Question

To answer this Question you need to see the top of the annual financial reports for 2018 - 2019. Pay attention to the cash flow

To answer this Question you need to see the top of the annual financial reports for 2018 - 2019.

Pay attention to the cash flow statement

A) Make a horizontal analysis for 2018 - 2019, on the financial statements that you download, and explain your opinion on the results of the horizontal analysis.

B) Fill in the following table based on data from the financial statement

|

| Ratio | Formula | Year 2018 | Year 2019 | Short analysis |

| 1 | Current ratio |

|

|

|

|

| 2 | Inventory turnover account receivable turn over |

|

|

|

|

| 3 | Profit margin |

|

|

|

|

| 4 | Return on assets |

|

|

|

|

| 5 | Earning per share |

|

|

|

|

| 6 | Debt to total assets |

|

|

|

|

Based on the results in case 6 above, explain your analysis of the liquidity, profitability and solvency of the company you choose!

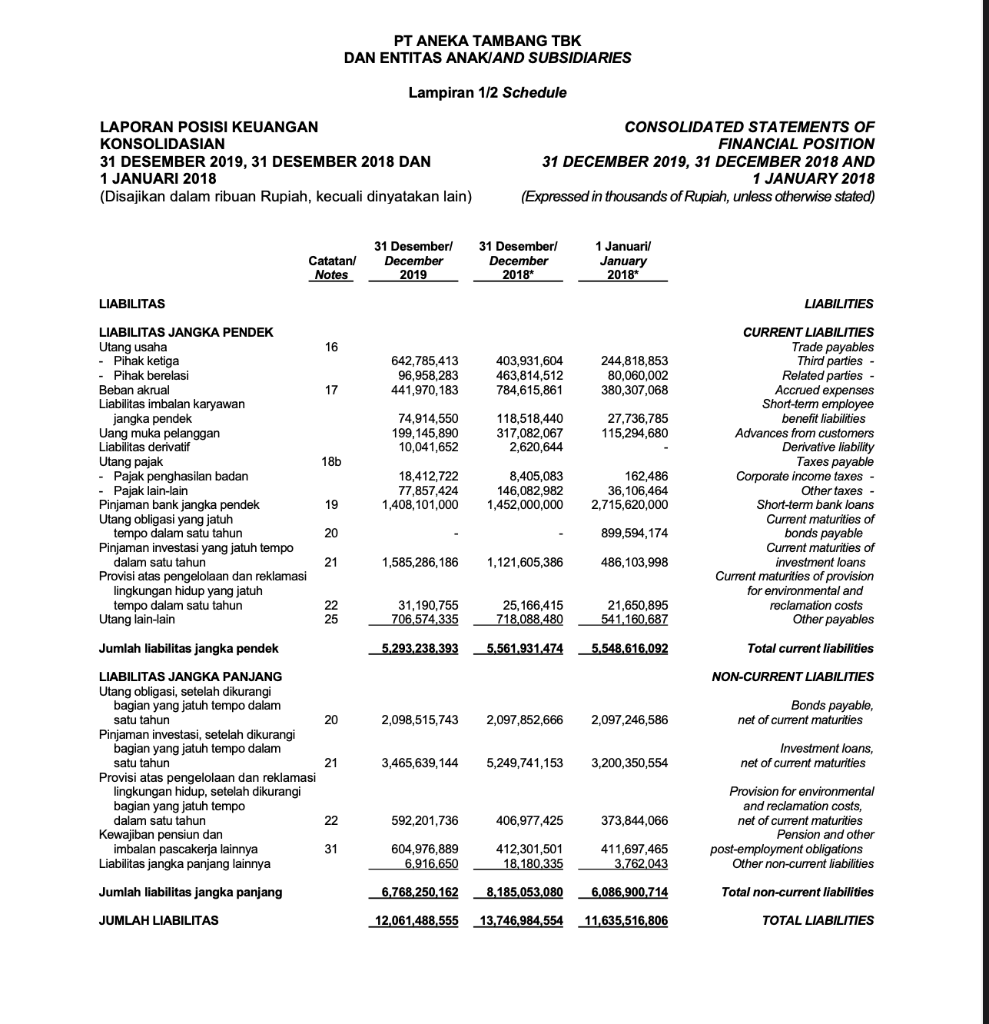

PT ANEKA TAMBANG TBK DAN ENTITAS ANAK AND SUBSIDIARIES Lampiran 1/2 Schedule LAPORAN POSISI KEUANGAN KONSOLIDASIAN 31 DESEMBER 2019, 31 DESEMBER 2018 DAN 1 JANUARI 2018 (Disajikan dalam ribuan Rupiah, kecuali dinyatakan lain) CONSOLIDATED STATEMENTS OF FINANCIAL POSITION 31 DECEMBER 2019, 31 DECEMBER 2018 AND 1 JANUARY 2018 (Expressed in thousands of Rupiah, unless otherwise stated) Catatan/ Notes 31 Desember/ December 2019 31 Desember/ December 2018* 1 Januaril January 2018* LIABILITAS LIABILITIES 16 642,785,413 96,958,283 441,970,183 403,931,604 463,814,512 784,615,861 244,818,853 80,060,002 380,307,068 17 74,914,550 199,145,890 10,041,652 118,518,440 317,082,067 2,620,644 27,736,785 115,294,680 18b LIABILITAS JANGKA PENDEK Utang usaha - Pihak ketiga - Pihak berelasi Beban akrual Liabilitas imbalan karyawan jangka pendek Uang muka pelanggan Liabilitas derivatif Utang pajak - Pajak penghasilan badan - Pajak lain-lain Pinjaman bank jangka pendek Utang obligasi yang jatuh tempo dalam satu tahun Pinjaman investasi yang jatuh tempo dalam satu tahun Provisi atas pengelolaan dan reklamasi lingkungan hidup yang jatuh tempo dalam satu tahun Utang lain-lain 18,412,722 77,857,424 1,408,101,000 8,405,083 146,082,982 1,452,000,000 162,486 36,106,464 2.715,620,000 CURRENT LIABILITIES Trade payables Third parties - Related parties - Accrued expenses Short-term employee benefit liabilities Advances from customers Derivative liability Taxes paya Corporate income taxes - Other taxes - Short-term bank loans Current maturities of bonds payable Current maturities of investment loans Current maturities of provision for environmental and reclamation costs Other payables 19 20 899,594,174 21 1,585,286,186 1,121,605,386 486,103,998 22 25 31,190,755 706,574,335 25,166,415 718,088,480 21,650,895 541,160,687 Jumlah liabilitas jangka pendek 5.293.238.393 5.561,931,474 5,548,616,092 Total current liabilities NON-CURRENT LIABILITIES Bonds payable, net of current matunities 20 2,098,515,743 2,097,852,666 2,097,246,586 21 3,465,639,144 Investment loans, net of current maturities 3,200,350,554 LIABILITAS JANGKA PANJANG Utang obligasi, setelah dikurangi bagian yang jatuh tempo dalam satu tahun Pinjaman investasi, setelah dikurangi bagian yang jatuh tempo dalam satu tahun Provisi atas pengelolaan dan reklamasi lingkungan hidup, setelah dikurangi bagian yang jatuh tempo dalam satu tahun Kewajiban pensiun dan imbalan pascakerja lainnya Liabilitas jangka