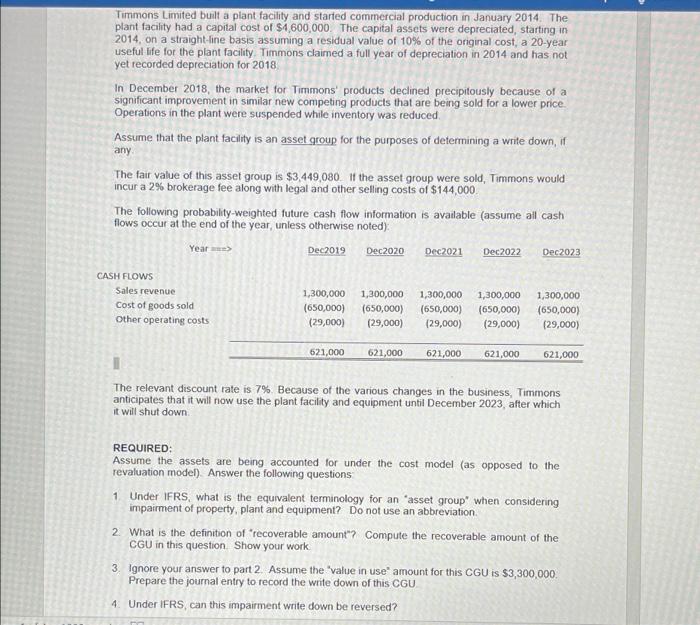

Timmons Limited built a plant facility and started commercial production in January 2014 The plant facility had a capital cost of $1,600,000. The capital assets were depreciated, starting in 2014, on a straight-line basis assuming a residual value of 10% of the original cost, a 20-year useful life for the plant facility Timmons claimed a full year of depreciation in 2014 and has not yet recorded depreciation for 2018 In December 2018, the market for Timmons' products declined precipitously because of a significant improvement in similar new competing products that are being sold for a lower price Operations in the plant were suspended while inventory was reduced Assume that the plant facility is an asset group for the purposes of determining a write down, if any The fair value of this asset group is $3,449,080. If the asset group were sold, Tommons would incur a 2% brokerage fee along with legal and other selling costs of $144,000 The following probability-weighted future cash flow information is available (assume all cash flows occur at the end of the year, unless otherwise noted) Year Dec2019 Dec2020 Dec2021 Dec2022 Dec2023 CASH FLOWS Sales revenue Cost of goods sold other operating costs 1,300,000 (650,000) (29,000) 1,300,000 (650,000) (29,000) 1,300,000 (650,000) (29,000) 1,300,000 (650,000) (29,000) 1,300,000 (650,000) (29,000) 621,000 621,000 621,000 621,000 621,000 The relevant discount rate is 7% Because of the various changes in the business, Timmons anticipates that it will now use the plant facility and equipment until December 2023, after which it will shut down REQUIRED: Assume the assets are being accounted for under the cost model (as opposed to the revaluation model). Answer the following questions 1 Under IFRS, what is the equivalent terminology for an 'asset group" when considering impairment of property, plant and equipment? Do not use an abbreviation 2. What is the definition of "recoverable amount"? Compute the recoverable amount of the CGU in this question Show your work 3. Ignore your answer to part 2. Assume the value in use" amount for this CGU is $3,300,000 Prepare the journal entry to record the write down of this CGU 4. Under IFRS can this impairment write down be reversed