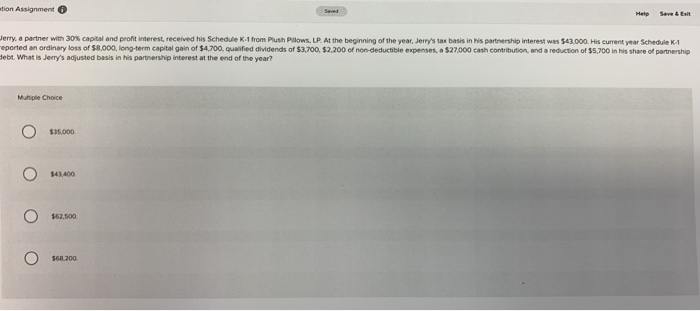

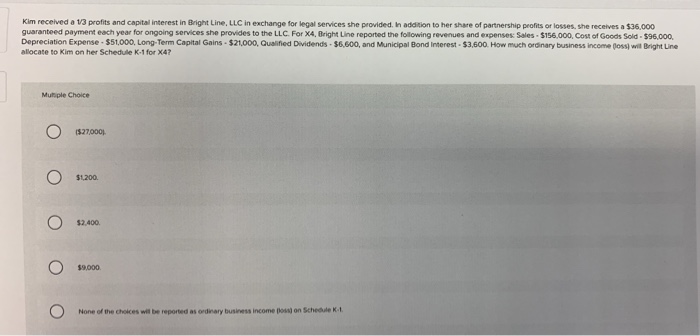

tion Assignment Jerry, a partner with 30% capital and profit interest, received his schedulettrom Push Pows UP At the beginning of the year s to be in his partnershiterst was $43.000. His current yearSched eported an ordinary loss of $8.00, long-term captain of 4700. ed udends of $300.52.200 of non-deducible expenses. $27.000 cash co t on and a reduction of $5.700 in his share of partnership Sebt. What is Jerry's adjusted basis in this partner test at the end of the year? Maple Choice O skooo o o o of Kim received a 13 profits and capital interest in Bright Line, LLC in exchange for legal services she provided. In addition to her share of partnership profits or losses. She receives a $35.000 guaranteed payment each year for ongoing services she provides to the LLC. For X4, Bright Line reported the following revenues and expenses Sales - $156.000, Cost of Goods Sold - 596,000 Depreciation Expense - $51,000, Long-Term Capital Gains. $21,000, Qualified Dividends - $6.500, and Municipal Bond Interest - $3,600. How much ordinary business income posswil Bright Line allocate to Kim on her Schedule K 1 for X47 M e Choice O $27.000 O $1.200 O $2,400 0 $9000 0 None of the chces will be reported as ordinary business income on Schee tion Assignment Jerry, a partner with 30% capital and profit interest, received his schedulettrom Push Pows UP At the beginning of the year s to be in his partnershiterst was $43.000. His current yearSched eported an ordinary loss of $8.00, long-term captain of 4700. ed udends of $300.52.200 of non-deducible expenses. $27.000 cash co t on and a reduction of $5.700 in his share of partnership Sebt. What is Jerry's adjusted basis in this partner test at the end of the year? Maple Choice O skooo o o o of Kim received a 13 profits and capital interest in Bright Line, LLC in exchange for legal services she provided. In addition to her share of partnership profits or losses. She receives a $35.000 guaranteed payment each year for ongoing services she provides to the LLC. For X4, Bright Line reported the following revenues and expenses Sales - $156.000, Cost of Goods Sold - 596,000 Depreciation Expense - $51,000, Long-Term Capital Gains. $21,000, Qualified Dividends - $6.500, and Municipal Bond Interest - $3,600. How much ordinary business income posswil Bright Line allocate to Kim on her Schedule K 1 for X47 M e Choice O $27.000 O $1.200 O $2,400 0 $9000 0 None of the chces will be reported as ordinary business income on Schee