Tips: Every year's taxable income may not fall in the same tax bracket. If you have a loss in a year assume 0$ taxes

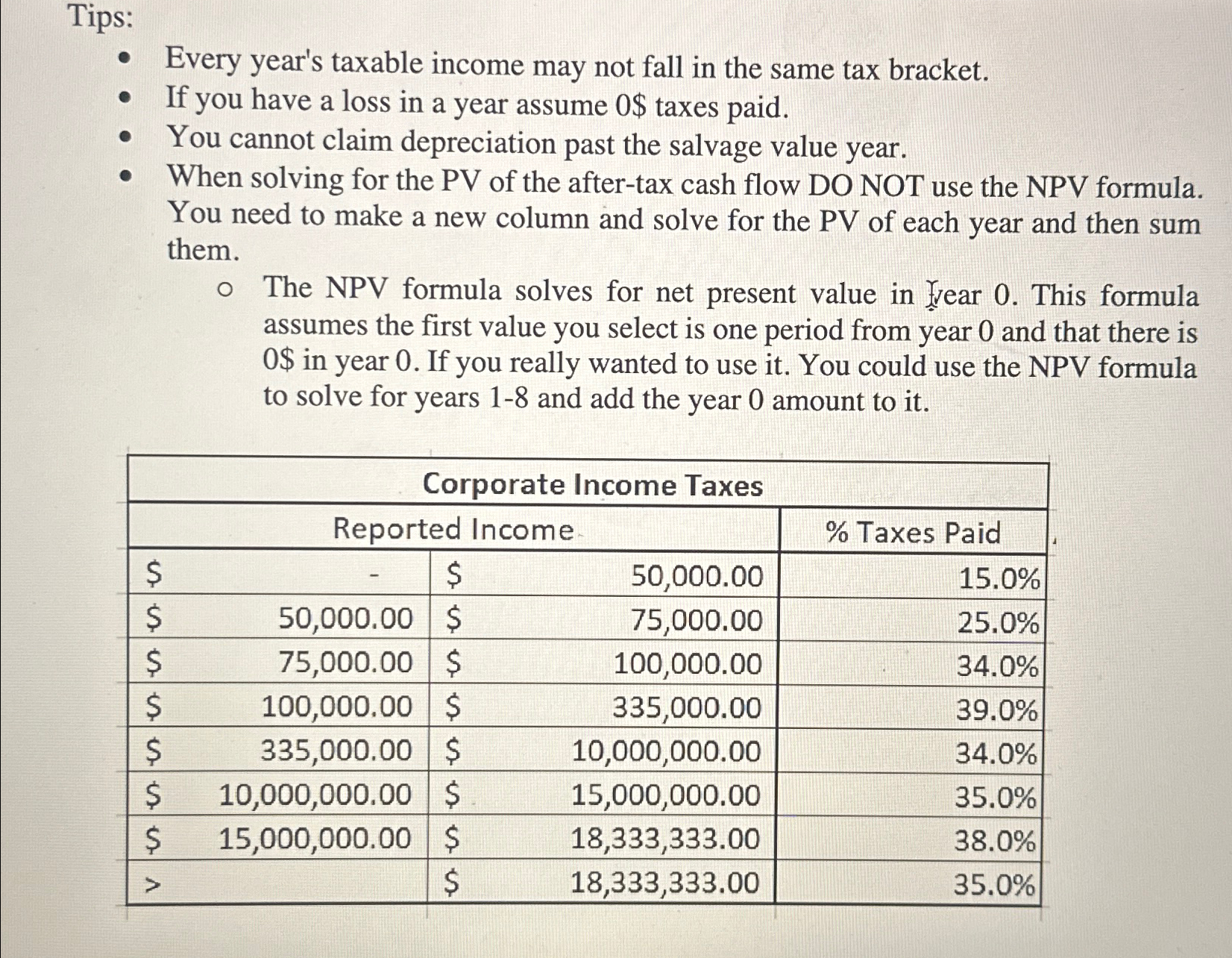

Tips: Every year's taxable income may not fall in the same tax bracket. If you have a loss in a year assume 0$ taxes paid. You cannot claim depreciation past the salvage value year. When solving for the PV of the after-tax cash flow DO NOT use the NPV formula. You need to make a new column and solve for the PV of each year and then sum them. o The NPV formula solves for net present value in year 0. This formula assumes the first value you select is one period from year 0 and that there is 0$ in year 0. If you really wanted to use it. You could use the NPV formula to solve for years 1-8 and add the year 0 amount to it. Corporate Income Taxes Reported Income % Taxes Paid $ $ 50,000.00 15.0% $ 50,000.00 $ 75,000.00 25.0% $ 75,000.00 $ 100,000.00 34.0% $ 100,000.00 $ 335,000.00 39.0% $ 335,000.00 $ 10,000,000.00 34.0% $ 10,000,000.00 $ 15,000,000.00 35.0% $ 15,000,000.00 $ 18,333,333.00 38.0% > $ 18,333,333.00 35.0%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started