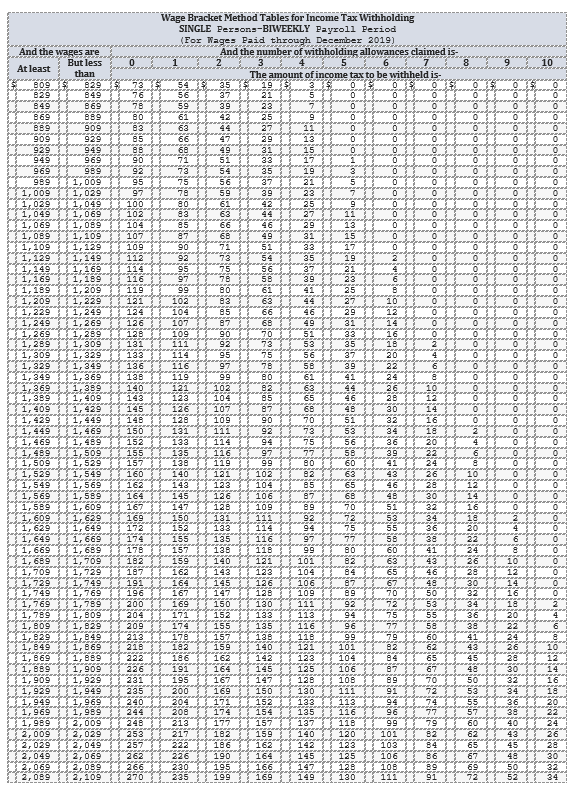

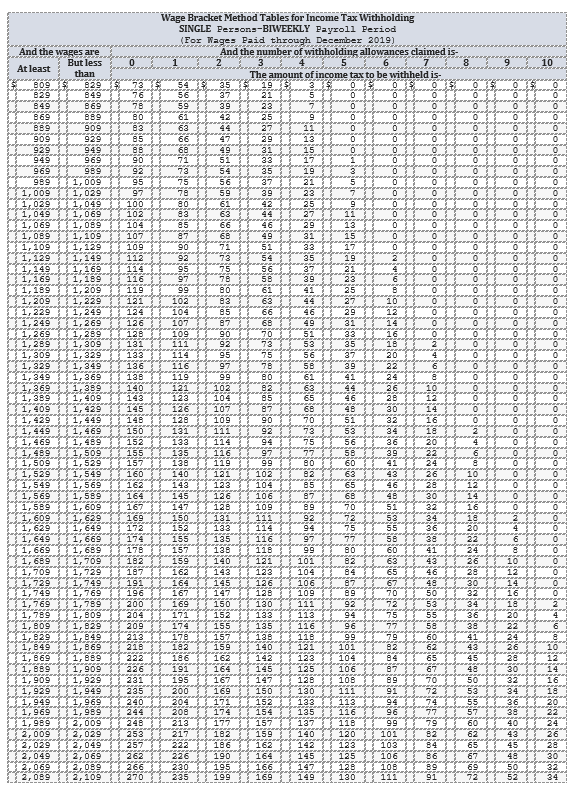

Tierney is a full-time nonexempt salaried employee who earns $990 per biweekly pay period. She is single with 1 withholding allowance and both lives and works in Bowling Green, Kentucky. Assuming that she had no overtime, what is the total of her Federal and state taxes for a pay period? (Use the wage-bracket tables. Kentucky state income rate is 5.00%. Round final answer to 2 decimal places.)

