To be conservative, Jones would like to understand how fast he can grow his business where he finances the growth entirely from internally generated cash flow. Help Jones to answer this question using the 2006 Income Statement and December 31, 2006 Balance sheet.

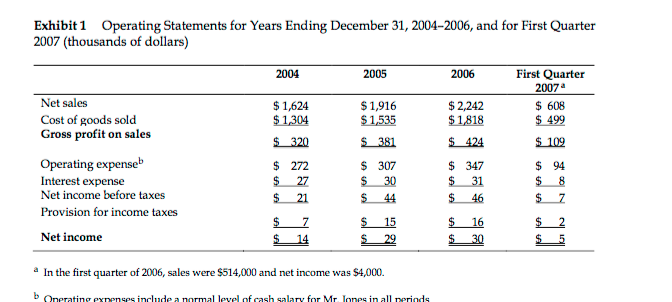

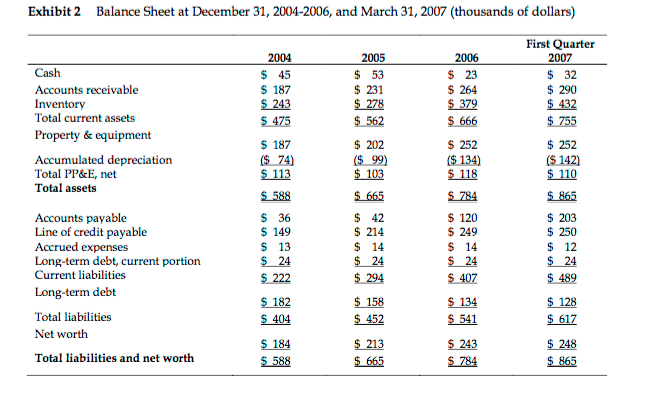

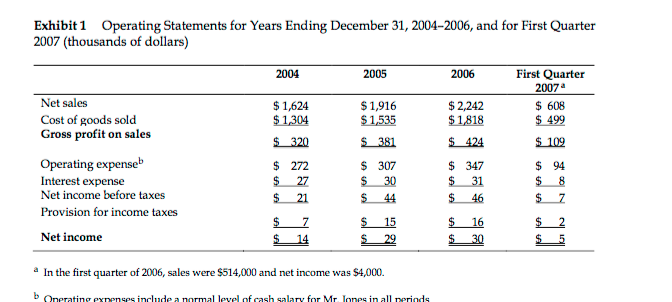

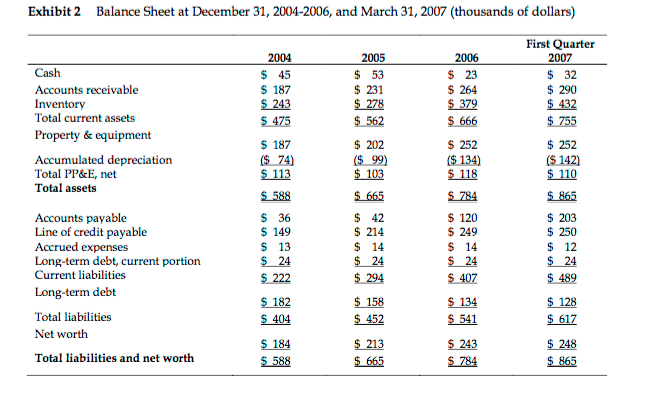

Exhibit 1 Operating Statements for Years Ending December 31, 2004-2006, and for First Quarter 2007 (thousands of dollars) 2004 2005 2006 First Quarter 2007 $ 608 $ 499 Net sales Cost of goods sold Gross profit on sales $ 1,624 $ 1,304 $ 109 $ $2,242 $1,818 $ 424 $ 347 $ 31 $ 46 94 $ 320 $ 272 $ 27 $ 21 $ 7 $_ 14 Operating expenseb Interest expense Net income before taxes Provision for income taxes $ 1,916 $ 1,535 $_381 $ 307 $ 30 $ 44 $ 15 $_29 $ $ 7 2 Net income $ $ 16 30 a In the first quarter of 2006, sales were $514,000 and net income was $4,000. b Onerating expenses include a normal level of cash salary for Mr Tones in all periods Exhibit 2 Balance Sheet at December 31, 2004-2006, and March 31, 2007 (thousands of dollars) 2004 $ 45 $ 187 $ 243 $ 475 2006 $ 23 $ 264 $ 379 $ 666 First Quarter 2007 $ 32 $ 290 $ 432 $ 755 Cash Accounts receivable Inventory Total current assets Property & equipment Accumulated depreciation Total PP&E, net Total assets $ 252 ($ 134) $ 118 $ 252 ($ 142) $ 110 2005 $ 53 $ 231 $ 278 $ 562 $ 202 ($ 99) $ 103 $ 665 $ 42 $ 214 $ 14 $ 24 $ 294 $ 158 $ 452 $2784 $ 187 ($ 74) $ 113 $ 588 $ 36 $ 149 $ 13 $ 24 $ 222 $ 182 $ 404 Accounts payable Line of credit payable Accrued expenses Long-term debt, current portion Current liabilities Long-term debt $ 120 $ 249 $ 14 $ 24 $ 407 $ 865 $ 203 $ 250 $ 12 $ 24 $ 489 Total liabilities Net worth $ 134 $ 541 $ 128 $ 617 Total liabilities and net worth $ 184 $ 588 $ 213 $ 665 $ 243 $ 784 $ 248 $ 865 Exhibit 1 Operating Statements for Years Ending December 31, 2004-2006, and for First Quarter 2007 (thousands of dollars) 2004 2005 2006 First Quarter 2007 $ 608 $ 499 Net sales Cost of goods sold Gross profit on sales $ 1,624 $ 1,304 $ 109 $ $2,242 $1,818 $ 424 $ 347 $ 31 $ 46 94 $ 320 $ 272 $ 27 $ 21 $ 7 $_ 14 Operating expenseb Interest expense Net income before taxes Provision for income taxes $ 1,916 $ 1,535 $_381 $ 307 $ 30 $ 44 $ 15 $_29 $ $ 7 2 Net income $ $ 16 30 a In the first quarter of 2006, sales were $514,000 and net income was $4,000. b Onerating expenses include a normal level of cash salary for Mr Tones in all periods Exhibit 2 Balance Sheet at December 31, 2004-2006, and March 31, 2007 (thousands of dollars) 2004 $ 45 $ 187 $ 243 $ 475 2006 $ 23 $ 264 $ 379 $ 666 First Quarter 2007 $ 32 $ 290 $ 432 $ 755 Cash Accounts receivable Inventory Total current assets Property & equipment Accumulated depreciation Total PP&E, net Total assets $ 252 ($ 134) $ 118 $ 252 ($ 142) $ 110 2005 $ 53 $ 231 $ 278 $ 562 $ 202 ($ 99) $ 103 $ 665 $ 42 $ 214 $ 14 $ 24 $ 294 $ 158 $ 452 $2784 $ 187 ($ 74) $ 113 $ 588 $ 36 $ 149 $ 13 $ 24 $ 222 $ 182 $ 404 Accounts payable Line of credit payable Accrued expenses Long-term debt, current portion Current liabilities Long-term debt $ 120 $ 249 $ 14 $ 24 $ 407 $ 865 $ 203 $ 250 $ 12 $ 24 $ 489 Total liabilities Net worth $ 134 $ 541 $ 128 $ 617 Total liabilities and net worth $ 184 $ 588 $ 213 $ 665 $ 243 $ 784 $ 248 $ 865