Question

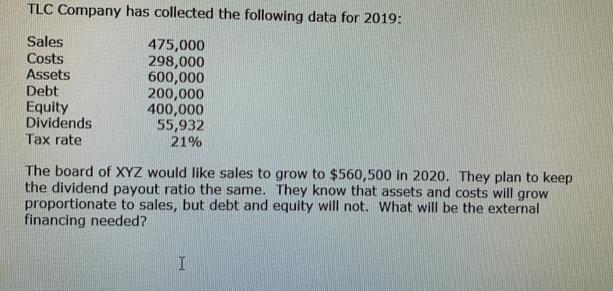

TLC Company has collected the following data for 2019: Sales 475,000 Costs 298,000 Assets 600,000 Debt 200,000 400,000 55,932 21% Equity Dividends Tax rate

TLC Company has collected the following data for 2019: Sales 475,000 Costs 298,000 Assets 600,000 Debt 200,000 400,000 55,932 21% Equity Dividends Tax rate The board of XYZ would like sales to grow to $560,500 in 2020. They plan to keep the dividend payout ratio the same. They know that assets and costs will grow proportionate to sales, but debt and equity will not. What will be the external financing needed? I

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Lets go through these steps one by one 1 Calculate Net Income for 2019 Net Income Sales Costs Divide...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Managerial Accounting Tools for Business Decision Making

Authors: Jerry J. Weygandt, Paul D. Kimmel, Donald E. Kieso, Ibrahim M. Aly

3rd Canadian edition

978-1118727737, 1118727738, 978-1118033890

Students also viewed these Banking questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App