Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Tim works for HydroTech, a manufacturer of high-pressure industrial water pumps. He reports directly to the CFO, and she has asked him to calculate

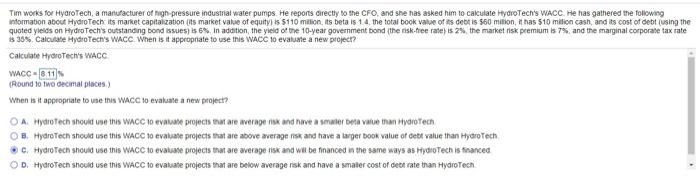

Tim works for HydroTech, a manufacturer of high-pressure industrial water pumps. He reports directly to the CFO, and she has asked him to calculate HydroTech's WACC. He has gathered the following Information about HydroTech: its market capitalization (its market value of equity) is $110 million, its beta is 1.4, the total book value of its debt is $60 milion, it has 510 million cash, and its cost of debt (using the quoted yields on HydroTech's outstanding bond issues) is 6%. In addition, the yield of the 10-year government bond (the risk-free rate) is 2%, the market risk premium is 7%, and the marginal corporate tax rate is 35%. Calculate HydroTech's WACC. When is it appropriate to use this WACC to evaluate a new project? Calculate HydroTech's WACC WACC 8.11% (Round to two decimal places.) When is it appropriate to use this WACC to evaluate a new project? OA. HydroTech should use this WACC to evaluate projects that are average risk and have a smaler beta value than HydroTech OB. HydroTech should use this WACC to evaluate projects that are above average risk and have a larger book value of debt value than HydroTech C. HydroTech should use this WACC to evaluate projects that are average risk and will be financed in the same ways as HydroTech is financed OD. HydroTech should use this WACC to evaluate projects that are below average risk and have a smaller cost of debt rate than HydroTech

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate HydroTechs WACC Weighted Average Cost of Capital we need to follow these steps Step 1 Calculate the Cost of Equity The cost of equity can ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started