Tlhole (Pty) Ltd.

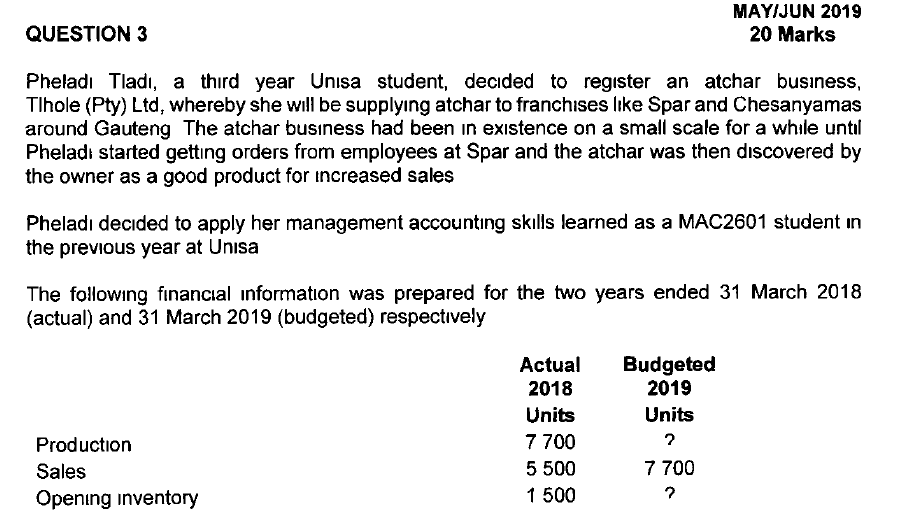

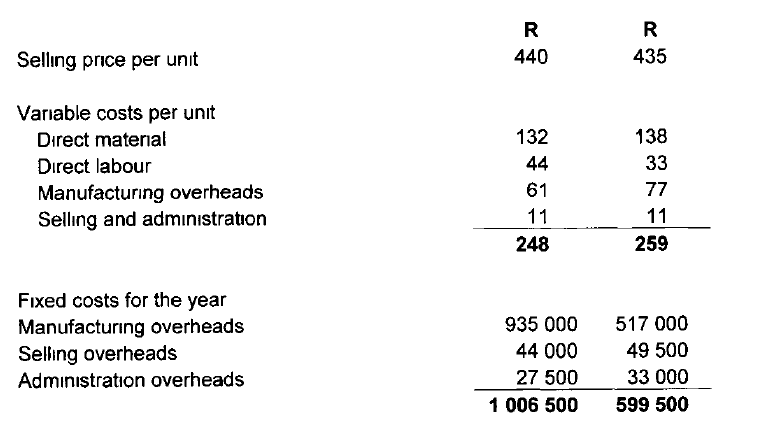

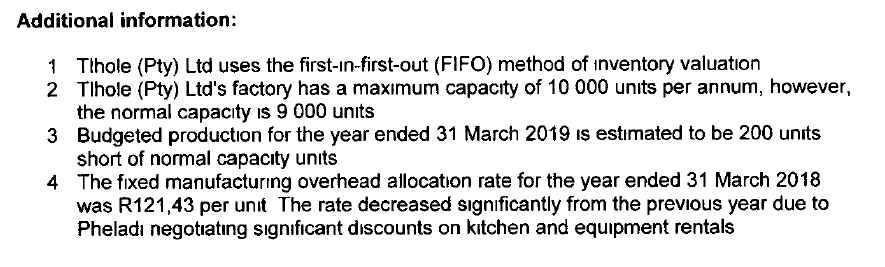

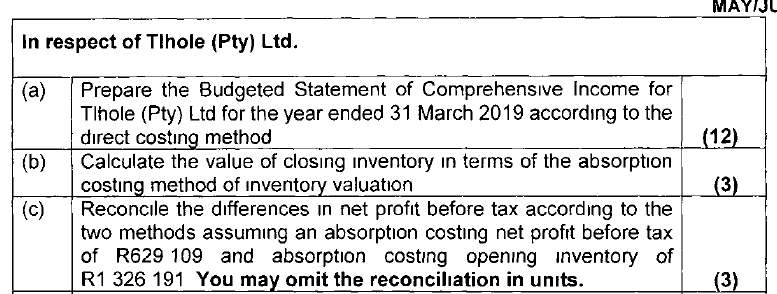

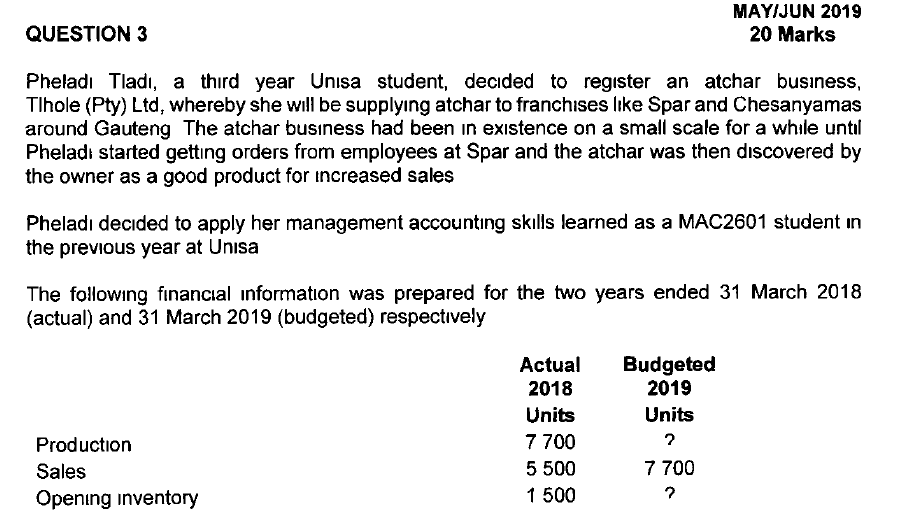

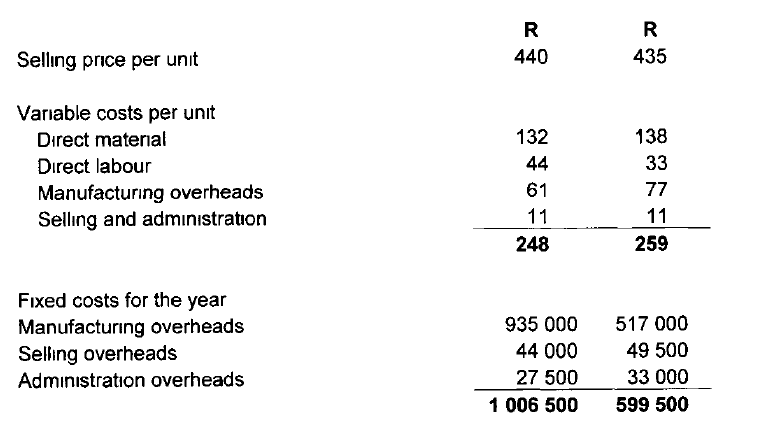

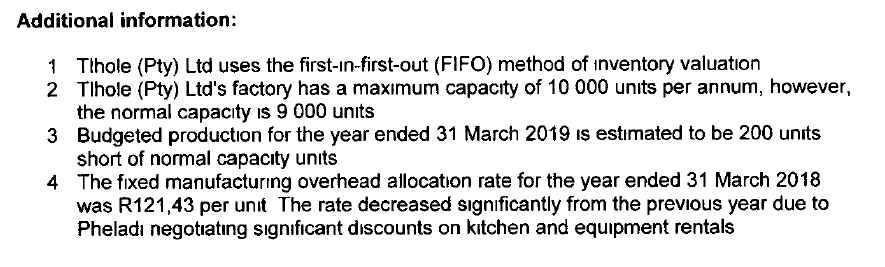

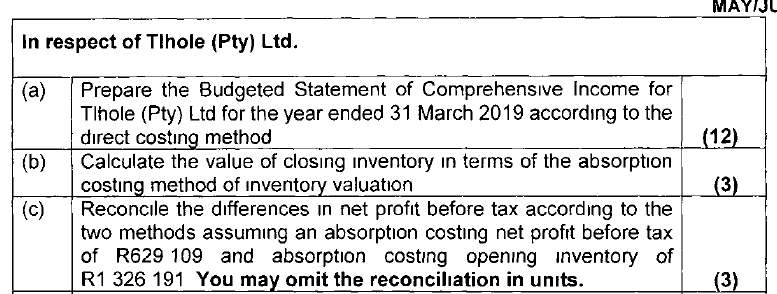

QUESTION 3 MAY/JUN 2019 20 Marks Pheladi Tlad, a third year Unisa student, decided to register an atchar business, Tlhole (Pty) Ltd, whereby she will be supplying atchar to franchises like Spar and Chesanyamas around Gauteng The atchar business had been in existence on a small scale for a while until Phelad started getting orders from employees at Spar and the atchar was then discovered by the owner as a good product for increased sales Pheladi decided to apply her management accounting skills learned as a MAC2601 student in the previous year at Unisa The following financial information was prepared for the two years ended 31 March 2018 (actual) and 31 March 2019 (budgeted) respectively Budgeted 2019 Units Actual 2018 Units 7 700 5 500 1 500 Production Sales Opening inventory 7 700 7 Selling price per unit 440 132 Variable costs per unit Direct material Direct labour Manufacturing overheads Selling and administration 44 61 11 11 248 259 Fixed costs for the year Manufacturing overheads Selling overheads Administration overheads 935 000 517 000 44 00049 500 27 500 33 000 1 006 500 599 500 Additional information: 1 Tihole (Pty) Ltd uses the first-in-first-out (FIFO) method of inventory valuation 2 Tihole (Pty) Ltd's factory has a maximum