Answered step by step

Verified Expert Solution

Question

1 Approved Answer

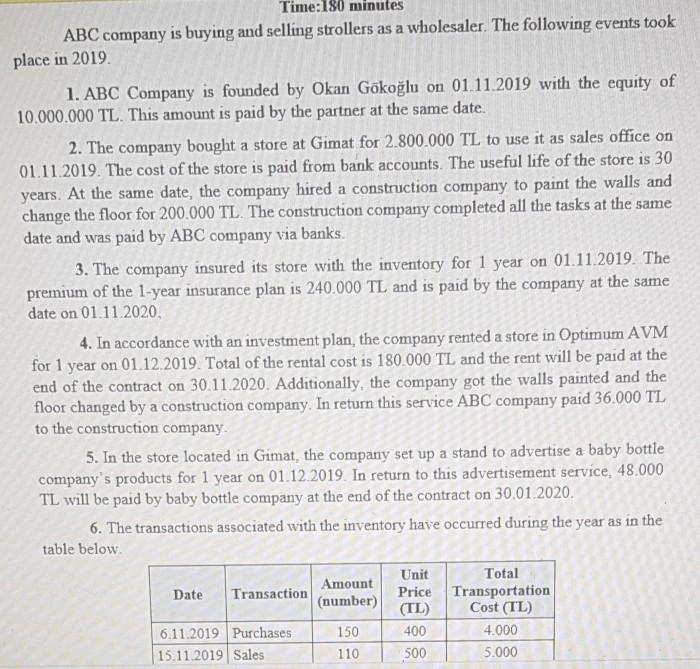

Time:180 minutes ABC company is buying and selling strollers as a wholesaler. The following events took place in 2019. 1. ABC Company is founded by

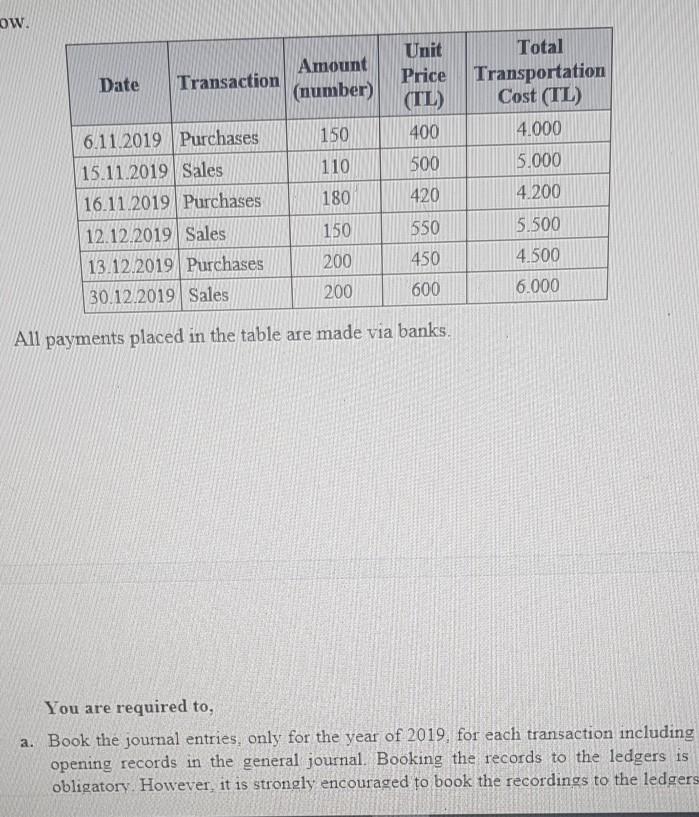

Time:180 minutes ABC company is buying and selling strollers as a wholesaler. The following events took place in 2019. 1. ABC Company is founded by Okan Gkolu on 01.11.2019 with the equity of 10.000.000 TL. This amount is paid by the partner at the same date. 2. The company bought a store at Gimat for 2.800.000 TL to use it as sales office on 01.11.2019. The cost of the store is paid from bank accounts. The useful life of the store is 30 years. At the same date, the company hired a construction company to paint the walls and change the floor for 200.000 TL. The construction company completed all the tasks at the same date and was paid by ABC company via banks. 3. The company insured its store with the inventory for 1 year on 01.11.2019. The premium of the 1-year insurance plan is 240.000 TL and is paid by the company at the same date on 01.11.2020 4. In accordance with an investment plan, the company rented a store in Optimum AVM for 1 year on 01.12.2019. Total of the rental cost is 180.000 TL and the rent will be paid at the end of the contract on 30.11.2020. Additionally, the company got the walls painted and the floor changed by a construction company. In return this service ABC company paid 36.000 TL to the construction company 5. In the store located in Gimat, the company set up a stand to advertise a baby bottle company's products for 1 year on 01.12.2019. In return to this advertisement service, 48.000 TL will be paid by baby bottle company at the end of the contract on 30.01.2020. 6. The transactions associated with the inventory have occurred during the year as in the table below Date Transaction Amount (number) Unit Total Price Transportation (TL) Cost (TL) 400 4.000 500 5.000 6.11.2019 Purchases 15.11.2019 Sales 150 110 ow. Date Transaction Amount (number) Unit Total Price Transportation (TL) Cost (TL) 400 4.000 500 5.000 150 110 180 420 4.200 6.11.2019 Purchases 15.11.2019 Sales 16.11.2019 Purchases 12.12.2019 Sales 13.12.2019 Purchases 30.12.2019 Sales 150 5.500 200 550 450 600 4.500 200 6.000 All payments placed in the table are made via banks. You are required to, a. Book the journal entries, only for the year of 2019, for each transaction including opening records in the general journal Booking the records to the ledgers is obligatory. However, it is strongly encouraged to book the recordings to the ledgers ta Gnderileri Gzden Geir Grnm Yardm Ne yapmak istediginizi soyleyin Dzenlemeyi Etkir Is ierebilir. Dzenlemeniz gerekmiyorsa, Korumal Grnmde kalmanz daha gvenli olur. You are required to, a. Book the journal entries, only for the year of 2019, for each transaction including the opening records in the general journal Booking the records to the ledgers is not obligatory. However, it is strongly encouraged to book the recordings to the ledgers so that you can track the numbers in a correct way. (45 Points) b. Book the inventory and closing records in the general journal on 31.12.2019 Booking the records to the ledgers is not obligatory. However, it is strongly encouraged to book the recordings to the ledgers so that you can track the numbers in a correct way. (45 Points) c. Prepare income statement of 2019 term on 31.12.2019. (10 Points) Note: The company uses FIFO inventory method under periodic inventory system. The company uses the straight line amortisation method with the indirect deduction. VAT rate is %18. Corporate tax rate is %22. Good Luck

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started