889 0 105 109 54 Ho 116 1991 126 20 And the wages are But less 0 At least than 809 $ 829 1 waar 73 829 849 76 849 869 869 80 889 909 83 909 929 85 929 949 ee 949 969 90 969 989 92 989 1,009 95 1,009 1,029 97 1,029 1,049 100 1,049 1,069 102 1,069 1,089 104 1,089 1,109 11, 106 1, 129 11, 129 1,149 112 111,149 1.169 114 1,169 1,189 11,189 1,209 119 1,209 1, 229 121 1,229 1,249 124 11,249 1,269 111,269 1,289 128 1,289 1, 309 131 11,309 1, 329 133 11, 329 1,349 136 11,349 1,369 138 11,369 1, 399 140 1,389 1,409 143 1,409 1,429 145 11,429 1,449 148 1,449 1,469 150 11,469 1,489 152 11,489 1,509 1,509 1,529 157 1,529 1,549 160 11,549 1,569 162 1,569 1,589 164 1,589 1,609 167 11,609 169 1,629 1,649 172 1,649 1,669 174 111,669 1,689 178 11,689 1,709 182 1,709 1,729 187 1.729 1,749 191 1,749 1,769 196 1,769 1,789 200 11,789 1, 809 204 11,609 1,629 209 1,029 1,849 213 11,849 1,869 216 11,869 1,889 222 1,889 1,909 226 1,905 1, 929 231 11,929 1,949 235 11,949 1,969 240 11,969 1,989 244 1,989 2,609 248 2,009 253 2,029 2,049 257 2,049 2,069 262 22.069 2,089 2,089 2, 109 270 Wage Bracket Method Tables for Income Tax Withholding SINGLE Persona-BIWEEKLY Payroll Period (For Wages Paid through December 2019) And the number of withholding allowances claimed is- 1 5 8 9 10 The amount of income tax to be withheld is- 549 35 51 195 0 % 0 % 0 $ 0 $ 0 56 0 $ 37 21 5 0 0 59 39 23 0 0 0 61 25 9 0 0 0 0 0 63 27 11 0 0 0 0 66 47 29 13 0 0 0 0 0 68 49 31 15 0 71 51 33 17 73 54 35 19 3 0 0 0 0 75 56 37 21 5 0 0 78 39 23 0 80 61 42 25 9 0 83 0 0 63 27 0 0 0 85 66 46 29 13 87 6B 49 31 15 0 90 71 51 33 17 0 92 73 35 19 2 0 0 0 95 75 56 37 21 97 78 56 39 23 6 99 80 61 41 25 B 102 83 63 27 10 0 104 85 66 46 29 12 0 107 68 49 31 0 109 90 70 51 33 16 111 92 73 53 25 18 114 95 75 56 37 0 116 97 78 56 39 22 119 99 80 61 41 24 8 0 121 102 92 63 26 10 123 104 85 65 46 26 12 126 107 97 68 48 30 14 0 126 109 90 70 51 32 16 131 111 92 73 53 34 18 133 114 94 75 56 36 20 4 0 0 135 116 97 56 39 22 0 0 138 119 99 80 60 41 24 8 0 0 140 121 102 82 63 43 26 10 0 143 123 104 85 65 46 28 12 145 126 106 87 66 30 14 147 128 109 89 70 51 32 16 150 131 111 92 72 53 34 18 152 133 114 75 55 36 20 155 135 116 97 77 SB 38 22 0 157 13B 118 99 80 60 41 24 159 140 121 101 82 63 43 26 10 162 143 123 104 65 46 28 12 164 145 126 106 87 67 48 30 167 14 126 109 50 32 169 150 130 111 92 72 53 34 18 171 152 133 113 75 55 36 20 174 155 135 96 57 58 38 22 6 1978 157 136 118 99 79 60 41 24 192 159 62 43 10 186 162 123 104 65 45 28 12 191 164 145 125 106 87 67 30 14 167 147 128 108 89 70 50 32 16 169 130 111 91 72 53 34 18 204 171 152 113 74 208 55 36 20 174 154 135 116 96 77 57 38 22 213 177 153 118 99 60 40 24 217 182 159 140 120 101 82 62 43 222 186 162 142 123 103 84 65 45 28 226 190 164 145 125 106 86 67 30 230 195 166 147 12B 108 89 69 235199 5032 169 149 130 111 91 72 52 34 ADOROSAS SSB ich 155 in 3,629 147 70 16 116 121 101 82 263 140 14 1 195 200 150 med 133 94 137 79 2,029 26 .... SOLOMON . - 266 LU -- Multiple Choice $128.25 $124.50 O $120.78 O $122.95