Question

Titan Enterprises Case Study Mr. Jonathon Lee, President of Titan Enterprises is excited about the mathematical programming model developed (see Figure 1) and wanted to

Titan Enterprises Case Study

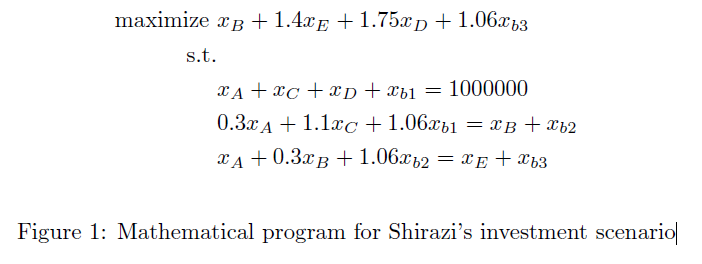

Mr. Jonathon Lee, President of Titan Enterprises is excited about the mathematical programming model developed (see Figure 1) and wanted to know if it could be extended to address a new concern brought forward by the Investment Review Committee. The model was originally created to optimize investment return over a 4 year investment time horizon based on an example case provided by Mr. Shirazi. The decision variables xA; xB; : : : xE denote the dollars to be invested in projects A thru E and the variables xb1; xb2; and xb3 denote the annual investment allocations to the bank for years 1, 2, and 3, respectively.

The members of the committee are Mr. Will Zhang, the Treasurer; Ms. Brandi Phillips, the Con- troller; and Mr. Amin Shirazi, Operations director. Mr. Zhang had some concerns regarding implicit assumptions in the modeling approach, namely, that the model does not account for risk in any of the investments.

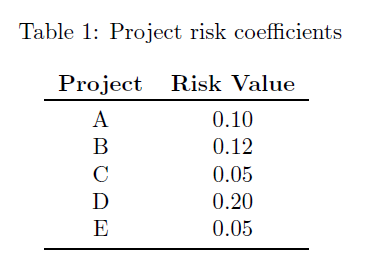

Ms. Phillips suggested the use of simple risk scores to be assigned to each project. For example, a risk score of 0.10 for project A would imply that 10% of the invested monies in A are at risk. She then suggested that the model could be tuned to minimize risk instead of maximizing the return. Mr. Lee noted that a minimum risk option would likely invest all money in the bank and not consider other Project options. He further noted that such a strategy is not an appealing option since the stockholders would not like such a risk averse strategy.

Based on these suggestions, Mr. Shirazi created a set of risk values associated with dollars invested in each of the projects. He assumed that there is no risk associated with investments in the bank. The risk coecients per dollar invested are provided in Table 1. He further suggested the use of multiple objective optimization to create a set of Pareto optimal investment strategies. The other committee members agreed to consider the approach, but they noted that they would likely need help evaluating the model outcomes.

(a) Formulate and solve Titan's investment problem as an LP to accomplish the following:

i. Maximize return only

ii. Minimize risk only (do not consider return, only risk)

iii. Solve the problem using a scalarized objective function to combine the objectives where  1

1  0 and

0 and  2

2  0 are the weights associated with returns and risks, respectively, and

0 are the weights associated with returns and risks, respectively, and  1+

1+ 2 = 1. Use the values,

2 = 1. Use the values,  1 = 0; 0:25; 0:5; 0:75; 1.

1 = 0; 0:25; 0:5; 0:75; 1.

iv. Use the  -constraint method to solve the investment problem for 20 values of

-constraint method to solve the investment problem for 20 values of  . The

. The  values that you choose should represent the entire spectrum of risk and return. That is, one solution in the set should correspond to the maximum returns achieved in (i) and one solution should correspond to the minimum risk achieved in (ii).

values that you choose should represent the entire spectrum of risk and return. That is, one solution in the set should correspond to the maximum returns achieved in (i) and one solution should correspond to the minimum risk achieved in (ii).

(b) Using the outcomes from either the scalarized or  -constraint method, graph the Pareto optimal results on objective space. Clearly label the axes, denote the feasible region and infeasible regions, and provide a brief, but clear, interpretation of the results to help the committee understand the graph, the tradeoffs involved, and how to make decisions regarding investments.

-constraint method, graph the Pareto optimal results on objective space. Clearly label the axes, denote the feasible region and infeasible regions, and provide a brief, but clear, interpretation of the results to help the committee understand the graph, the tradeoffs involved, and how to make decisions regarding investments.

(c) Using the  -constraint results, analyze how the investment portfolio changes across the spectrum of risk-tolerance solutions. Include a clear interpretation to help the decision-makers understand the set of Pareto optimal solutions (visualizations will help!)

-constraint results, analyze how the investment portfolio changes across the spectrum of risk-tolerance solutions. Include a clear interpretation to help the decision-makers understand the set of Pareto optimal solutions (visualizations will help!)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started