Answered step by step

Verified Expert Solution

Question

1 Approved Answer

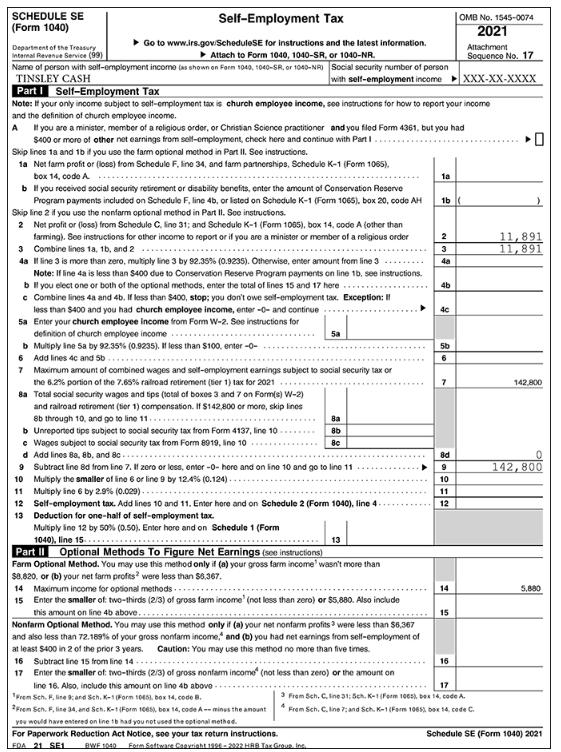

Tinsley Cash (29) is filing as a single taxpayer. She is self-employed as a life coach and reporting a net profit from her sole proprietorship.

Tinsley Cash (29) is filing as a single taxpayer. She is self-employed as a life coach and reporting a net profit from her sole proprietorship. Tinsley's partially completed Schedule SE, Self-Employment Tax, is shown below. Using the information provided, compute the amount of Tinsley's deduction for one-half of her self-employment tax. (Answer choices are below the image.)

$318

$840

$1,362

$1,680

SCHEDULE SE (Form 1040) Self-Employment Tax Go to www.irs.gov/ScheduleSE for instructions and the latest information. Attach to Form 1040, 1040-SR, or 1040-NR. Name of person with self-employment income (as shown on Form 1040, 1040-SR, or 1040-NR) TINSLEY CASH Part I Self-Employment Tax Note: If your only income subject to self-employment tax is church employee income, see instructions for how to report your income and the definition of church employce income. A Department of the Treasury Internal Revenue Service (99) Social security number of person with self-employment income 3 4a Il line 3 is more than zero, multiply line 3 by 92.35% (0.9235). Otherwise, enter amount from line 3 Note: If line 4a is less than $400 due to Conservation Reserve Program payments on line 1b, see instructions. b Il you elect one or both of the optional methods, enter the total of lines 15 and 17 here.... c Combine lines 4a and 4b. If less than $400, stop; you don't owe self-employment tax. Exception: I less than $400 and you had church employee income, enter -0- and continue 5a Enter your church employee income from Form W-2. See instructions for definition of church employee income b Multiply line 5a by 92.35% (0.9235). If less than $100, enter-0- 6 Add lines 4c and Sb.... 7 If you are a minister, member of a religious order, or Christian Science practitioner and you filed Form 4361, but you had $400 or more of other net earnings from self-employment, check here and continue with Part I. Skip lines 1a and 1b if you use the farm optional method in Part II. See instructions. 1a Not farm profit or (loss) from Schedule F, line 34, and farm partnerships, Schedule K-1 (Form 1065), box 14, code A b Il you received social security retirement or disability benefits, enter the amount of Conservation Reserve Program payments included on Schedule F, line 4b, or listed on Schedule K-1 (Form 1065), box 20, code AH Skip line 2 if you use the nonfarm optional method in Part II. Soe instructions. 2 Net profit or (loss) from Schedule C, line 31; and Schedule K-1 (Form 1065), box 14, code A (other than farming). See instructions for other income to report or if you are a minister or member of a religious order Combine lines 1a, 1b, and 2 5a Maximum amount of combined wages and self-employment earnings subject to social security tax or the 6.2% portion of the 7.65% railroad retirement (tier 1) tax for 2021 8a Total social security wages and tips (total of boxes 3 and 7 on Form(s) W-2) and railroad retirement (tier 1) compensation. If $142,800 or more, skip lines 8b through 10, and go to line 11... b Unreported tips subject to social security tax from Form 4137, line 10 e Wages subject to social security tax from Form 8919, lino 10 d Add lines 88, 8b, and 8c... 9 Subtract line 8d from line 7. If zero or less, enter -0- here and on line 10 and go to line 11 10 Multiply the smaller of line 6 or line 9 by 12.4% (0.124). 8a 8b 8c 11 Multiply line 6 by 2.9% (0.029)... 12 Self-employment tax. Add lines 10 and 11. Enter here and on Schedule 2 (Form 1040), line 4 13 Deduction for one-half of self-employment tax. Multiply line 12 by 50% (0.50). Enter hore and on Schedule 1 (Form 1040), line 15... Part II Optional Methods To Figure Net Earnings (see instructions) Farm Optional Method. You may use this method only if (a) your gross farm income wasn't more than $8,820, or (b) your net farm profits were less than $6,367. you would have entered on line 1b had you not used the optional method. For Paperwork Reduction Act Notice, see your tax return instructions. FDA 21 SE1 BWF 1040 Form Software Copyright 1996-2022 HRB Tax Group, Inc 13 14 Maximum income for optional methods.... 15 Enter the smaller of: two-thirds (2/3) of gross farm income (not less than zero) or $5,880. Also include this amount on line 4b above........ Nonfarm Optional Method. You may use this method only if (a) your net nonfarm profits were less than $6,367 and also less than 72.189% of your gross nonfarm income, and (b) you had net earnings from self-employment of at least $400 in 2 of the prior 3 years. Caution: You may use this method no more than five times. 16 Subtract line 15 from line 14... 17 Enter the smaller of: two-thirds (2/3) of gross nonfarm income (not less than zero) or the amount on line 16. Also, include this amount on line 4b above From Sch. F. line 9; and Sch. K-1 (Form 1045), box 14,code B. From Sch. F, line 34, and Sch. K-1 (Form 1065), bex 14, code A--mines the amount 1a 1b #SUN 4a 4b 4c 5b 6 7 8d 9 10 11 12 14 OMB No. 1545-0074 2021 15 16 Attachment Sequence No. 17 XXX-XX-XXXX 17 3 From Sch. C, Ine 31; Sch. K-1 (Form 1065), box 14, code A. From Sch. C. line 7; and Sch. K-1 (Form 1065), box 14, code C. 11,891 11,891 142,800 142,800 5,880 Schedule SE (Form 1040) 2021

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Solution The correct answer is 840 Net profit 1189100 Multiply by 9235 Amount subj...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started