capacity of 10 000 units per annum, however, the normal capacity is 9 000 units 3 Budgeted production for the year ended 31 March 2019 is estimated to be 200 units short of normal capacity units The fixed manufacturing overhead allocation rate for the year ended 31 March 2018 was R121,43 per unit The rate decreased significantly from the previous year due to Pheladi negotiating significant discounts on kitchen and equipment rentals MAYIJU In respect of Tlhole (Pty) Ltd. (a) (b) Prepare the Budgeted Statement of Comprehensive Income for Tlhole (Pty) Ltd for the year ended 31 March 2019 according to the direct costing method Calculate the value of closing inventory in terms of the absorption costing method of inventory valuation Reconcile the differences in net profit before tax according to the two methods assuming an absorption costing net profit before tax of R629 109 and absorption costing opening inventory of R1 326 191 You may omit the reconciliation in units. (c) (3) QUESTION 3 MAY/JUN 2019 20 Marks Pheladi Tlad, a third year Unisa student, decided to register an atchar business, Tlhole (Pty) Ltd, whereby she will be supplying atchar to franchises like Spar and Chesanyamas around Gauteng The atchar business had been in existence on a small scale for a while until Phelad started getting orders from employees at Spar and the atchar was then discovered by the owner as a good product for increased sales Pheladi decided to apply her management accounting skills learned as a MAC2601 student in the previous year at Unisa The following financial information was prepared for the two years ended 