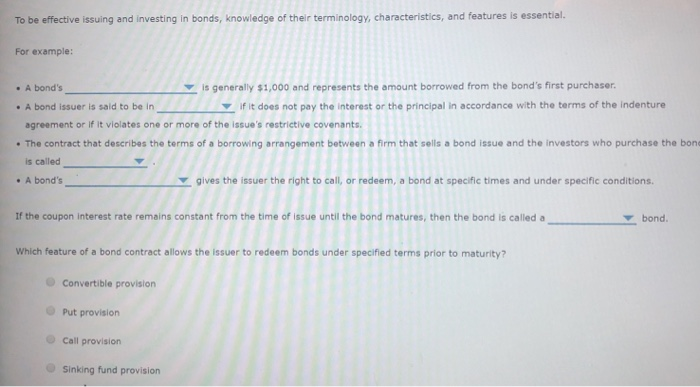

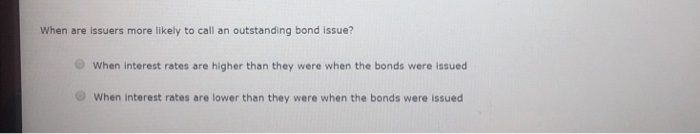

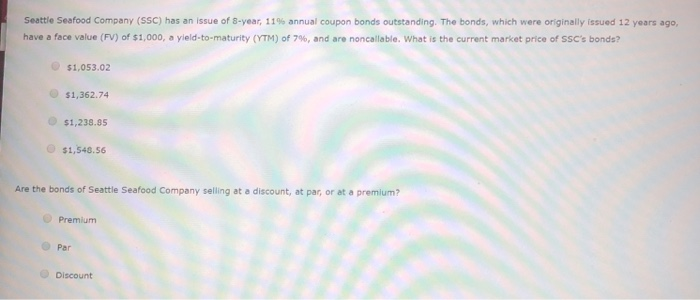

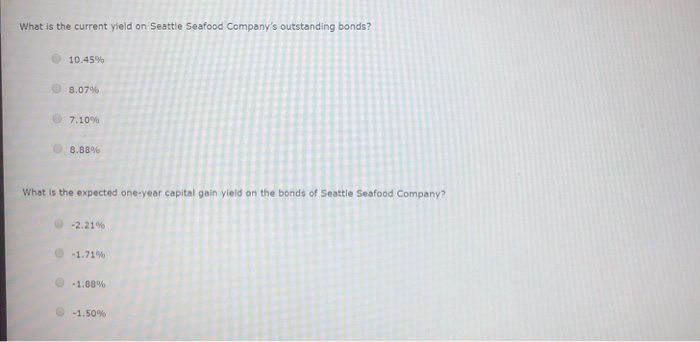

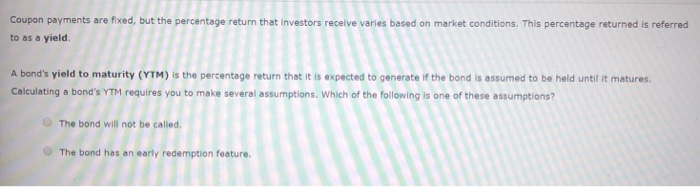

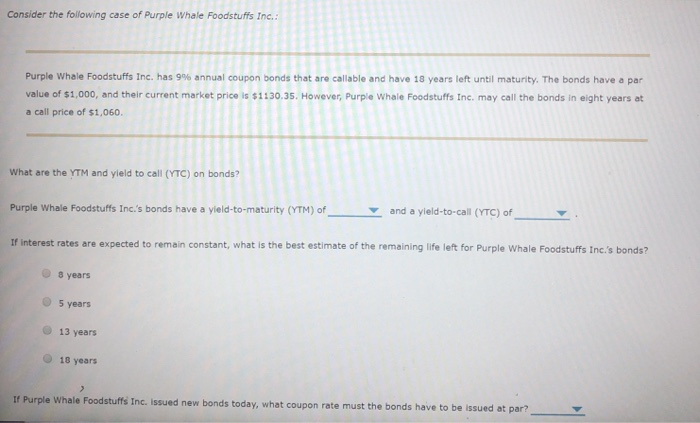

To be effective issuing and investing in bonds, knowledge of their terminology, characteristics, and features is essential. For example: is generally $1,000 and represents the amount borrowed from the bond's first purchaser e A bond's if it does not pay the interest or the principal in accordance with the terms of the indenture A bond issuer is said to be in agreement or if it violates one or more of the issue's restrictive covenants The contract that describes the terms of a borrowing arrangement between a firm that sells a bond issue and the investors who purchase the bon is called . A bonds gives the issuer the right to call, or redeem, a bond at specific times and under specific conditions. If the coupon interest rate remains constant from the time of issue until the bond matures, then the bond is called a bond. Which feature of a bond contract allows the issuer to redeem bonds under specified terms prior to maturity? Convertible provisiorn Put provision Call provision Sinking fund provision When are issuers more likely to call an outstanding bond issue? When interest rates are higher than they were when the bonds were issued When interest rates are lower than they were when the bonds were issued Seattle Seafood Company (SSC) has an issue of 8-year, 11% annual coupon bonds outstanding. The bonds, which were originally issued 12 years ago have a face value (FV) of $1,000, a yield-to-maturity (YTM) of 79%, and are noncallable. What is the current market price of SSC's bonds? $1,053.02 $1,362.74 $1,238.85 $1,548.56 Are the bonds of Seattle Seafood Company selling at a discount, at par, or at a premium? Premium Par Discount What is the current yield on Seattle Seafood Company's outstanding bonds? 10.45% 8.07% @ 7.10% 8.88% What is the expected one-year capital gain yield on the bonds of Seattle Seafood Company? @-2,21% @-1.71% -1.00% -1.50% Coupon payments are fixed, but the percentage return that investors recelve varies based on market conditions. This percentage returned is referred to as a yield A bond's yield to maturity (YTM) is the percentage return that it is expected to generate if the bond is assumed to be held until it matures. llstin a alire ou to ma assu The bond will not be called The bond has an early redemption feature Consider the following case of Purple Whale Foodstuffs Inc. Purple whale Foodstuffs Inc. has 9% annual coupon bonds that are callable and have 18 years left until maturity. The bonds have a par value of $1,000, and their current market price is $1130.35. However, Purple Whale Foodstuffs Inc. may call the bonds in eight years at a call price of $1,060. what are the YTM and yieid to cal /TC) on bonds? Purple Whale Foodstuffs Inc.'s bonds have a yield-to-maturity (YTM) ofand a yield-to-call (YTC) of If interest rates are expected to remain constant, what is the best estimate of the remaining life left for Purple Whale Foodstuffs Inc.'s bonds? 