Answered step by step

Verified Expert Solution

Question

1 Approved Answer

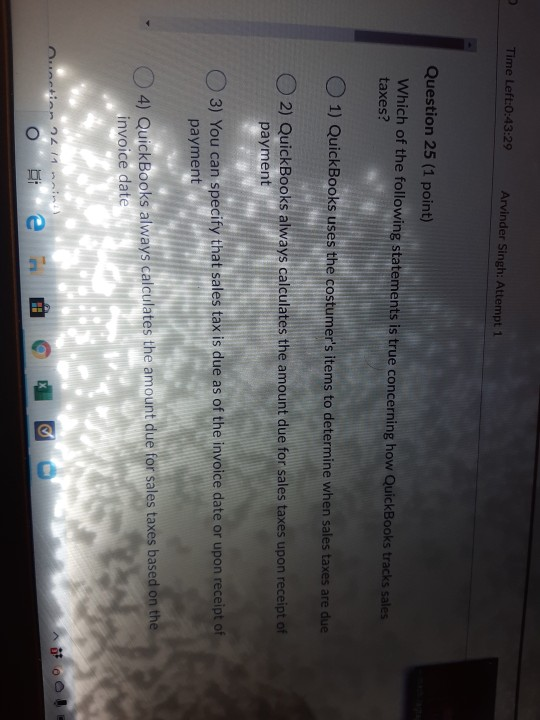

Time Left:0:43:29 Arvinder Singh: Attempt 1 Question 25 (1 point) Which of the following statements is true concerning how QuickBooks tracks sales taxes? 1) QuickBooks

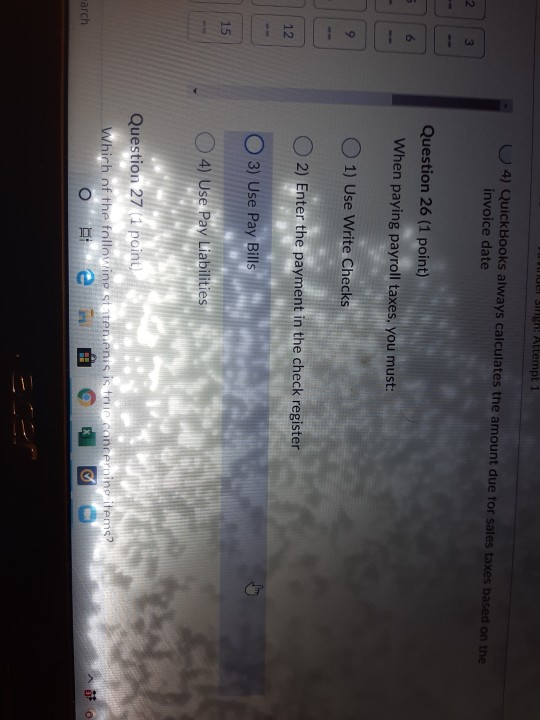

Time Left:0:43:29 Arvinder Singh: Attempt 1 Question 25 (1 point) Which of the following statements is true concerning how QuickBooks tracks sales taxes? 1) QuickBooks uses the costumer's items to determine when sales taxes are due 2) QuickBooks always calculates the amount due for sales taxes upon receipt of payment 3) You can specify that sales tax is due as of the invoice date or upon receipt of payment 4) QuickBooks always calculates the amount due for sales taxes based on the invoice date Nunctional 11 ninil el Singh: Allempt 1 U 4) QuickBooks always calculates the amount due for sales taxes based on the invoice date 3 6 Question 26 (1 point) When paying payroll taxes, you must: 9 1) Use Write Checks 2) Enter the payment in the check register 12 3) Use Pay Bills 15 4) Use Pay Liabilities Question 27 (1 point) Which of the following statements is the concerning items? o i e arch

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started