Answered step by step

Verified Expert Solution

Question

1 Approved Answer

timed task, please answer for an upvote :)) The following are the data of Jusko Appliance Co., a VAT-registered taxpayer, for the last quarter of

timed task, please answer for an upvote :))

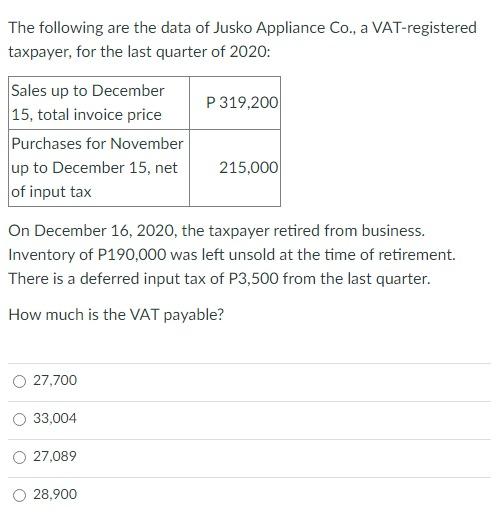

The following are the data of Jusko Appliance Co., a VAT-registered taxpayer, for the last quarter of 2020: P 319,200 Sales up to December 15, total invoice price Purchases for November up to December 15, net of input tax 215,000 On December 16, 2020, the taxpayer retired from business. Inventory of P190,000 was left unsold at the time of retirement. There is a deferred input tax of P3,500 from the last quarter. How much is the VAT payable? 27,700 33,004 27,089 28.900 The following are the data of Jusko Appliance Co., a VAT-registered taxpayer, for the last quarter of 2020: P 319,200 Sales up to December 15, total invoice price Purchases for November up to December 15, net of input tax 215,000 On December 16, 2020, the taxpayer retired from business. Inventory of P190,000 was left unsold at the time of retirement. There is a deferred input tax of P3,500 from the last quarter. How much is the VAT payable? 27,700 33,004 27,089 28.900Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started