Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Time left 0 : 5 8 : 1 3 Megan is a proprietor and owns a hair salon. Determine the total Canada Pension Plan (

Time left ::

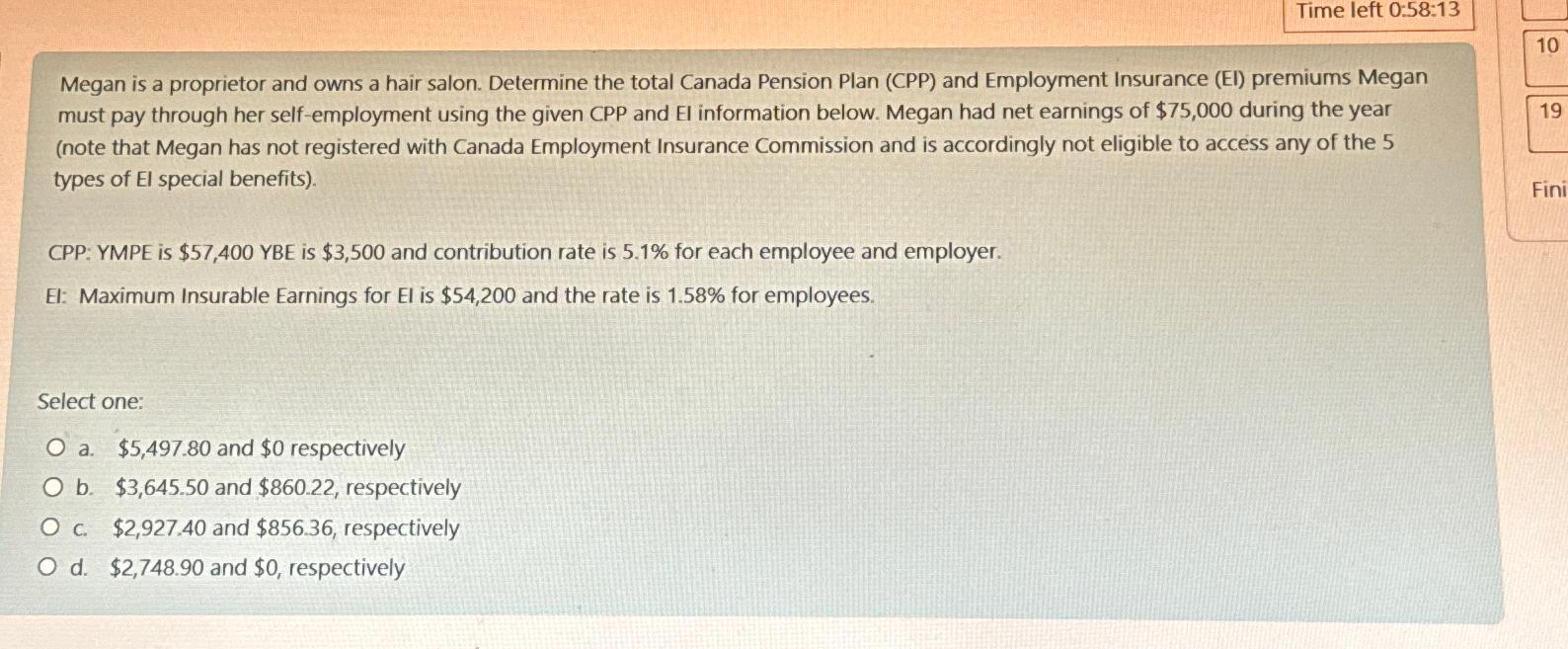

Megan is a proprietor and owns a hair salon. Determine the total Canada Pension Plan CPP and Employment Insurance EI premiums Megan must pay through her selfemployment using the given CPP and EI information below. Megan had net earnings of $ during the year note that Megan has not registered with Canada Employment Insurance Commission and is accordingly not eligible to access any of the types of El special benefits

CPP: YMPE is $ YBE is $ and contribution rate is for each employee and employer.

El: Maximum Insurable Earnings for is $ and the rate is for employees.

Select one:

a $ and $ respectively

b $ and $ respectively

c $ and $ respectively

d $ and $ respectively

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started