Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are the finance director of Zibuck Engineering Plc (ZEP), a UK based firm that specializes in manufacturing batteries to power electric vehicles. Major

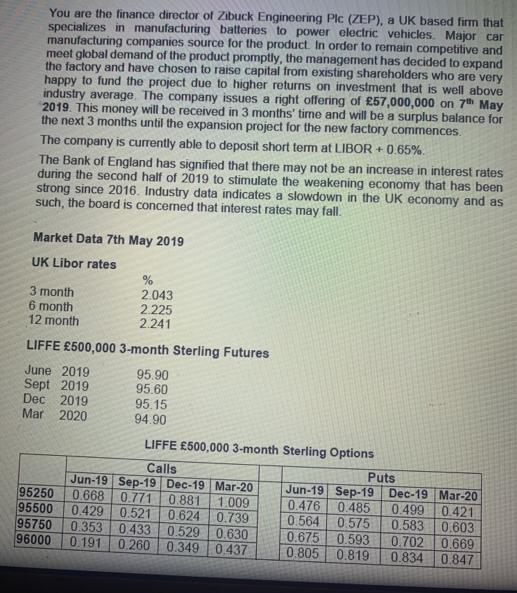

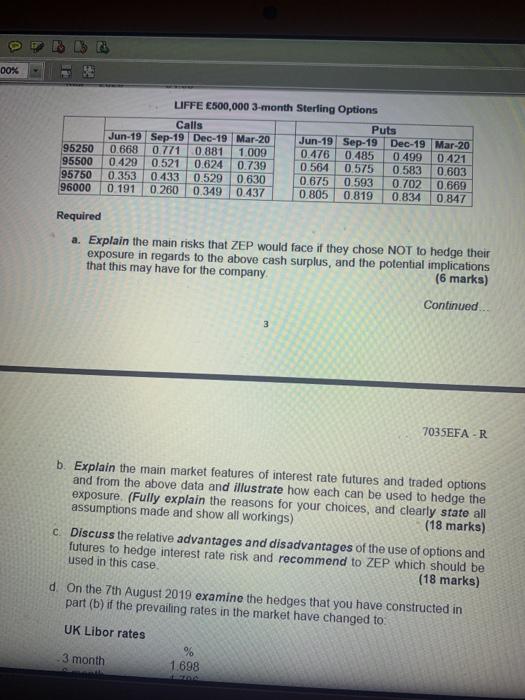

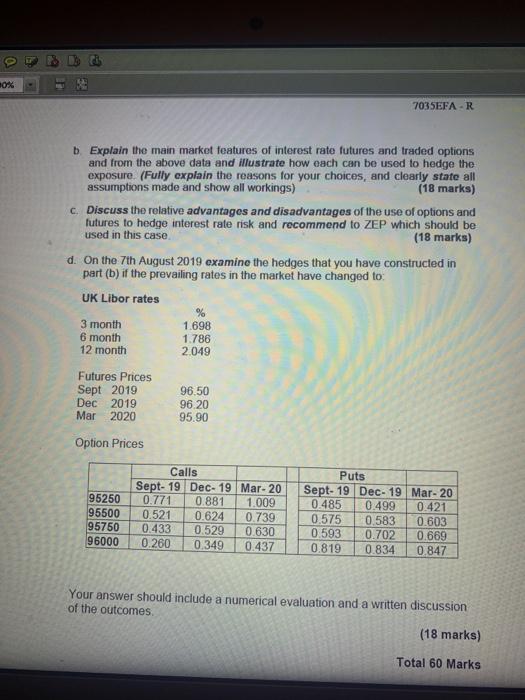

You are the finance director of Zibuck Engineering Plc (ZEP), a UK based firm that specializes in manufacturing batteries to power electric vehicles. Major car manufacturing companies source for the product. In order to remain competitive and meet global demand of the product promptly, the management has decided to expand the factory and have chosen to raise capital from existing shareholders who are very happy to fund the project due to higher returns on investment that is well above industry average. The company issues a right offering of 57,000,000 on 7th May 2019. This money will be received in 3 months' time and will be a surplus balance for the next 3 months until the expansion project for the new factory commences. The company is currently able to deposit short term at LIBOR + 0.65% The Bank of England has signified that there may not be an increase in interest rates during the second half of 2019 to stimulate the weakening economy that has been strong since 2016. Industry data indicates a slowdown in the UK economy and as such, the board is concerned that interest rates may fall. Market Data 7th May 2019 UK Libor rates 3 month 6 month 12 month % 2.043 2.225 2.241 LIFFE 500,000 3-month Sterling Futures June 2019 Sept 2019. Dec 2019 Mar 2020 95.90 95.60 95.15 94.90 95750 0.353 96000 0.191 LIFFE 500,000 3-month Sterling Options Calls Jun-19 Sep-19 Dec-19 Mar-20 0.771 0.881 1.009 0.624 0.739 95250 0.668 95500 0.429 0.521 0.433 0.529 0.630 0.260 0.349 0.437 Puts Jun-19 Sep-19 Dec-19 Mar-20 0.476 0.485 0.499 0.421 0.583 0.603 0.564 0.575 0.702 0.669 0.834 0.847 0.675 0.593 0.805 0.819 0 00% 95250 95500 0.429 95750 0.353 96000 0.191 LIFFE 500,000 3-month Sterling Options Calls Jun-19 0.668 0.771 0.521 Sep-19 Dec-19 Mar-20 0.881 1.009 0.624 0.739 0.529 0.630 0.349 0.437 0.433 0.260 3 month Required a. Explain the main risks that ZEP would face if they chose NOT to hedge their exposure in regards to the above cash surplus, and