Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Time left 1:59.25 A 12 year bond, with par value of $1000, pays 8% annually (interest is paid semi-annually). Similar bonds are currently yielding 71%

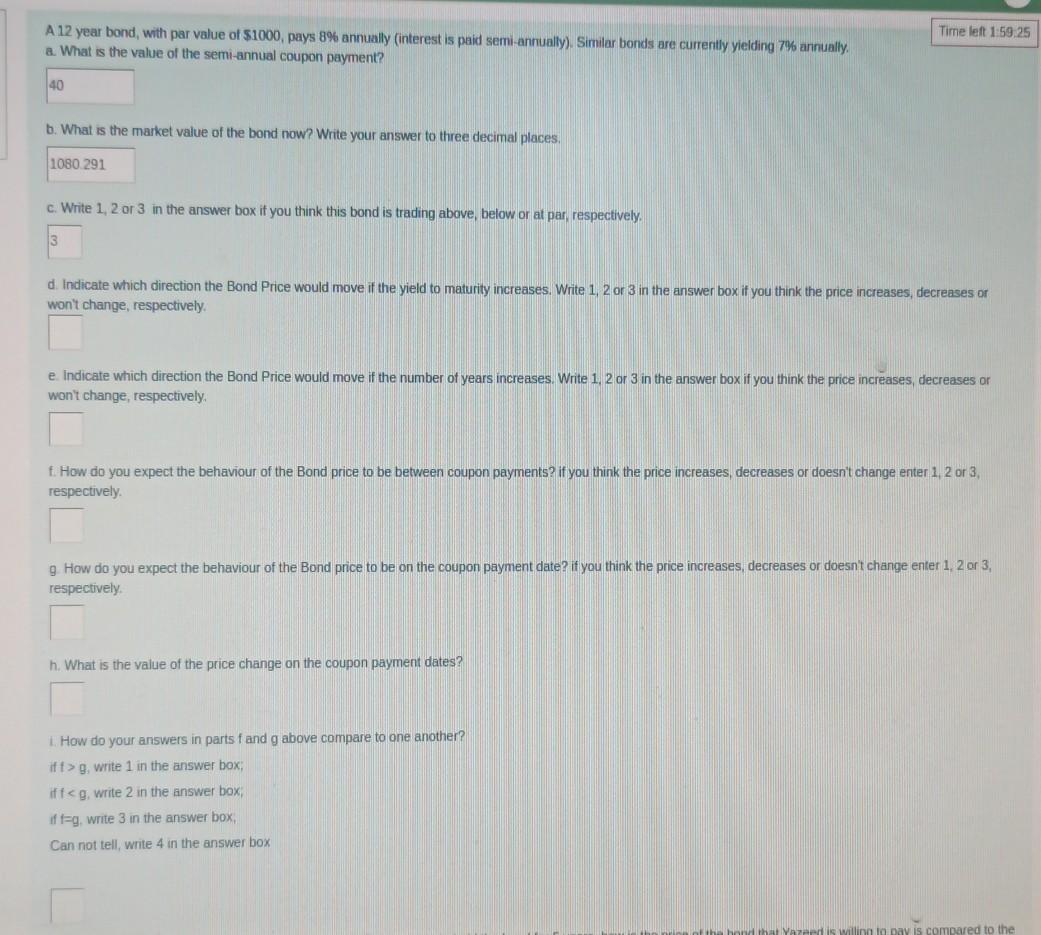

Time left 1:59.25 A 12 year bond, with par value of $1000, pays 8% annually (interest is paid semi-annually). Similar bonds are currently yielding 71% annually. a. What is the value of the semi-annual coupon payment? 40 b. What is the market value of the bond now? Write your answer to three decimal places, 1080 291 c. Write 1, 2 or 3 in the answer box if you think this bond is trading above, below or at par, respectively. 3 d. Indicate which direction the Bond Price would move if the yield to maturity increases. Write 1, 2 or 3 in the answer box if you think the price increases, decreases or won't change, respectively. e indicate which direction the Bond Price would move if the number of years increases. Write 1, 2 or 3 in the answer box if you think the price increases, decreases or won't change, respectively f. How do you expect the behaviour of the Bond price to be between coupon payments? if you think the price increases, decreases or doesn't change enter 1, 2 or 3 respectively g How do you expect the behaviour of the Bond price to be on the coupon payment date? if you think the price increases, decreases or doesn't change enter 1, 2 or 3, respectively h. What is the value of the price change on the coupon payment dates? How do your answers in parts fand g above compare to one another? ift>g, write 1 in the answer box iff

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started