panjang lainnya 5,249,741,153 22 592,201,736 406,977,425 373,844,066 Provision for environmental and reclamation costs, net of current maturities Pension and other post-employment obligations Other non-current liabilities 31 604,976,889 6.916.650 412,301,501 18, 180,335 411,697,465 3.762,043 Jumlah liabilitas jangka panjang 6,768,250 162 8.185,053.080 6,086,900,714 Total non-current liabilities JUMLAH LIABILITAS 12,061,488,555 13.746,984,554 11,635,516,806 TOTAL LIABILITIES PT ANEKA TAMBANG TBK DAN ENTITAS ANAK AND SUBSIDIARIES Lampiran 1/2 Schedule LAPORAN POSISI KEUANGAN KONSOLIDASIAN 31 DESEMBER 2019, 31 DESEMBER 2018 DAN 1 JANUARI 2018 (Disajikan dalam ribuan Rupiah, kecuali dinyatakan lain) CONSOLIDATED STATEMENTS OF FINANCIAL POSITION 31 DECEMBER 2019, 31 DECEMBER 2018 AND 1 JANUARY 2018 (Expressed in thousands of Rupiah, unless otherwise stated) Catatan/ Notes 31 Desember/ December 2019 31 Desember/ December 2018* 1 Januaril January 2018* LIABILITAS LIABILITIES 16 642,785,413 96,958,283 441,970,183 403,931,604 463,814,512 784,615,861 244,818,853 80,060,002 380,307,068 17 74,914,550 199,145,890 10,041,652 118,518,440 317,082,067 2,620,644 27,736,785 115,294,680 18b LIABILITAS JANGKA PENDEK Utang usaha - Pihak ketiga - Pihak berelasi Beban akrual Liabilitas imbalan karyawan jangka pendek Uang muka pelanggan Liabilitas derivatif Utang pajak - Pajak penghasilan badan - Pajak lain-lain Pinjaman bank jangka pendek Utang obligasi yang jatuh tempo dalam satu tahun Pinjaman investasi yang jatuh tempo dalam satu tahun Provisi atas pengelolaan dan reklamasi lingkungan hidup yang jatuh tempo dalam satu tahun Utang lain-lain 18,412,722 77,857,424 1,408,101,000 8,405,083 146,082,982 1,452,000,000 162,486 36,106,464 2.715,620,000 CURRENT LIABILITIES Trade payables Third parties - Related parties - Accrued expenses Short-term employee benefit liabilities Advances from customers Derivative liability Taxes paya Corporate income taxes - Other taxes - Short-term bank loans Current maturities of bonds payable Current maturities of investment loans Current maturities of provision for environmental and reclamation costs Other payables 19 20 899,594,174 21 1,585,286,186 1,121,605,386 486,103,998 22 25 31,190,755 706,574,335 25,166,415 718,088,480 21,650,895 541,160,687 Jumlah liabilitas jangka pendek 5.293.238.393 5.561,931,474 5,548,616,092 Total current liabilities NON-CURRENT LIABILITIES Bonds payable, net of current matunities 20 2,098,515,743 2,097,852,666 2,097,246,586 21 3,465,639,144 Investment loans, net of current maturities 3,200,350,554 LIABILITAS JANGKA PANJANG Utang obligasi, setelah dikurangi bagian yang jatuh tempo dalam satu tahun Pinjaman investasi, setelah dikurangi bagian yang jatuh tempo dalam satu tahun Provisi atas pengelolaan dan reklamasi lingkungan hidup, setelah dikurangi bagian yang jatuh tempo dalam satu tahun Kewajiban pensiun dan imbalan pascakerja lainnya Liabilitas jangka panjang lainnya 5,249,741,153 22 592,201,736 406,977,425 373,844,066 Provision for environmental and reclamation costs, net of current maturities Pension and other post-employment obligations Other non-current liabilities 31 604,976,889 6.916.650 412,301,501 18, 180,335 411,697,465 3.762,043 Jumlah liabilitas jangka panjang 6,768,250 162 8.185,053.080 6,086,900,714 Total non-current liabilities JUMLAH LIABILITAS 12,061,488,555 13.746,984,554 11,635,516,806 TOTAL LIABILITIES

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started