Answered step by step

Verified Expert Solution

Question

1 Approved Answer

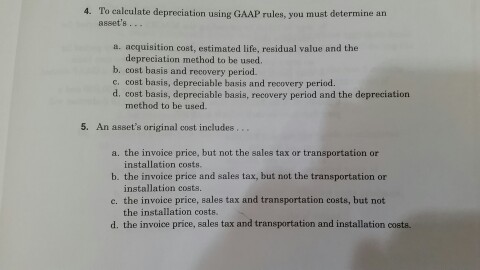

To calculate depreciation using GAAP rules, you must determine an asset's... acquisition cost, estimated life, residual value and the depreciation method to be used. cost

To calculate depreciation using GAAP rules, you must determine an asset's... acquisition cost, estimated life, residual value and the depreciation method to be used. cost basis and recovery period. cost basis, depreciable basis and recovery period. cost basis, depreciable basis, recovery period and the depreciation method to be used. An asset's original cost includes ... the invoice price, but not the sales tax or transportation or installation costs. the invoice price and sales tax, but not the transportation or installation costs. the invoice price, sales tax and transportation costs, but not the installation costs. the invoice price, sales tax and transportation and installation costs

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started