8 years O 5 years 13 years O 18 years sued at par? If Purple Whale Foodstuffs Inc. Issued new bonds today, what coupon rate must the bonds have to be is To be effective issuing and investing in bonds, knowledge of their terminology, characteristics, and features is essential. For example: is generally $1,000 and represents the amount borrowed from the bond's first purchaser e A bond's if it does not pay the interest or the principal in accordance with the terms of the indenture A bond issuer is said to be in agreement or if it violates one or more of the issue's restrictive covenants The contract that describes the terms of a borrowing arrangement between a firm that sells a bond issue and the investors who purchase the bon is called . A bonds gives the issuer the right to call, or redeem, a bond at specific times and under specific conditions. If the coupon interest rate remains constant from the time of issue until the bond matures, then the bond is called a bond. Which feature of a bond contract allows the issuer to redeem bonds under specified terms prior to maturity? Convertible provisiorn Put provision Call provision Sinking fund provision When are issuers more likely to call an outstanding bond issue? When interest rates are higher than they were when the bonds were issued When interest rates are lower than they were when the bonds were issued Seattle Seafood Company (SSC) has an issue of 8-year, 11% annual coupon bonds outstanding. The bonds, which were originally issued 12 years ago have a face value (FV) of $1,000, a yield-to-maturity (YTM) of 79%, and are noncallable. What is the current market price of SSC's bonds? $1,053.02 $1,362.74 $1,238.85 $1,548.56 Are the bonds of Seattle Seafood Company selling at a discount, at par, or at a premium? Premium Par Discount What is the current yield on Seattle Seafood Company's outstanding bonds? 10.45% 8.07% @ 7.10% 8.88% What is the expected one-year capital gain yield on the bonds of Seattle Seafood Company? @-2,21% @-1.71% -1.00% -1.50% Coupon payments are fixed, but the percentage return that investors recelve varies based on market conditions. This percentage returned is referred to as a yield A bond's yield to maturity (YTM) is the percentage return that it is expected to generate if the bond is assumed to be held until it matures. llstin a alire ou to ma assu The bond will not be called The bond has an early redemption feature Consider the following case of Purple Whale Foodstuffs Inc. Purple whale Foodstuffs Inc. has 9% annual coupon bonds that are callable and have 18 years left until maturity. The bonds have a par value of $1,000, and their current market price is $1130.35. However, Purple Whale Foodstuffs Inc. may call the bonds in eight years at a call price of $1,060. what are the YTM and yieid to cal /TC) on bonds? Purple Whale Foodstuffs Inc.'s bonds have a yield-to-maturity (YTM) ofand a yield-to-call (YTC) of If interest rates are expected to remain constant, what is the best estimate of the remaining life left for Purple Whale Foodstuffs Inc.'s bonds? 8 years O 5 years 13 years O 18 years sued at par? If Purple Whale Foodstuffs Inc. Issued new bonds today, what coupon rate must the bonds have to be is