31 March 2018 (actual) and 31 March 2019 (budgeted) respectively Budgeted 2019 Units Actual 2018 Units 7 700 5 500 1 500 Production Sales Opening inventory 7 700 7 Selling price per unit 440 132 Variable costs per unit Direct material Direct labour Manufacturing overheads Selling and administration 44 61 11 11 248 259 Fixed costs for the year Manufacturing overheads Selling overheads Administration overheads 935 000 517 000 44 00049 500 27 500 33 000 1 006 500 599 500 Additional information: 1 Tihole (Pty) Ltd uses the first-in-first-out (FIFO) method of inventory valuation 2 Tihole (Pty) Ltd's factory has a maximum capacity of 10 000 units per annum, however, the normal capacity is 9 000 units 3 Budgeted production for the year ended 31 March 2019 is estimated to be 200 units short of normal capacity units The fixed manufacturing overhead allocation rate for the year ended 31 March 2018 was R121,43 per unit The rate decreased significantly from the previous year due to Pheladi negotiating significant discounts on kitchen and equipment rentals MAYIJU In respect of Tlhole (Pty) Ltd. (a) (b) Prepare the Budgeted Statement of Comprehensive Income for Tlhole (Pty) Ltd for the year ended 31 March 2019 according to the direct costing method Calculate the value of closing inventory in terms of the absorption costing method of inventory valuation Reconcile the differences in net profit before tax according to the two methods assuming an absorption costing net profit before tax of R629 109 and absorption costing opening inventory of R1 326 191 You may omit the reconciliation in units. (c) (3)