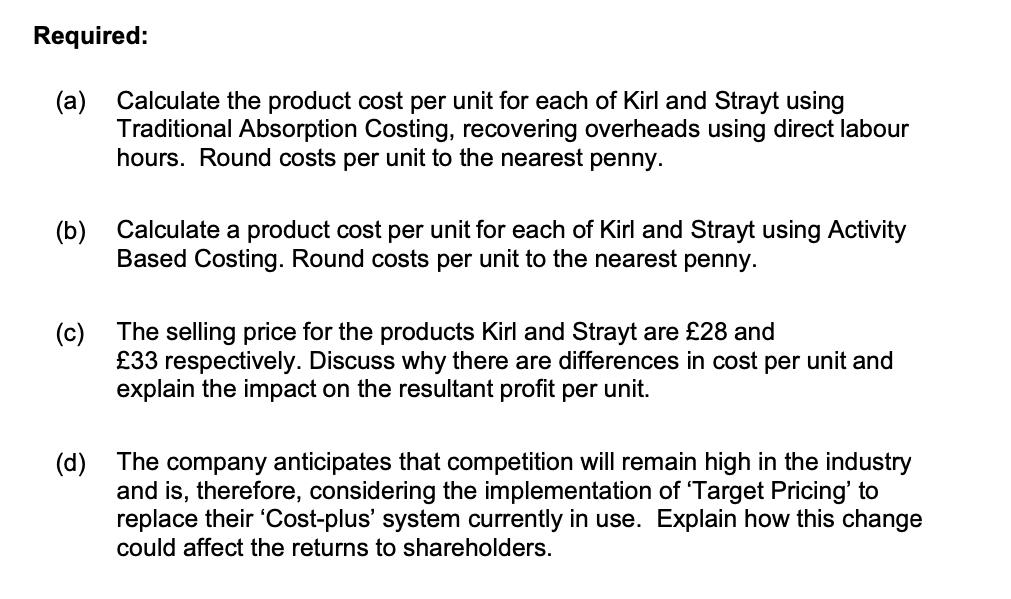

Tidy Hair Ltd, manufactures two products that help create sensational hair styles at affordable prices. The two products are: the Curler 'Kirl' and the Straightener 'Strayt'. These two products can be sold separately or together. The company has traditionally allocated its production overhead costs on the basis of direct labour hours used in the manufacturing department (assembly line hours). Direct labour costs 9 per hour. The company is now considering using Activity Based Costing. Details of overheads and drivers are as follows: Production overheads: Manufacturing Inspection Set-ups Total production overheads Total cost Number of set-ups Number of products in a batch Number of inspections per batch 300,000 270,000 340,000 910,000 Planned Production Number of units to be produced Per unit Assembly line labour costs per unit Assembly line hours per unit Direct materials per unit For total production You have obtained the following information about the planned production over the coming year: Kirl 125,000 9 1 13 Cost driver 1,000 500 4 Assembly line hours Number of inspections Number of set-ups Strayt 90,000 13.5 1.5 15 400 750 3 Total 1,400 Required: (a) Calculate the product cost per unit for each of Kirl and Strayt using Traditional Absorption Costing, recovering overheads using direct labour hours. Round costs per unit to the nearest penny. (b) Calculate a product cost per unit for each of Kirl and Strayt using Activity Based Costing. Round costs per unit to the nearest penny. (c) The selling price for the products Kirl and Strayt are 28 and 33 respectively. Discuss why there are differences in cost per unit and explain the impact on the resultant profit per unit. (d) The company anticipates that competition will remain high in the industry and is, therefore, considering the implementation of 'Target Pricing' to replace their 'Cost-plus' system currently in use. Explain how this change could affect the returns to shareholders.

Step by Step Solution

3.43 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Qd Target pricingcosting is not just a method of costing it is also a management technique in which prices are set based on the state of the market an...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started