the potential implications that this may have for the company. (6 marks) Puts 3 Jun-19 Sep-19 Dec-19 Mar-20 0.476 0.485 0.499 0.421 0.564 0.575 0.583 0.603 0.675 0.593 0.702 0.669 0.805 0.819 0.834 0.847 1.698 Continued b. Explain the main market features of interest rate futures and traded options and from the above data and illustrate how each can be used to hedge the exposure. (Fully explain the reasons for your choices, and clearly state all assumptions made and show all workings) (18 marks) 7035EFA-R c. Discuss the relative advantages and disadvantages of the use of options and futures to hedge interest rate risk and recommend to ZEP which should be used in this case. (18 marks) d. On the 7th August 2019 examine the hedges that you have constructed in part (b) if the prevailing rates in the market have changed to: UK Libor rates 0 10% b. Explain the main market features of interest rate futures and traded options and from the above data and illustrate how each can be used to hedge the exposure. (Fully explain the reasons for your choices, and clearly state all assumptions made and show all workings) (18 marks) c. Discuss the relative advantages and disadvantages of the use of options and futures to hedge interest rate risk and recommend to ZEP which should be used in this case. (18 marks) d. On the 7th August 2019 examine the hedges that you have constructed in part (b) if the prevailing rates in the market have changed to: UK Libor rates 3 month 6 month 12 month Futures Prices Sept 2019 Dec 2019 Mar 2020 Option Prices 1.698 1.786 2.049 96.50 96.20 95.90 Calls 7035EFA-R Sept-19 Dec-19 Mar-20 0.771 0.881 1.009 95250 95500 0.521 0.739 95750 0.433 0.630 96000 0.260 0.349 0.437 0.624 0.529 Puts Sept-19 Dec- 19 Mar-20 0.485 0.499 0.421 0.575 0.583 0.593 0.702 0.819 0.834 0.603 0.669 0.847 Your answer should include a numerical evaluation and a written discussion of the outcomes. (18 marks) Total 60 Marks

Step by Step Solution

★★★★★

3.45 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Explain the main risks that ZEP would face if they chose NOT to hedge their exposure in regards to the above cash surplus and the potential implications that this may have for the company ZEP would fa...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started