Answered step by step

Verified Expert Solution

Question

1 Approved Answer

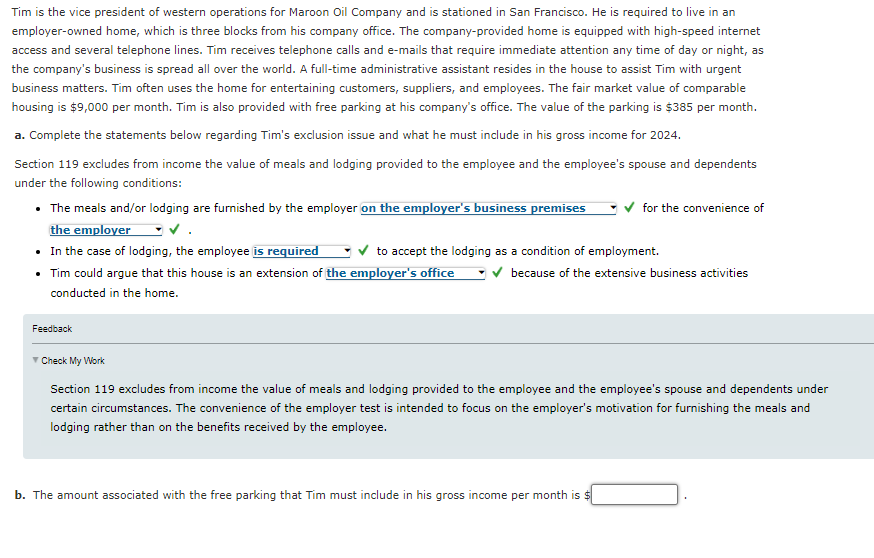

Tim is the vice president of western operations for Maroon Oil Company and is stationed in San Francisco. He is required to live in an

Tim is the vice president of western operations for Maroon Oil Company and is stationed in San Francisco. He is required to live in an

employerowned home, which is three blocks from his company office. The companyprovided home is equipped with highspeed internet

access and several telephone lines. Tim receives telephone calls and emails that require immediate attention any time of day or night, as

the company's business is spread all over the world. A fulltime administrative assistant resides in the house to assist Tim with urgent

business matters. Tim often uses the home for entertaining customers, suppliers, and employees. The fair market value of comparable

housing is $ per month. Tim is also provided with free parking at his company's office. The value of the parking is $ per month.

a Complete the statements below regarding Tim's exclusion issue and what he must include in his gross income for

Section excludes from income the value of meals and lodging provided to the employee and the employee's spouse and dependents

under the following conditions:

The meals andor lodging are furnished by the employer on the employer's business premises for the convenience of

:

In the case of lodging, the employee is required to accept the lodging as a condition of employment.

Tim could argue that this house is an extension of the employer's office because of the extensive business activities

conducted in the home.

Feedback

Check My Work

Section excludes from income the value of meals and lodging provided to the employee and the employee's spouse and dependents under

certain circumstances. The convenience of the employer test is intended to focus on the employer's motivation for furnishing the meals and

lodging rather than on the benefits received by the employee.

b The amount associated with the free parking that Tim must include in his gross income per month is $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started