Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume you deposit $2,000 every three months at a percent annual rate, compounded quarterly. How much will you have at the end of years?

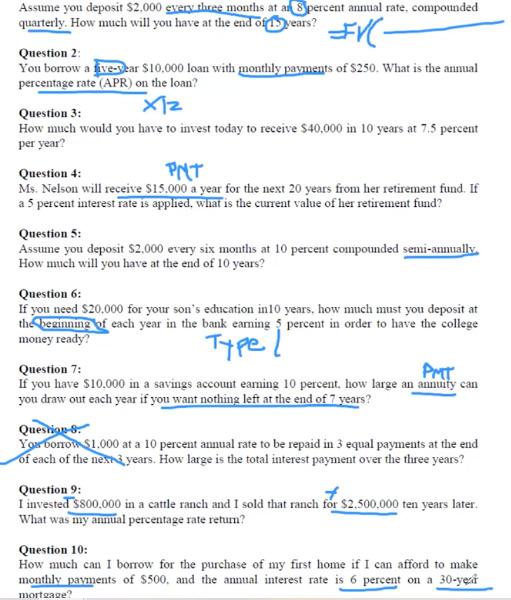

Assume you deposit $2,000 every three months at a percent annual rate, compounded quarterly. How much will you have at the end of years? #VC- Question 2: You borrow a five-year $10,000 loan with monthly payments of $250. What is the annual percentage rate (APR) on the loan? Question 3: x12 How much would you have to invest today to receive $40,000 in 10 years at 7.5 percent per year? Question 4: PNT Ms. Nelson will receive $15,000 a year for the next 20 years from her retirement fund. If a 5 percent interest rate is applied, what is the current value of her retirement fund? Question 5: Assume you deposit $2.000 every six months at 10 percent compounded semi-annually. How much will you have at the end of 10 years? Question 6: If you need $20,000 for your son's education in 10 years, how much must you deposit at the beginning of each year in the bank earning 5 percent in order to have the college money ready? Question 7: PMT If you have $10.000 in a savings account earning 10 percent, how large an annuity can you draw out each year if you want nothing left at the end of 7 years? Question-8. Your borrow $1.000 at a 10 percent annual rate to be repaid in 3 equal payments at the end of each of the next years. How large is the total interest payment over the three years? Question 9: I invested $800.000 in a cattle ranch and I sold that ranch for $2.500,000 ten years later. What was my annual percentage rate return? Question 10: How much can I borrow for the purchase of my first home if I can afford to make monthly payments of $500, and the annual interest rate is 6 percent on a 30-year mortgage?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

SOLUTION Here are the answers to your questions Question 1 If you invest 10000 quarterly for 10 years at an annual rate of return of 75 you will have ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started